Authors: MJ Yuan, Ziyi Xu

Editor: Ginger

Woman leaders are filling more and more high-level roles in the business world. Long flattered as the “fairer sex” but not expected to achieve, women have proven time and again that they are just as capable as men, using their acumen to guide business and becoming indispensable to the company. Helen Chen is a key example of this kind of woman.

Helen Chen: Managing partner of L.E.K. Consulting Greater China, where she leads the healthcare and life sciences practice, and a director of the L.E.K. Asia Pacific Life Sciences Centre of Excellence, established in cooperation with the Singapore Economic Development Board.

In 1989, Helen Chen earned an honors degree in applied mathematics from Harvard University. She started her career in a boutique consulting company, moved to industry work at Abbott Laboratories, and then joined Genentech (now Roche Pharmaceuticals) where she was an associate director in finance.

In 2000, Helen went to China. At that time, she was traveling between China and the United States with an Internet consulting firm. With the Internet technology bubble sweeping across the United States, Asia was emerging as more promising compared to Silicon Valley. Helen decided to stay in China, joining L.E.K. Consulting in 2003.

Looking back on those 20 years, Helen and L.E.K. lived through the lack of investment and government support of the Chinese pharmaceutical industry support in the early days, as well as witnessing first-hand the industry’s wave of development set off by healthcare reforms in China and the “Twelfth Five-Year Plan”. In this ever-changing medical industry landscape, she has made great strides and led the L.E.K. life sciences team in Greater China to its premier position today. In the process, she demonstrated outstanding leadership skills and was named a Global Leader in Consulting by Consulting magazine in 2019.

In today’s interview, we discussed the importance of female leadership with Helen Chen. She also addressed the current status of the pharmaceutical industry in China and abroad, detailing how Chinese companies can achieve sustainable development and growth despite external environmental factors such as the recent COVID-19 outbreak, and pathways for foreign companies to enter China’s market.

MyBioGate: Why did you choose to work in the healthcare consulting industry?

Helen Chen: My first job was to run market analyses in a boutique consulting company and looked at reams of pharmaceutical data, so perhaps I just fell into it. I strongly admire the patient-centric focus that the industry adopts. Consulting, the way L.E.K. practices, is customer-centric, which gives me the opportunity to establish professional bonds with our clients in various fields and provide them with customized solutions. I like to focus on projects and clients, and constantly think about how to solve their problems, how to communicate and ensure understanding, and how to provide clients with needed assistance. This makes me feel very fulfilled.

MyBioGate: What made you decide to start working at L.E.K. in China?

Helen Chen: The Internet bubble burst around 2001. At that time, I had two choices: return to California or stay in Beijing. In the end, my husband and I jointly decided on the latter as the overall environment in China at that time was sunnier. Later, I joined L.E.K. in Beijing: L.E.K. was expanding its business in China and my experience in strategy consulting and healthcare was a good fit. I hoped to incorporate the Chinese market into L.E.K.’s global life sciences business and help international companies who are interested in the Chinese market.

The development of China’s healthcare industry has benefited from some major factors.

In fact, around 2007, I almost gave up because customer demand was low. But fortunately, we persisted, and we soon benefitting from China’s healthcare reform in 2009. At the same time, China’s Ministry of Science and Technology was also emphasizing the importance of innovation. Each five-year plan has a new focus. With the support of the then CFDA and other departments, the government has passed many new laws and regulations, which have further encouraged innovation in the healthcare industry that has only now begun to realize its potential.

We originally planned to stay for only 3 to 5 years. We definitely didn’t expect it to be going on 20+ years. Looking back, the decision at that time was circumstantial, though clearly persistence and resilience has contributed to who I am today.

MyBioGate: As one of the global leaders in consulting named by “Consulting” magazine, can you share the main challenges faced by woman leaders, the reasons why women truly become outstanding leaders, and how women gain experience as leaders?

Helen Chen: Women’s leadership is unparalleled.

At present, almost no industry has achieved true gender equality. Compared with men, women often take longer to achieve the same career goals. We can see that among the Fortune 500 companies, the proportion of woman CEOs is relatively low. Today’s society still expects women to contribute more to the family. For example, mothers are usually expected to attend parent-teacher meetings at schools, not the fathers.

Therefore, women need more support in career development.

Here I am very grateful to my husband for sharing family responsibilities so that I could devote myself to my work.

In order to support overall leadership, L.E.K. hopes to have more female partners. Our goal is to double the proportion of woman partners in the next few years, and have put in place active talent development programs to do so.

