Authors: XU Ziyi, CHEN Chun

Editor: Ginger Ding

Dry eye is an ophthalmological disease where a person’s eyes either don’t produce enough tears, or if they don’t make the right kind of tears. According to the American Optometric Association, there can be multiple contributing factors to dry eyes, including age, gender, medications, medical conditions, and environmental conditions. Symptoms include a stinging, burning, or scratching sensation, blurred vision, stringy mucus near the eye, redness, light sensitivity, and watery eyes. If timely and effective treatment is not taken, it can cause inflammation and damage to the surface of the eye, easily developing intractable dry eye, and even blindness. At present, dry eye is the most common disease represented in ophthalmology clinics, accounting for 70% of all eye diseases. It is estimated that, on average, one in five people has dry eye.

So what is the state of dry eye market? What are the mainstream drugs in Europe, America, and China? What breakthrough treatments have recently entered the market? What new drugs have the potential to disrupt the market in the future? For investors, where are the future opportunities? This article will answer each question one by one.

Steady market growth

According to the dry eye market survey report released by Fortune Business Insights this year, the global dry eye market value reached as high as US$4.5 billion in 2020. With the increasing popularity of contact lenses in modern life and screen devices such as mobile phones and computers as a part of people’s daily lives, the incidence of dry eye has increased significantly. Meanwhile, the main affected population has transitioned from the elderly to the youth. The compound annual growth rate (CAGR) is expected to be approximately 6.9%, and the market size is expected to exceed $7.7 billion in 2026【1】.

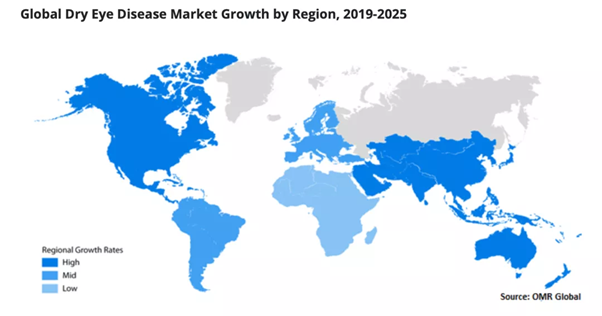

In terms of the growth rate of each region, North America and the Asia-Pacific region are the most notable, but the reasons for the rapid development of the market size in the two regions are completely different. The vigorous development of the North American market is mainly due to the high dependence of the population on contact lenses and the strong awareness for available dry eye treatment options.

▲Source: OrionMarket Research

In the Asia-Pacific region, aging and air pollution are the main reasons driving market development【2】. The number of patients with dry eye in China is particularly large. According to data from the Tongren Eye Foundation, it is estimated that the patient population is about 200 to 300 million【3】. In the face of a huge patient population, the Chinese government has emphasized in its 13th Five-Year Plan that more attention should be paid to ocular health. Driven by this policy, China’s dry eye market has grown substantially. According to the “Global Dry Eye Drug Industry Market Status Survey Report 2020” released by New Thinking, the market size of dry eye disease will reach more than RMB 4 billion, representing the largest segment within the ophthalmic medicine industry【4】.

Various treatment options are available and are dependent on local conditions

Dry eye occurs when either people with the condition produce an inadequate amount of tears or when their tears are of a poor quality. Treatment methods vary according to the cause and severity of the disease, and are mainly divided into cause removal, non-drug treatment and drug treatment【5】. The goal of the first is to remove the external environmental factors that cause dry eye. Non-drug treatment involves a series of physical therapy and psychological interventions. However, if neither of these options is successful in relieving dry eye, drug therapy becomes the main treatment option.

For mild dry eye caused by insufficient tear secretion, the current mainstream drug treatment on the market is over-the-counter tear drops. These can relieve the symptoms of dry eye by increasing the amount of tears on the ocular surface. Using eye drops requires long-term commitment by patients. When tears are not sufficiently secreted and dry eye disease progresses from moderate to severe, anti-inflammatory treatment is often the first choice. This includes glucocorticoids, non-steroidal anti-inflammatory drugs, and immunosuppressive agents, which regulate immune or cause inflammation pathways to achieve an anti-inflammatory effect.

Many schools of thought compete

Worldwide, the attention of pharmaceutical companies to the field of dry eye disease started in the 1990s. In 1995, eye drops developed by Santen Pharmaceutical in Japan was approved to be marketed. Its high sales volume quickly drove the development of the dry eye market, making dry eye emerge as an independent subclass in the ophthalmology field.

