Author: Ginger Ding

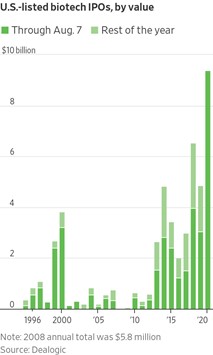

During the COVID-19 downturn, something surprising happened within the US biotechnology industry: The Wall Street Journal reported that as of August 7, 2020 45 biotechnology companies have had an IPO, raising a total of US$9.4 billion. It was total of US$6.5 billion in 2018.

▲Figure 1: US-listed biotech IPOs, by value

Source: The Wall Street Journal

In addition to taking the traditional IPO route, companies such as Therapeutics Acquisition choose the SPAC (Special Purpose Acquisition Company) model to go public. SPACs, which last enjoyed popularity in the 1980s, raise money from stock-market investors to buy unspecified privately traded companies. After the reverse acquisition, these targeted companies are listed on the New York Stock Exchange or Nasdaq.

In fact, the biotechnology industry has been enjoying a lot of attention from SPACs. In 2020, SPACs have successfully completed mergers and acquisitions. Below are some examples:

◆ On July 2, TCR-T company Immatics completed a merger and listing with SPAC ARYA Sciences Acquisition III Corp. As part of the merger, Immatics received approximately US$148 million in cash from within Arya’s trust account and received US$104 million in cash in common stock private investment in private equity (PIPE) from Perceptive Advisors and other top-tier US healthcare investors.

◆ On July 30, Cerevel Therapeutics merged with Arya Sciences Acquisition Corp II. After the merger, proceeds from the PIPE and cash in Arya II’s trust account totaled about US$445 million. The funds are to be used to advance development of Cerevel’s neuroscience pipeline. This is one of the largest IPOs in the biotechnology industry in recent years, comparable to Legend Bio, and second only to Moderna and Genmab.

As of early August, at least six healthcare-related SPACs have been listed. A recent example occurred on July 4 when the health services company MultiPlan Inc agreed to merge with SPAC Churchill Capital Corp III CCXX.N. The transaction was valued at about US$11 billion, making it the largest SPAC merger to date. The merged company will operate under the name MultiPlan.

▲Figure 2: SPAC listed healthcare companies in 2020

Source: public information

Looking back at the major SPAC-related events in 2019, Chardan Healthcare, which was listed with a SPAC on October 29, successfully completed a merger and acquisition with BiomX, which potentially inspired more companies to choose SPAC as a model to go public. In fact, Chardan Healthcare launched a second SPAC company this year.

What is SPAC? Why do investors favor SPAC? What is the relationship between SPAC and the acquired company? Which Chinese companies choose SPAC channels for listing in the US? This article will attempt to answer these questions one-by-one.

The past and present of SPACs

SPACs are “blank-check” companies formed by mutual funds and hedge funds. The SPAC has only funds and does not conduct business. The company is listed on the Nasdaq or the New York Stock Exchange and raises funds by issuing a combination of common stocks and options in the form of investment units. The funds are deposited in a third-party trust account.