MyBioGate: Since 2001, what changes have you witnessed in China?

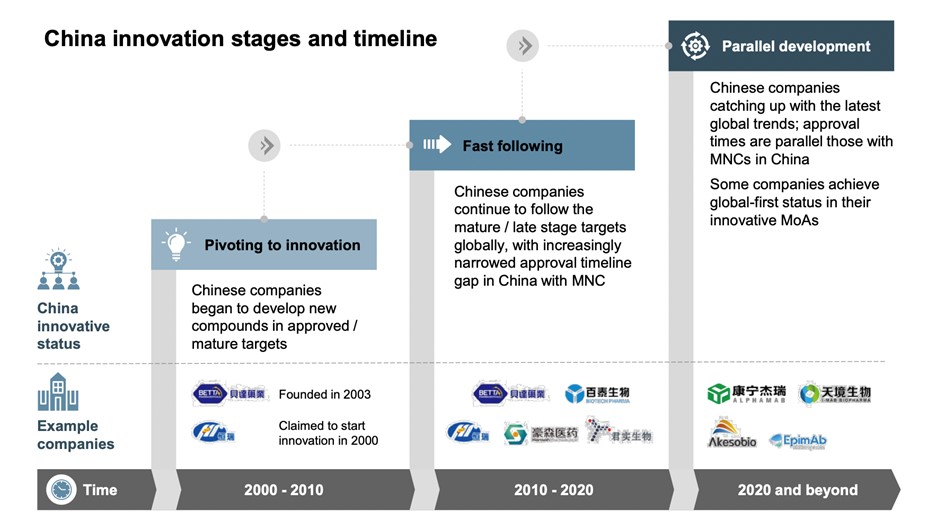

Figure 1: Significant changes in the Chinese pharmaceutical market towards innovation

Source: L.E.K. research and analysis

Helen Chen: China has been focusing on innovation.

In 2001, China formally joined the World Trade Organization (WTO) and was positioned as a “key industrial manufacturing country.” At that time, the emerging industries were mostly Technology, Media, and Telecom (TMT industry for short). Many biomedical companies were established around that time, such as WuXi AppTec in 2000. However, China’s life sciences infrastructure was still weak at the time, and any discussions on healthcare reform wouldn’t materialize for a decade.

In 2006, Shanghai hosted the “International Life Science Forum”. Many international venture capitalists came to China, but because of the lack of innovative pharmaceutical products in the market at that time, they did not show much investment interest.

In 2007, WuXi AppTec was listed on the New York Stock Exchange as a pharmaceutical “rising star” and acquired AppTec, U.S.-based biologics focused Contract Research Organization (CRO) the following year.

In 2009, the Chinese government began to carry out drastic healthcare reforms. “Achieving comprehensive medical coverage” and “consolidating the medical and healthcare industries” were both key discussions. Then there were comprehensive infrastructure improvements, large-scale establishing and upgrading of county hospitals that assumed the functions of regional medical service centers, the introduction of supporting medical equipment, and the improvement of the clinician training system.

These advances brought a new wave of commercial expansion to the pharmaceutical industry, and at the same time sent a message to the world that “China is focusing on the development of and investment in the pharmaceutical and health industries.”

Since 2011, the “Twelfth Five-Year Plan” and additional overall policies have included elements to further promote pharmaceutical innovation.

Many multinational pharmaceutical companies set up R&D centers in China. Talented diaspora Chinese come to China set up their own start-ups, capital is growing, and a new pharmaceutical ecosystem has taken shape. China’s pharmaceutical industry is gradually transforming from generics to innovative drugs. A milestone event was the establishment of a China joint venture between Fosun Pharma and Kite Pharma in 2017, with $95 million deal in cell therapy.

Twenty years ago, China’s pharmaceutical market was generics and manufacturing-driven, and did not have the financing, infrastructure support, or the government regulations to foster growth. It was difficult for innovative pharmaceutical companies to take root in China. Today’s China is moving beyond “the world’s factory” label, but also the “second largest market” and “innovation”. It must be said that in the global economy, China is constantly striving towards innovation.

MyBioGate: Although the Chinese pharmaceutical market continues to grow, biomedical companies still face a lot of pressure, such as government regulation, lack of innovation, and increasing competition. What suggestions do you have for the sustainable growth of Chinese biomedical companies?

Helen Chen: Today’s market environment is much more friendly to biomedical companies.

