Ginger Ding, Chen Lixing

Introduction

“Industry Research | Pediatric Drug Market and Cross-border Collaboration Trends (Part 1)” reviews the latest legislation and incentive measures that aim to promote the development of the pediatric medicine field, provides market trend forecasts, compares the differences in Chinese and international fields, and analyzes potential challenges. This article further analyzes the pediatric drug market opportunities from key areas, demand-led formulation optimization, and innovative treatment plans. We’ll also interpret the global pediatric drug cooperation trend and the pediatric drug composition of the five major international pharmaceutical companies and provide a navigation reference for product introductions.

The market potential of the respiratory and digestive fields rapidly increasing, antibiotic resistance needs to be overcome

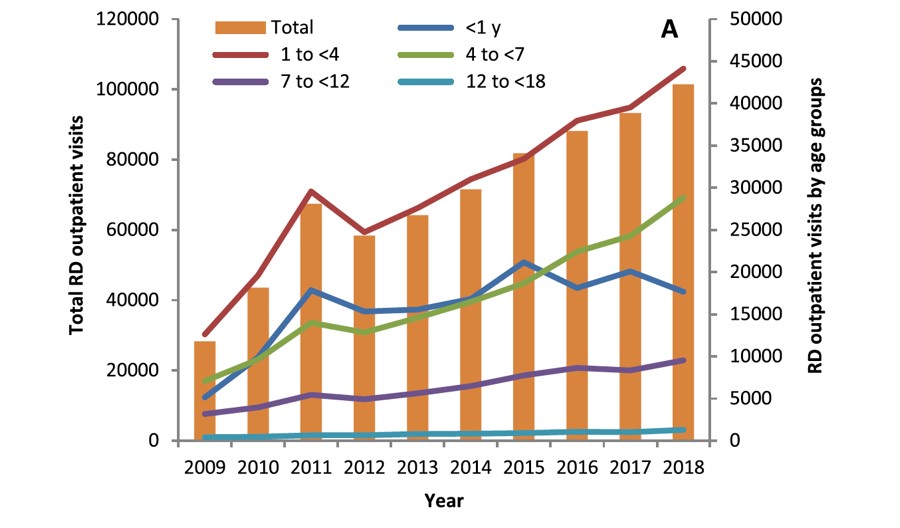

The “2016 Children’s Drug Safety Survey Report” shows that the respiratory diseases (39.4%) and gastrointestinal diseases (20.52%) have a higher prevalence in children in China [1]. A 10-year survey of outpatient clinics at the Children’s Hospital of Fudan University showed that [2], the number of outpatient clinics for respiratory diseases increased from 28, 329 in 2009 to 101, 419 in 2018, with an average annual growth rate of 15.2%. Bronchitis was the most common, accounting for a total of 27.6% patient visits, followed by pneumonia (18.5%), asthma (10.7%), and rhinitis (9.2%). World Health Organization data show that pneumonia or other acute respiratory infections are the main cause of death among children worldwide, among which pneumonia accounts for 15% of all deaths among children under the age of 5.

▲ Chart 1: Number of Outpatient Visits for Pediatric Respiratory Diseases

Source: Shi et al. BMCPediatrics (2020) 20:115

Physicians primarily treat respiratory tract infections with antibiotics and antiviral drugs. A study showed that the use rate of antibacterial drugs in 900 Chinese pediatric outpatients with acute upper respiratory tract infection was 82%. The commonly used antibacterial drugs in descending order were azithromycin, ceftazidime, cefaclor, alexandrite, Moxilin and Cefazolin [3].

In addition to respiratory diseases, antibiotics are also used to treat gastrointestinal diseases. A study published in 2020 on 35, 167 Chinese pediatric patients [4] shows that physicians used antibiotics on children with diarrhea at a rate of 24.3%. From a global perspective [5], diarrhea is the second leading cause of death for children under five years of age. Approximately 1.7 billion children suffer from it each year, and with 525,000 children under five dying from diarrhea.

Unfortunately, such high use rates of antibiotics make drug resistance to them a global public health problem. By 2050, the number of deaths due to antibiotic resistance is expected to be as high as 10 million, surpassing cancer.

Traditional antibiotics includes a broad spectrum of drugs. The development of new-generation antibiotics has been inspired by drugs to treat tumors. Major pharmaceutical companies have begun to experiment with precision antibiotics, opening a new era. For example, CDI developed by Summit Therapeutics specifically kills Clostridium difficile through tissue cell division and is currently in clinical phase III. Entasis Therapeutics is developing a combination drug ETX2514SUL against Acinetobacter resistance. It has also entered clinical phase III.

