Ginger Ding, Chen Lixing

Introduction

Children ages 0 to 18 account for about 26% of the global population, but the development and market value of pediatric drugs has been seriously underrepresented for a long time. Due to the gradual implementation of the “two-child” policy in China and issues such as environmental pollution, the pediatric drug market is continuing to rise there. By the end of this year it is estimated to be around US$22.5 billion. There are more than 7,000 pharmaceutical manufacturers in China, but only around a dozen of them specialize in the production of children’s drugs. Children’s drugs account for less than 2% of the total pharmaceutical output, resulting in a serious imbalance between supply and demand. Currently, more than 50% of pediatric drugs have no clinical data reference. Doctors adjust the dosage based on personal experience rather than data to administer drugs, which can result in ineffective treatment or even serious side effects.

The global pediatric drug and vaccine market was valued at approximately US$122 billion in 2019 and is expected to reach US$141 billion in 2025, with a compound annual growth rate of 2.4%. Over the past two decades, regulatory agencies in various countries have made tremendous efforts to encourage pharmaceutical companies to develop pediatric drugs. However, designing the drugs, recruiting patients, executing pediatric clinical trials, and determining appropriate clinical endpoints continues to remain a challenge.

The first part of our report reviews the latest legislation and incentive measures that aim to promote the development of the pediatric medicine field, provides market trend forecasts, compares the differences in Chinese and international fields, and analyzes potential challenges. The second part will focus on analyzing the cases of leading pediatric medicine companies, the trend of global pediatric medicine collaboration, and provide further insights into the opportunities of the pediatric medicine industry.

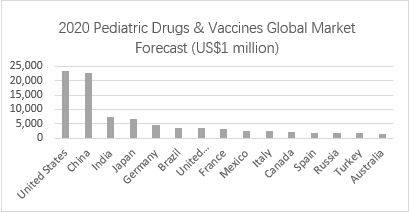

China and the United States lead the global market, the Asia-Pacific region is an important growth area

Geographically, North America is still the largest single regional market for pediatric drugs, followed by China. BCC research data shows that the pediatric drug market’s growth is mainly driven by the Asia-Pacific region generally and China specifically. It is expected to occupy an even larger market share over the next few years. Another country with a rapidly expanding market share of pediatric drugs is India.

▲ Chart 1: 2020 pediatric drug global market forecast

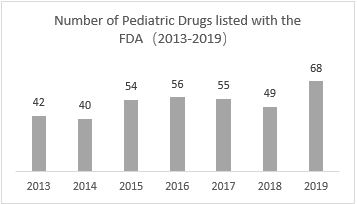

Favorable policies continue to influence the market, the number of pediatric drug labels in 2019 hit a record high

The number of pediatric drug labels has increased since 2013, reaching a record high in 2019, with 68 pediatric drugs labelled. This is closely related to the support from regulatory agencies for the development of pediatric drugs.

▲Chart 2: Number of FDA Pediatric Drug Labels (2013-2019)

Compared to China, the concept of pediatric drugs developed relatively early in the West. The United States and the European Union have issued corresponding policies to encourage the development of pediatric drugs and have accumulated relatively mature experience in policies and regulations.

In 1997 the United States enacted a bill to give pediatric drugs longer exclusive rights. In 2012, Congress passed the Food and Drug Administration Safety and Innovation Act (FDASIA), which included the Pediatric Research Equity Act (PREA) and the Best Pharmaceuticals for Children Act (BPCA). In addition, the FDASIA Act also introduced the Priority Review Voucher (PRV) program for drug developers addressing rare pediatric diseases. PRV holders can receive priority approval for any new drug in the future. Since its adoption, the plan has attracted great interest from many pharmaceutical companies seeking to develop treatments for rare pediatric diseases. BioMarin received its first PRV in 2012 and sold it at a high price of US$6.75 billion five months later. So far, more than ten pharmaceutical companies have obtained a PRV.