First, sufficient funding. Local governments, venture capital, and private equity can provide financial assistance for the commercial development of enterprises. Second, the government has increasingly sourced overseas talents and introduced preferential landing policies. Third, infrastructure improvements. There are more and more pharmaceutical contract research organizations (CRO) and pharmaceutical contract manufacturing organizations (CMO). They can help start-ups accelerate R&D and production processes and reduce initial costs. Fourth, the internationalization of pharmaceutical registration policies. Approval time for pharmaceutical products is shorter, and the return on investment has increased. Fifth, improving diagnostic testing infrastructure. For example, with wide application, biomarker tests help to achieve personalized anti-cancer approaches. Sixth, a more robust medical insurance system expands the scope of payment for pharmaceutical products.

Nevertheless, competition in the biomedical industry remains fierce.

Solid scientific data, good decision-making on clinical trials, and keen business insight are the keys to success. Compared with landing in the United States, innovative products landing in China can reduce costs for biomedical companies, reduce infrastructure investment, and shorten time to return on capital. Companies that are interested in the emerging field of cell therapy can choose to conduct “investigator-initiated trials” (IIT) in China and get preliminary clinical results earlier than they can in the United States. Once they have advanced technology, pharmaceutical companies can expand their business territory worldwide.

MyBioGate: The international situation is full of uncertainties, such as the Sino-US trade war that began in 2018, COVID-19 that swept the world in early 2020, and the impending US presidential election this November. What advice do you have for Chinese pharmaceutical companies to enter overseas markets?

Helen Chen: Overall, the COVID-19 epidemic has indeed challenged the pharmaceutical industry, as it has all industries. The most obvious impact is the overall slowdown of global clinical trials. But at the same time, our survey data shows that compared with other regions, the recovery speed of clinical trials, hospital visits, and admission surgery in Asian countries, especially China, is relatively fast.

Challenges are often accompanied by opportunities, and many domestic Chinese vaccine and related pharmaceutical companies have begun to emerge.

As for the Sino-US trade conflict, it seems to me very unfortunate. The obstruction of currency circulation between China and the United States, import and export controls, and blockades around investment, data, and technology cause investors and companies to be more cautious.

However, there are two paths forward: technology and business. From a technical perspective, Europe and Israel offer alternatives sites for innovation. From a commercialization perspective, in addition to European and American markets, the Southeast Asian market also has future potential.

Although the situation continues, we should also realize that healthcare is a global industry, the pursuit of a healthy lifestyle is in demand, and competitive biomedical products (drugs, devices, and diagnostics) will surely have a place in the market.

MyBioGate: What advice do you have for overseas companies that plan to bring their pharmaceutical products to the Chinese market?

Helen Chen: We suggest that international healthcare companies give priority to the Chinese market when considering overseas expansion. First, the Chinese pharmaceutical market ranks second in the world, after only the United States; second, China actively encourages innovation. Clinical data from their home countries can support the registration process in China, which is particularly important for overseas companies.

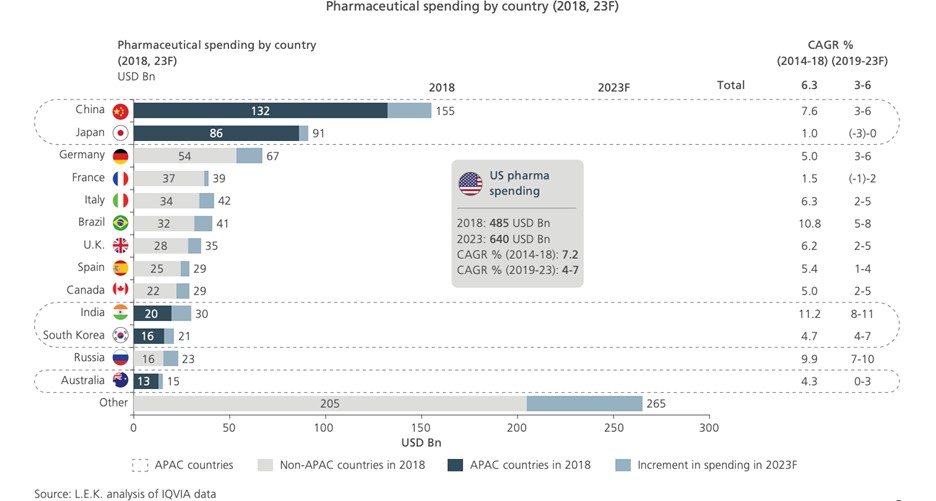

Figure 2: The Asia-Pacific region accounts for 30% of global medical expenditures. In the next five years, China alone will bring about US$23 billion in growth to the global prescription drug market