In the following decades, major ophthalmology companies such as Alcon/ Novartis and Bausch & Lomb have joined the competition to optimize the composition and formulation of eye drops and launch next-generation products. Among them, the tetrahydrozoline hydrochloride eye drops, Systane, developed early by Alcon is still strong. In fact, it almost monopolized the European dry eye market in 2017, while the US market has formed a pattern of continuous listing of drugs with new mechanisms of action.

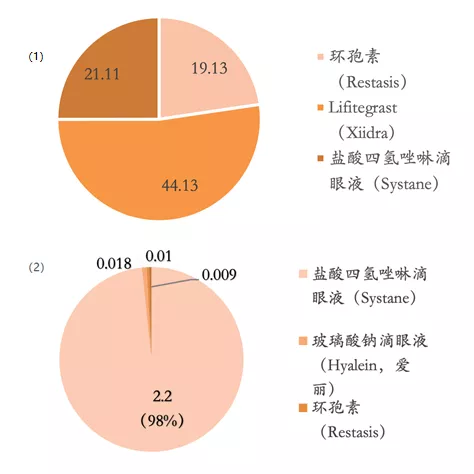

In 2002, the 0.05% cyclosporine preparation Restasis developed by Allergan (now AbbVie) was approved for marketing in the United States. It had a moderate advantage in clinical trials, breaking the prior situation of no effective drugs for moderate to severe dry eye. As the first-line medication for such indications and the only treatment product at that time, cyclosporine became the mainstream product in the American dry eye market with its unique immunosuppressive mechanism. During its peak sales period, it brought in more than US$1.4 billion in revenue for Allergan every year. Another anti-inflammatory small molecule drug, Xiidra, entered the market in 2016 through Shire’s research and development department. Xiidra quickly seized Restasis’ market share by virtue of its faster onset time. In 2017, Xiidra’s sales accounted for 44% of the total market.

▲ Summary of the dry eye market in the United States and Europe: (1) The market share of dry eye in the United States in 2017 (by product); (2) Market share of dry eye in Europe in 2017 (by product)

Source: IMS, Guangzheng Heng Sheng

Unlike the European and American markets, the main dry eye treatment method in China remains eye drops. Eye drops, as a tear substitute that imitates the components of human tears, can moisturize the eyes. However, there are no biologically active ingredients in these products. Thus, for patients with dry eye, eye drops can only provide relief, not a cure.

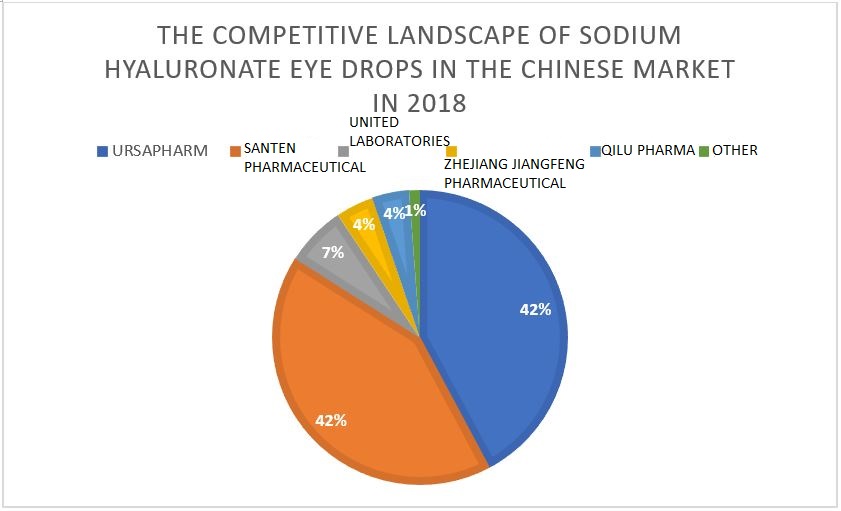

In the 1990s, after tear drops were recognized by the market, a large number of eye drops using polyethylene glycol, polypropylene alcohol, glycerin, hyaluronic acid, and others as active ingredients were successively developed. The dosage form and ingredients were continuously optimized to increase viscosity so that the drops remained in the eyes longer. At present, the third-generation sodium hyaluronate eye drops represents the mainstream market in China, accounting for 89% of the eye drop market in 2018 【6】. The structure of sodium hyaluronate is similar to the viscous glycoprotein in tear fluid, making it easy to interact with tears. Compared with the previous product, it can increase the stability of tears and promote the repair of corneal epithelial cells. It is safe and gentle, and patients rarely have allergic reactions to it. Therefore, it has become the main treatment for mild dry eye symptoms. The domestic Chinese sodium hyaluronate eye drops market is still dominated by foreign companies, and the market is highly concentrated. The top two companies are URSAPHARM from Germany Santen Pharmaceutical from Japan. Together, they account for 84.09% of the market share.