13% of childhood asthma is related to air pollution. Takeda and AbbVie are deploying the gastrointestinal tract

Pediatric asthma is a hot area of study for pediatric respiratory disease drugs. The 2019 “Lancet Planetary Health” study showed [6] that 13% of childhood asthma cases diagnosed each year are related to air pollution. China is the country with the most air pollution-related asthma, with 7.6 million cases, followed by India, the United States, Indonesia and Brazil. Another study showed [7] that the prevalence of asthma in China was 0.13% to 1.34% in 1990, with the prevalence of asthma among urban children being relatively high. By 2010, the overall prevalence of asthma in children aged 0-14 in China was 2.12% or equivalent to 5.16 million children with asthma. It is expected that by 2020 that instances of asthma will continue to rise; the asthma rate among urban children may be as high as 10.27%.

Strategies for alleviating asthma are relatively advanced. Many companies have promoted using adult drugs for children while trying to cover the younger age groups. For example, GlaxoSmithKline’s asthma drug Nucala targets eosinophilic phenotypic asthma. Medicines for treating asthma can also achieve different effects with the change of different dosage forms. Possibilities are aerosols, dry powders, tablets, injections, and so forth. Many asthma drugs have also entered clinical phase III and are expected to achieve launch in the near future.

The development of drugs for pediatric gastrointestinal diseases mainly focuses on colitis, Crohn’s disease, and esophagitis. Takeda and AbbVie already have drugs released and several clinical phase III products are already under development. Among the most studied targets are TNF, such as Humira and Simponi®, and blocking α4β7-MAdCAM-1 interaction, such as etrolizumab, SHP647, Entyvio®, and others.

Combining marker detection and treatment has become the future trend of pediatric medicine

More and more companies are beginning to pay attention to the combination of marker detection and treatment to achieve precise treatment. Several drugs have been approved for use in children in recent years, including the following:

- In October 2018, Sanofi and its partner Regeneron jointly announced that the FDA approved a new indication for the anti-inflammatory drug Dupixent. Dupixent would treat adolescents and adults with moderate to severe asthma who are 12 years old and older. The treatment is related to the reduction in the level of markers of type 2 inflammation (including specific types of asthma), including FeNO, IgE, eosinophil chemotactic protein 3, and so forth.

- In August 2019, the FDA approved Rozlytrek’s second indication for the treatment of children and adult patients 12 years and older with neurotrophic tyrosine receptor kinase (NTRK) gene fusion.

- In September 2019, GSK’s IL-5 monoclonal antibody drug Nucala was approved for the treatment of severe eosinophilic asthma in pediatric patients aged 6-11 years. It is worth mentioning that Nucala is the only targeted biologic approved for patients in the 6-11 years old age group in the US market.

Using the collaboration strategy to quickly expand product lines and achieve an international structure

Pediatric drug R&D companies use collaboration, acquisition, and authorization strategies to quickly obtain innovative products in order to expand product lines and market potential. For example, Tracleer, the first drug approved by the FDA to treat children with congenital pulmonary hypertension, is one of the assets of Acelion acquired by Johnson & Johnson for $30 billion; generic drug giant Lupin has also reached a cooperation agreement with MonoSol to use its platform to develop children’s drugs.

In July 2020, Changchun High & New Tech Industry Inc. announced that they intend to purchase preferred shares of Brillian, a US children’s drug research and development company, for US$28.3 million. After it is completed, Changchun High & New Tech Industry Inc. will hold 42.14% of the company’s shares and become the largest shareholder. They plan to use Brillian’s pediatric medicine platform to quickly reach domestic and foreign markets.

Eton Pharmaceuticals announced in March 2020 that it will acquire the US marketing rights of Alkindi® Sprinkle, a drug under Diurnal, for US$5 million. Alkindi Sprinkle is the first drug for the treatment of pediatric adrenal insufficiency (AI). Those with European clinical data can apply for NDA rapid listing through the 505(b)(2) new formulation route, thus avoiding risks and early investment. They will have seven years of orphan drugs’ market franchise. At the same time, AI patients will need to use Alkindi Sprinkle for a long time, which will produce long-term, high-value, and lasting returns. Alkindi Sprinkle is expected to complete the FDA’s PDUFA deadline on September 29, 2020, and the US market is estimated to exceed US$100 million.