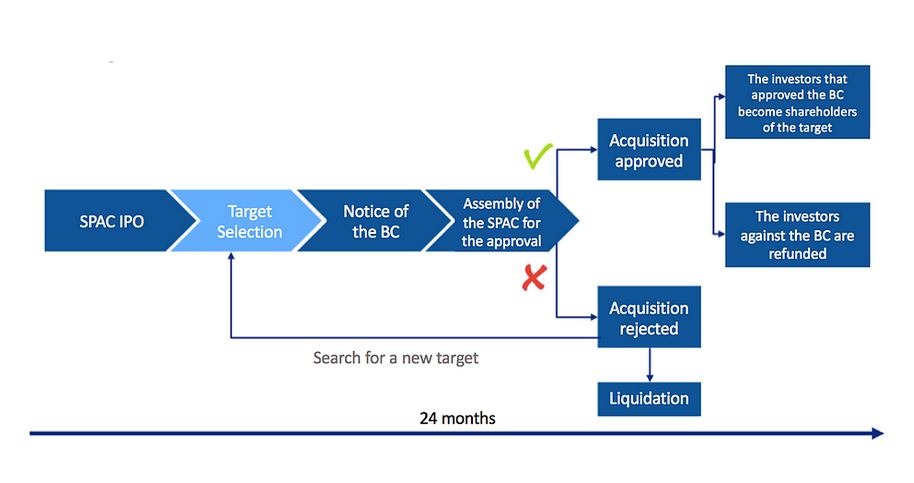

After listing, SPACs need to find high-quality companies with whom to complete mergers and acquisitions, usually within 24 months. After completing the merger, the company can access the trust funds raised by the SPAC. If a successful merger does not occur within the 24-month timeframe, the SPAC is liquidated and dissolved.

▲Figure 3: SPAC listing process

Source: BSPE club

According to securities trading rules, acquisition transactions must be conducted with one or more target companies whose market value reaches at least 80% of the assets held in the trust account.

In short, the purpose of establishing of a SPAC is to find valuable non-listed companies for mergers and acquisitions.

SPACs first appeared on the Toronto Stock Exchange and were used to acquire mining companies. In the mid-1990s, GKN Securities in the US managed about a dozen blank-check IPOs and attempted to trademark the term “SPAC” in 1992. After the subprime mortgage crisis swept the world in 2008, in order to reinvigorate the financial market, the SPAC listing system was adjusted. Previously, one could only exchange SPACs on OTC (over-the-counter). Now, SPACs are directly listed on the New York Stock Exchange or Nasdaq.

“SPACs were approximately 3% of the IPO market back in 2014, now they are almost 35% of all new listings,” says Jay Heller, the Nasdaq’s head of capital markets.

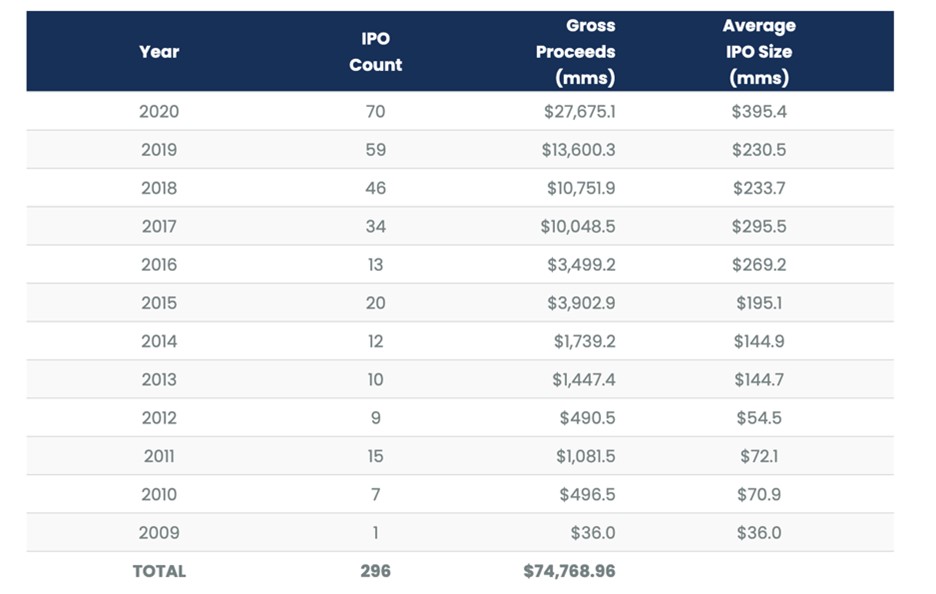

After more than 20 years of development, the SPAC listing system has become very mature. So far in 2020, 67 SPAC companies in the United States have been listed, raising about US$26.05 billion.

▲Figure 4: SPAC listing data (as of August 12, 2020)

Source: SPAC Insider

What are the advantages of SPACs?

“At present, the most suitable targets for SPAC in China are companies on the New Third Board. Among the more than 10,000 companies on the New Third Board, I think there should be 2,000 companies that can find a way to access the capital market overseas.”