▲ The competitive landscape of sodium hyaluronate eye drops in the Chinese market in 2018

For the treatment of moderate to severe dry eye, the domestic Chinese market is currently in a blank stage. But the deployment of new drugs for dry eye is in full swing. In June of this year, Xingqi’s generic drug cyclosporine eye drops (II) was approved by the State Food and Drug Administration, becoming the first approved drug in China for the treatment of dry eye.

At the same time, the domestic pharmaceutical giant Hengrui Medicine is not far behind in the ophthalmology field. In 2019, it spent US$165 million to in-license two new dry eye drugs, CyclASol™ and NOV03, through a licensing agreement with Novaliq in Germay. CyclASol™ is a cyclosporine with anti-inflammatory and immunomodulatory effects. It is used for the treatment of dry eye where patients don’t produce enough tears. NOV03 is a lubricant based on perfluorohexyl octane. It can quickly spread on the eye surface and form a stable lipid layer, which can improve the symptoms of patients’ tears are of a poor quality. Both drugs are currently in Phase III clinical trials in the United States. In completed trials, they have shown good efficacy, safety and tolerability.

In addition, many domestic Chinese pharmaceutical companies have joined the field of dry eye drug development, but their layouts are relatively scattered. For example, Essex Biotechnology in-licensed Mitotech’s cardiolipin peroxidation inhibitor SkQ1 eye drops; Lee’s Pharm licensed-in sterile preservative-free eye drops RGN-259 based on Tβ4; as well as the second-generation LFA-1 antagonist of Vivo Bio. These different strategies show that the battle for the development of new drugs to treat dry eye has begun.

In general, whether overseas or domestic, the dry eye market is in a state of development. Products can be roughly divided into eye drops and targeting drugs. Older pharmaceutical companies still are the main manufacturers of eye drops, such as Santen, Alcon, and Bausch & Lomb. Their products are constantly updated in terms of ingredients and dosage forms (drops and ointments). New products continue being released and have reached the fifth generation. The anti-inflammatory drug Restasis, the original cyclosporine drug, has improved the concentration of cyclosporine and has a new drug delivery system. However, many new target drugs are also being developed by small and medium-sized biotech companies one. These drugs are not alike in structure, target, and mechanism of action. They may become acquisition targets by major pharmaceutical companies.

Current problems with dry eye treatments include single treatment options, slow onset, and adverse side effects

♦ The Chinese market is highly dependent on eye drops. Eye drops can only relieve mild symptoms and have little effect on moderate to severe dry eye. Moreover, the retention time of artificial tears in the tear film is not long enough. Patients must use the drops 5-6 times a day, which can be an inconvenience. In addition, most varieties of eye drops contain preservatives, and frequent and frequent use can harm the cornea. Therefore, the Chinese market is in urgent need of a safe and convenient medicine for dry eye to meet the needs of patients.

♦ Drugs for moderate to severe dry eye in the European and American markets have a long onset of action. Taking Restasis as an example, it takes 3-6 months of continuous use before it starts to take effect. Even with higher concentrations, it still takes 4 weeks to take effect. There are also the adverse side effects such as a burning sensation caused by frequent administration.

♦ Rapid anti-inflammatory drugs have significant adverse side effects. Although glucocorticoids have a quick effect, short-term use, they have the side effect of increasing intraocular pressure, and long-term use has the potential to cause glaucoma. For chronic diseases such as dry eye, glucocorticoids are not suitable for long-term use.

Future opportunities

Although there is a gap in the domestic Chinese market for the treatment of moderate to severe dry eye, the major Chinese pharmaceutical companies are ready to deploy new products. For those who want to stand out and help patients, it is necessary to take advantage of a short time window. It is essential to quickly launch innovative drugs with fast onset times and minor side effects.

RASP inhibitor: Reproxalap

Reproxalap is a RASP (reactive aldehyde species) inhibitor developed by Aldeyra Therapeutics. RASP is a new anti-inflammatory receptor. Studies found that RASP can form covalent bonds with biological macromolecules in cells, destroy their function, and activate pro-inflammatory mediators. RASP itself can be formed by a variety of pathways, including lipid peroxidation, alcohol oxidation, polyamine, and glucose metabolism.

Reproxalap relieves dry eye by inhibiting RASP, which is elevated in ocular inflammation. At present, Reproxalap is in Phase III clinical trials. In Phase IIb clinical trials that have just been completed, Reproxalap significantly improved a variety of symptoms in patients with dry eye. In an experiment of more than 1,100 patients, there were no safety issues, and the only adverse reaction was mild irritation at the drip site. In addition, the onset time of reproxalap is much faster than that of drugs on the market. It can relieve the itching symptoms caused by dry eye within 10 minutes to 1 hour after use. If Reproxalap can be successfully launched, it will have great potential to disrupt the dry eye market【7】.