Source: L.E.K. “Expanding Into Asia-Pacific: Life sciences opportunities and strategies for success”

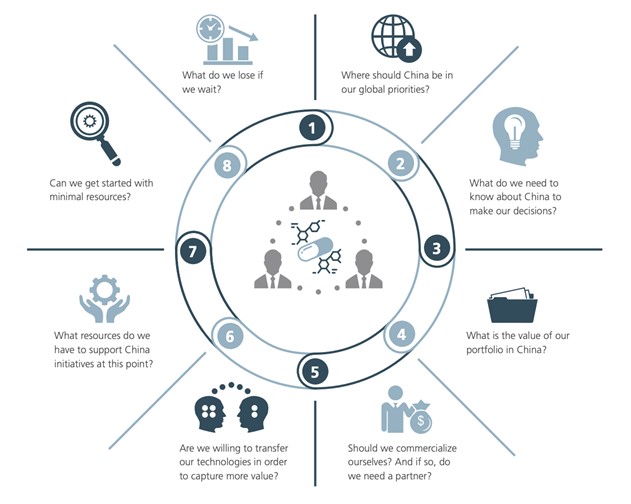

Therefore, the answer to this question depends on the specific circumstances and the goals the company wants to achieve: Is the scale of the enterprise to be a global integrated pharma or a development company? Does the company want to expand the portfolio or focus on existing pipelines? Is the market currently sufficiently attractive in home regions?

Figure 3: Questions biopharma boards and management should be asking

Data source: L.E.K. ” Heading East: Biopharma International Expansion to China and Asia “

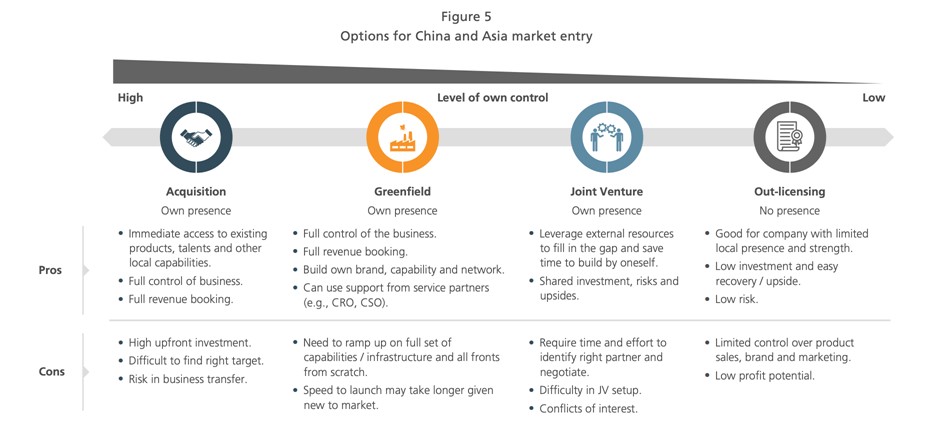

According to our experience, many international pharmaceutical companies will start by looking for partners in China. Collaboration options include CRO, out-licensing, joint development, and joint ventures. For example, in 2018, Biohaven (a biopharmaceutical company focused on clinical phases in Connecticut) established a subsidiary called Bioshin in Shanghai. That same year, Ascendis Pharma, a Nordic biomedical company, and Sino-U.S. Vivo Capital established a joint venture company, VISEN, to use Ascendis’s TransCon (TM) technology platform for the development of rare endocrine disease drugs in China. There’s also the example of Fosun-Kite I mentioned earlier.

Figure 4: Case study: Ways to enter the Chinese and Asian markets

Data source: L.E.K. “Heading East: Biopharma International Expansion to China and Asia”

MyBioGate: Can you share with us L.E.K.’s future strategy and outlook in China?

Helen Chen: L.E.K. is a strategic consulting firm. We focus on providing growth strategies for the company’s leadership and investors. We cover many industries. In addition to healthcare and life sciences, our business also covers private equity, industrial goods, consumer goods, media and other industries. The growth of the Chinese market is particularly important for L.E.K. In addition to life sciences, we are committed to providing support for private equity investment in China. We have established services that focuses on technology in industrial products and services, but we also look forward to our expansion in all L.E.K. global sectors. In summary, China is a key region for L.E.K., and an important promoter for growth in the Asia-Pacific region and the world. Whether you are a newcomer who wants to engage in consulting work or an experienced consultant, L.E.K. welcomes you to join us.

0 Comments