——Dr. Fan Di, founder and chairman of Asia Alliance Capital

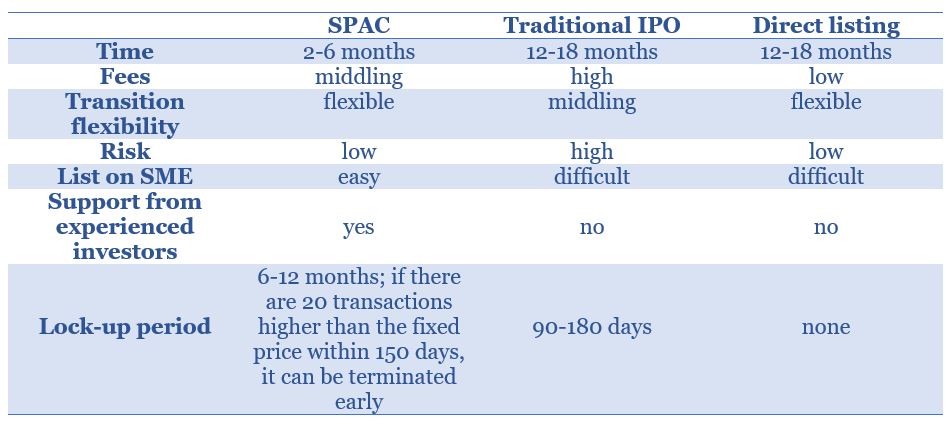

SPAC can normalize corporate restructuring and M&A and activate capital. Compared with traditional listing channels, what are the advantages of SPAC?

▲Figure 5: Comparison of three listing channels

Source: public information

◆ Short wait time, available in a few weeks at the earliest

Traditional listing methods require companies to work with underwriters (investment banks) and regulators to formulate detailed investor prospectuses, along with frequent roadshows to sell shares to early investors. The entire process takes several months. SPACs can omit many steps. The investor roadshow does not need to explain the business, only introduce the vision and management team. It could be listed on the market within 8 weeks.

◆ Low threshold for IPOs, suitable for small and medium enterprises

SPACs can bypass the rigid regulations of the US Securities Regulatory Commission on corporate IPOs. There is no threshold for IPOs, making it more suitable for small and medium-sized enterprises, especially small enterprises that are not qualified to be traditional IPOs.

◆ Low cost, can save about 70% of listing cost

The target company can go public through a single-step merger instead of multi-stage cross-listing, which can save about 70% of listing costs. Traditional IPO underwriters usually get a discount of 5% to 7% of the total IPO proceeds. The typical structure of SPAC listing is to pay 2% of the total proceeds at the end of the IPO. The other 3.5% is deposited in the trust account and paid to the underwriter at the end of the acquisition transaction. If there is no acquisition transaction, 3.5% will not be paid to the underwriters, but will be used to redeem public shares together with the trust account balance.

◆ High success rate

Only the consent of the acquiring parties is required, and there is no issuance failure due to other reasons.

◆ Team support

Investors are mostly hedge funds and mutual funds with a good public image. After the merger, the SPAC management team usually retains at least one key person to play an active role as a consultant.

◆ Double guarantee for listing and financing

The SPAC market has maintained almost constant activity, especially when traditional IPO activity is low due to the overall financial environment. SPACs must have already raised a sum of not less than US$50 million. After the target company completes the merger with the SPAC company, its operating entity can be listed and obtain financing at the same time.

For investors, SPACs also have a special appeal

◆ Decision-making power

Investors will not only receive common shares, but also rights or warrants. At the same time, investors also have the right to vote on potential merger targets.

◆ Low risk

All investors’ funds will be immediately deposited in the trust account. Even in the worst case, if the merger is not completed within two years, investors can still get the principal and corresponding interest after deducting part of the management fee.

◆ Flexible entry and exit

Investors can sell their stocks and rights before and after mergers and acquisitions. When announcing mergers and acquisitions, stocks tend to rise. Investors can also sell stocks while retaining the rights.

◆ Opportunities to invest in small companies

SPACs provide opportunities to invest in small companies at an early stage.