Recombinant Human Lubricin: ECF843

ECF843 is recombinant human lubricin (rh-Lubricin) developed by Lubris BioPharma. Lubricin naturally exists on the ocular surface. It can prevent the cornea and ocular surface from being injured by preventing the friction between the cornea and the conjunctiva and reducing the shear stress caused by blinking, thus playing an important role in the health and comfort of the eyes. Usually, patients with moderate to severe dry eye will affect the normal level of lubricin produced by the body due to injury, disease, and inflammation caused by aging, which will cause discomfort when they blink.

ECF843 as a recombinant human lubricin supplement can eliminate surface friction and repair surface function. Compared with existing therapies, ECF843 can restore the homeostasis of the tear film and help improve the biocompatibility of contact lenses and extend the wearing time. At present, ECF843 performs well in Phase II clinical trials. Compared with the standard treatment of sodium hyaluronate, Lubricin supplement therapy can reduce the patient’s symptoms by 72% from baseline within 28 days, and no treatment-related adverse events have been found. In addition, ECF843 has potential uses other than dry eye, such as treatment of osteoarthritis, dry mouth caused by salivary gland damage in patients with head and neck cancer, repair of the inner surface of the bladder, and others.【8】.

Nicotinic acetylcholine receptor agonist: OC-01

Oyster Point Pharma is a new and innovative biotechnology listed company focusing on dry eye. Its candidate product OC-01 is a highly selective nicotinic acetylcholine receptor (nAChR) agonist. It is currently being developed as a preservative-free nasal spray.

Its emerging mechanism is mainly through the trigeminal nerve accessible in the nose in order to partially control the tear film, promote the establishment of tear film homeostasis, and achieve the purpose of relieving dry eye. According to the results of clinical trials, the drug was administered twice a day, and it started to take effect in the second week. In December last year, it submitted an application to the FDA. The same drug candidate is still in Phase II clinical trials, focusing on neuroparalytic keratitis in the dry eye market segment. As an orphan drug, and with its safety and effectiveness verified, OC-01 is expected to get a good return on investment in the short term.

Topical synthetic peptide: Lacripep

Lacripep is a biologically active 19 amino acid fragment developed by Dr. Gordon, a professor of cell biology at the University of Virginia, for dry eye. It was commercialized by TearSolutions and completed Phase II clinical trials in January this year. In the Phase I/II trials for Primary Sjögren Syndrome dry eye, Lacripep began to significantly reduce the symptoms of dry eye (burning and tingling) in the second week, and there were no serious adverse reactions related to the treatment. The company is small and sophisticated, and subsequent clinical trials need to be completed by partners.

Cyclosporin-hydrogel delivery system: OTX-CSI

Ocular Therapeutix is a biomedical company specializing in the field of ophthalmology. It uses its unique hydrogel formulation to release the drug slowly and continuously through the lacrimal canaliculus. Now it has successfully developed Dextenza for ocular inflammation and pain indications after eye surgery. On its existing pipeline, Ocular still has 5 drugs for 4 different eye diseases. Among them, OTX-CSI combines cyclosporine, which has been on the market for many years, with a hydrogel drug delivery system. With the advantage of the platform, OTX-CSI has completed Phase I clinical trials, its safety has been verified, and its efficacy began to appear in the second week. It is now recruiting patients for Phase II clinical trials.

About the authors

XU Ziyi is an investment analyst with MyBioGate and a PhD student in the Department of Chemistry at Boston University, majoring in chemical biology and drug delivery systems. He is one of the founders of the Boston University Biotechnology Business Club and Tufts Biotechnology Business Club. He is active in the pharmaceutical science industry in the Greater Boston area.

CHEN Chun is an investment analyst with MyBioGate and a PhD candidate in the Department of Chemistry at Boston University, majoring in organic synthesis of natural products and drug development. Co-founder of Boston University Biotechnology Business Club, member of Tufts University and Massachusetts Institute of Technology Consulting Club, and active in the pharmaceutical science industry in the Greater Boston area.

References

【1】Fortune Business Insights| Global Market Research Report

【2】Orion Market Research:Dry Eye Disease Market Size, Share & TrendsAnalysis Report

【3】Tongren Eye Foundation

【4】2020 global dry eye medication industry market status survey report

【5】Sina Finance: Xingqi Eye Drops in-depth report: eye drops leader

【6】Guangzheng Hengsheng (special report on ophthalmology medication) dry eye disease, AMD medication enters a new journey

【7】Aldeyra Therapeutics website

【8】Lubris BioPharma website

0 Comments