On January 27, 2007, The European Union established the “Regulations on the Administration of Pediatric Drugs”. It stipulated that starting from July 26, 2008, all new drug applications would have to be submitted to the children’s drug research and development plan. Meanwhile, starting from January 26, 2009, any new indications, new supplementary applications for prescriptions, and new dosage forms would also have to include a children’s drug development plan.

As the second largest pediatric drug market in the world, China is drawing on the leading experiences of the United States and the European Union. It has issued guidance documents such as the “Guidelines for Clinical Trials of Pediatric Drugs for the Population” and “China National Formulary (Children’s Edition)” to further explore ways of formulating pediatric laws and regulations. These two documents provided added value to pediatric drug development.

FDA registration of Chinese and international companies has the same number of clinical applications in China, mainly in the field of infection

Clinical data from Clinicaltrials.gov shows that there is currently ongoing research for 501 pediatric drugs in China, of which 62.5% are for both adults and children for a total of 313. There are 188 projects that focus specifically on pediatric drugs. The main body of the analysis in this report is the clinical research of pediatric special drugs, of which 93 applicants are Chinese companies and 95 are international companies.

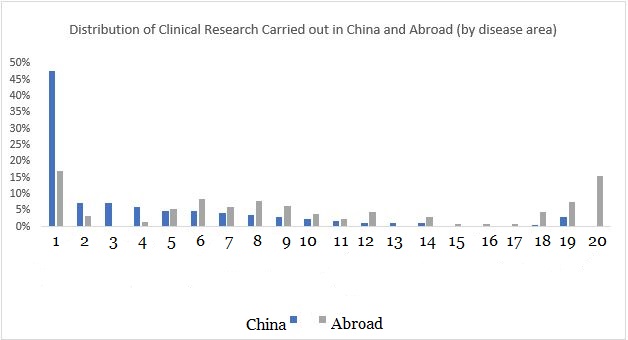

From a disease perspective, 42% of current pediatric clinical research is aimed at the field of infection, covering DTP, influenza, pneumonia, meningitis, and so forth. It is worth noting that, compared with clinical trials carried out overseas, the number of clinical trials carried out in China on infection, such hand-foot-mouth disease treatment, developmental diseases and eye diseases is relatively large, but cancer drugs and skin disease drugs are relatively few.

▲ Chart 3: Comparison of the distribution of clinical research carried out by China and international countries

Number reference: 1. Infections, 2. Developmental diseases, 3. Hand, foot, and mouth, 4. Eye diseases, 5. Respiratory diseases, 6. Nervous system diseases, 7. Heart diseases, 8. Diabetes, 9. Mental disorders, 10. Blood diseases, 11. Inflammation, 12. Gastrointestinal diseases, 13. Immune system diseases, 14. Allergies, 15. Kidney diseases, 16. Liver diseases, 17. Transplants, 18. Tumors, 19. Skin diseases, 20. Genetic diseases

Source:https://clinicaltrials.gov/;Medicines in Development for Children 2020 Report (PhRMA)

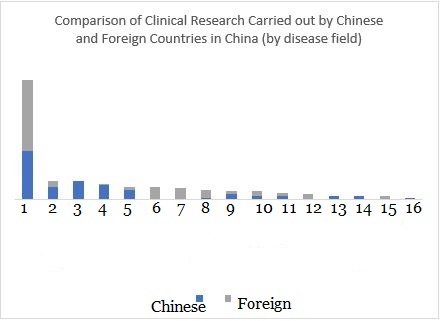

It is worth noting that clinical trials carried out by foreign companies in China are very different from those carried out overseas. They have paid more attention to infections and nervous system diseases (epilepsy), cardiovascular drugs (heart failure, blood pressure) and other research that meet the needs of the Chinese market. Domestic Chinese companies focus on hand, foot and mouth disease, eye diseases, and respiratory diseases. In order to develop of drug for infectious diseases, many Chinese companies regularly consult with their foreign counterparts.