Chinese SPAC Case Study

Due to its unique advantages, more and more Chinese companies are choosing to list as SPACs in the United States. The first SPAC listing in China was in March 2004, when Beijing O.R.G Seed Company was listed on OTC through the American company Chardan. In November 2005, O.R.G. and Chardan completed the merger, obtaining US$24 million in financing and started to be traded on NASDAQ. In January 2006, O.R.G. issued warrants to raise US$40 million. The original investors including hedge funds had a return on their investment of 700%.

Since 2019, many Chinese companies have chosen to go public through SPACs. Among them, SPAC listed companies include CITIC Capital Acquisition Corporation, Shanghai Company Brilliant Acquisition, China Yunhong Holdings, and others. SPAC mergers and listings include Renren’s Kaixin Auto + CM Seven Star Acquisition Corporation, Blue Focus Communication Group + Legacy Acquisition (the first A-share company to be listed on US stocks through SPAC), and United Family Healthcare + New Frontier.

Below, we will focus on cases in the healthcare fields.

United Family Healthcare and Fosun break up, and goes public in the US as New Frontier Health Corp.

United Family Healthcare is the first foreign-funded hospital in China, co-founded by CEO Li Bijing and the Chinese Academy of Medical Sciences. Since its establishment in 1997, it has opened and operated 7 medium-to-large high-end hospitals and 14 high-end clinics in first- and second-tier cities across China. Its Beijing and Shanghai Puxi Hospitals were the first hospitals in China to obtain JCI certification.

United Family Healthcare was originally part of Chindex, a medical and health company listed on the Nasdaq in the United States, whose main business is to provide medical services and medical equipment to the Chinese market. After 2009, Fosun began to invest in United Family Healthcare and entered the field of medical services.

On December 19, 2019, under the direction of Liang Jinsong (the husband of diving queen Fu Mingxia), the chairman of New Frontier, the investment platform New Frontier (NYSE trading code: NFC) announced the completion of the acquisition of United Family Healthcare. New Frontier acquired United Family Healthcare shares from existing shareholders such as TPG and Fosun Pharma. The financial support for this acquisition came the cash in New Frontier’s trust account, bank loans, and the company’s common stock issuance. The company’s market value is approximately US$1.4 billion.

Although the ten-year partnership has ended, Chen Qiyu, Chairman of Fosun Pharma will serve as co-chairman at United Family Healthcare, and Fosun Pharma will continue to be an important long-term strategic partner.

Conclusion

More and more well-known domestic Chinese biotechnology companies (Legend Creatures, Genetron Health, Burning Stone DX, I-Mab, etc) have chosen to list on the Nasdaq. The U.S. has a large capital market and capacity, high price-earnings ratio, and can improve the company’s global reputation. Strict regulations are also conducive to the company’s long-term development. These distinctive features are quite attractive to Chinese companies.

SPACs have been present in the market for more than 20 years, although it was not until 2018 that more biotech companies tried this model. The successful merger of several large transactions in 2019 and 2020 has greatly enhanced investors’ confidence. In addition, the coronavirus epidemic in 2020 has further lengthened the traditional IPO listing times, while the SPAC listing process has the advantages of being simple, fast, and low cost.

Of course, there are also many concerns about the listing of SPACs in the market. Some believe that companies listed on SPACs have not undergone the same rigorous review that traditional IPOs must do. The simplified process provides investors with less information and time to make wise decisions, and there are certain risks.

SPACs have no business in the traditional sense. In order to reduce risks, it is especially important for them to conduct a comprehensive and in-depth evaluation of the management team. Take Therapeutics Acquisition as an example. Investors threw in because its founder is the famous investor Peter Kolchinsky. After establishing RACapital in 2002, Peter invested US$1.4 billion in more than 124 companies, including Arvinas and Black Diamond Therapeutics.

About the author:

Dr. Ginger Ding is the Director of Investment Analysis at MyBioGate and an advisor for the Texas Medical Center and Columbia University Consulting Club. She has worked at the Howard Hughes Medical Institute and MD Anderson Cancer Center. During the period, she participated in the preclinical research of tumor brain metastasis which received funding from the National Institutes of Health RO1, Susan G. Komen, and Taiho Pharmaceutical.

0 Comments