Analysis of pediatric drug composition of international pharmaceutical companies

Gilead: With anti-virus medicine as the core, it gradually stepped into other fields through mergers and acquisitions

From 2015 to 2019, Gilead completed antiviral drugs with anti-HIV drugs and hepatitis B and C. The drugs currently on sale include those that address the prevention, suppression, and treatment of HIV type 1, including single-use drugs and cocktail therapy. Viread is used to treat hepatitis B and has coverage for all ages. The two major hepatitis C drugs Harvoni and Sovaldi are used in the treatment of hepatitis C in children going up to age 12. After Gilead acquired Kate Pharmaceuticals, they expanded to cancer treatment, and Kate’s CAR-T therapy Yescarta has also entered the clinical stage for pediatrics. At the same time, Gilead is also collaborating with GlaxoSmith to develop Letaris, a drug used to treat pulmonary hypertension. In terms of antiviral drugs, they expect to continue covering HIV, hepatitis B, and C drugs for all ages, as well as clinically testing Cayston against pseudoaeruginosa infections. On the whole, Gilead’s strategy is to provide care for children using the same drugs as those for adults.

Merck: Comprehensive coverage in multiple fields, K medicine continues to make efforts to cover pediatrics

Merck’s pediatric drugs are relatively extensive, including coverage for asthma, allergies, relief of chemotherapy side effects, antiviral drugs, vaccines, and so forth. The HPV vaccine Gardasil has also achieved age coverage starting at children 9 years of age. Merck’s pediatric clinical research projects cover cancer, type 2 diabetes and various bacterial and viral infections. While taking into account the coverage of hepatitis in lower age groups, they also expanded K medicine to the pediatric field. For type 2 diabetes, Merck also arranged four drugs of various efficacy and price to meet the needs of different consumer groups.

GlaxoSmithKline: Focusing on respiratory diseases, combining drugs and vaccines

At present, GlaxoSmithKline’s pediatric medicine focuses on addressing respiratory diseases. They have achieved wide age coverage for their pediatric influenza vaccines and asthma treatment, as well as having psychiatric drugs and antiviral drugs available. The focus of their clinical research is on various vaccines and alleviating respiratory diseases. The types of vaccines have expanded from influenza viruses on to respiratory viruses, hepatitis, and meningococcal viruses. They also have coverage for young children for asthma.

Johnson & Johnson: Anti-virus and inflammation care continues to expand, entering the psychiatric and genetic disease market

Johnson & Johnson mainly sells drugs focusing on HIV-1 treatment and inflammation. The treatments for HIV-1 have reached a wider age range, and there is also an oncology drug, Yondelis, which targets sarcomas in many different locations. Clinical research is divided into seven major sections: antiviral, psychiatric, cancer, cardiovascular, diabetes, inflammation, and genetic diseases. The antiviral category mainly covers all age groups of HIV treatment and the expansion of respiratory viruses. Their inflammation drugs continue to expand their capabilities while their psychiatric and genetic disease treatments are projected to become a very advantageous competitive advantage for the company.

Allergan: Continuing to expand Botox products and carry out a number of studies on mental illness

Allergan (acquired by AbbVie), as a relatively small company, avoided HIV-1, vaccines, diabetes and other fiercely competitive fields, focusing on anti-acne drugs and some dermatological drugs, while also expanding its own Botox to treat children’s limb spasm and neurological-related urinary incontinence. They’re further strengthening their foray into the field of mental illness.

About the authors:

Dr. Ginger Ding is the Director of Investment Analysis at MyBioGate and a consultant for the Texas Medical Center and Columbia University Consulting Club. She has also worked at the Howard Hughes Medical Institute and MD Anderson Cancer Center. There, she participated in the preclinical research of tumor brain metastasis and received funding from the National Institutes of Health RO1, Susan G. Komen, and Japan’s Taiho Pharmaceutical.

Chen Lixing is an investment analyst at MyBioGate. She has a master’s degree from KGI Graduate School and Drucker School of Management. As a graduate consultant, she provided strategic consulting services for Samumed and SomaLogic.

Sources:

【1】2016 Investigation Report on Children’s Drug Safety

【2】Shi et al. BMC Pediatrics (2020) 20:115

【3】Clinical Medicine Research and Practice, 2019-03, Wang Zhaoxia

【4】JPediatr. 2020 May; 220:125-131.e5.

【5】World Health Organization official website

【6】Lancet Planet Health. 2019Apr;3(4):e166-e178

【7】J GlobHealth. 2020 Jun; 10(1): 010801.

【8】PEDIATRICS Volume 134, Number2, August 2014

【9】J ClinPharmacol. 2018 Oct;58 Suppl 10:S26-S35

0 Comments