▲ Figure 4: Comparison of the distribution of clinical research conducted by Chinese and foreign companies in China (by disease field)

Number reference: 1. Infections, 2. Developmental diseases, 3. Hand, foot, and mouth, 4. Eye diseases, 5. Respiratory diseases, 6. Nervous system diseases, 7. Heart diseases, 8. Diabetes, 9. Skin diseases, 10. Mental disorders, 11. Blood diseases, 12. Inflammation, 13. Immune system diseases, 14. Gastrointestinal diseases, 15. Allergies, 16. Tumors

Data source: https://clinicaltrials.gov/

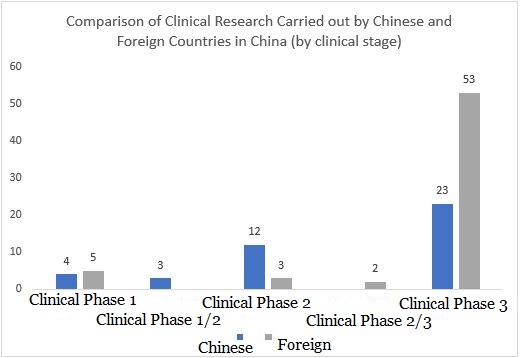

From the perspective of R&D stage distribution, although the third phase of clinical research is still dominated by overseas companies, the number of early clinical trials led by domestic Chinese companies is higher than that of foreign pharmaceutical companies. This is in line with the rapid development of R&D and innovation capabilities of domestic Chinese companies in recent years and their active international deployment coincides with the trend.

▲ Chart 5: Comparison of the distribution of clinical research carried out by Chinese and foreign companies in China (by clinical stage)

Source: https://clinicaltrials.gov/

The pediatric clinical design is complex and there are huge challenges in patient recruitment

Although the implementation of pediatric drug development laws and regulations has achieved gratifying results, the market demand for pediatric drugs is still far from being met. In resource-poor areas, the demand gap has been exacerbated due to restricted economic conditions and fragmented medical care systems.

About 50% of children’s drugs are administered by doctors through off-label use [1], with adult doses adjusted based on personal experience rather than data. This threatens patient safety and drug effectiveness. According to monitoring documentation issued by the National Medical Products Administration, adverse reactions among children are significantly higher than those in the general population. Especially for anti-infective drugs, the adverse reaction of the general population is 42.3%, but the incidence in children is 73% [2]. This shows that the clinical development of pediatric drugs is urgent.

However, the high cost and complexity of pediatric clinical trials (such as the recruitment of children, clinical trial logistics, ethics, changes in pharmacokinetics caused by the rapid growth of children, etc.) remain the biggest challenges facing developers.

Some countries with small populations, or certain niche disease areas, lack sufficient pediatric populations to participate in clinical trials. Furthermore, there is often no corresponding recruitment network and platform for basic implementation assistance. In addition, guardians often worry about the risks of clinical trials, resulting in low participation.

The development of medicine for children in China lags behind developed countries. Two major reasons are the shortage of talent in clinical trials and the gap in cutting-edge technologies, such as transdermal patches that solve the limitations of intravenous injection. Strategies such as micro-sampling, sparse sampling and computer simulation are attempting to increase the success rate of drug development.

Despite the challenges, the potential of the pediatric drug market, regulatory agencies’ policies, and the rapid development of preparation technology still provide an unmissable opportunity for enterprise development. More specific details will be in the “Industry Research | Pediatric Drug Market and Cross-border Collaboration Trends (Part 2)”.

About the authors:

Dr. Ginger Ding is the Director of Investment Analysis at MyBioGate and a consultant for the Texas Medical Center and Columbia University Consulting Club. She has also worked at the Howard Hughes Medical Institute and MD Anderson Cancer Center. There, she participated in the preclinical research of tumor brain metastasis and received funding from the National Institutes of Health RO1, Susan G. Komen, and Japan’s Taiho Pharmaceutical.

Chen Lixing is an investment analyst at MyBioGate. She has a master’s degree from KGI Graduate School and Drucker School of Management. As a graduate consultant, she provided strategic consulting services for Samumed and SomaLogic.

Reference materials:

【1】Mei et al. BMC Pediatrics (2019) 19:281

【2】Pharmacol Res.2019 Oct;148:104412

0 Comments