Author: Youwen Dai

Recently, I visited several senior executives of pharmaceutical companies in China. A large proportion of companies visited reported that they plan to in-license respiratory-related products and optimize product pipelines to cope with the impact of centralized procurement across the country. In order to find the reason behind such a large interest in the respiratory field, I take stock of respiratory drugs, especially asthma and chronic obstructive pulmonary disease (COPD) companies and products.

The global respiratory drug market

The global respiratory drug market is expected to reach US$30.7 billion in 2024.

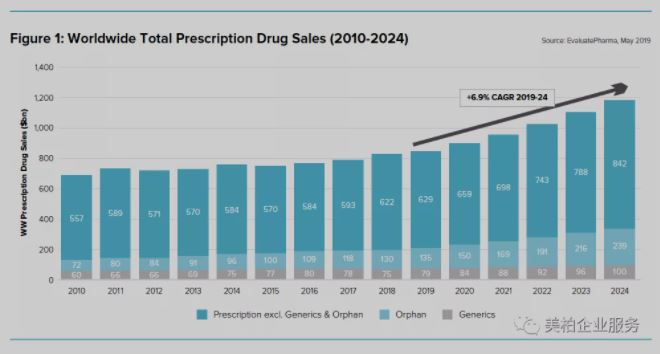

According to EvaluatePharma’s “World Preview 2019, Outlook to 2024” report, the global prescription drug market in 2019 was US$833 billion and the compound annual growth rate (CAGR) is expected to grow by 6.9% between 2019 and 2024. By 2024, the total prescription drug market is expected to reach US$1.18 trillion 【1】.

▲Figure 1: Global Prescription Drug Market Sales Forecast (2010-2024)

Source: World Preview 2019, Outlook to 2024

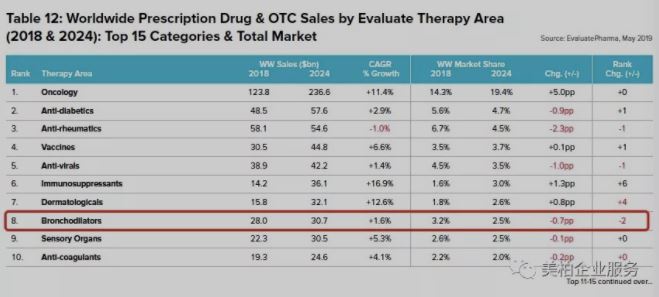

The 2018 global drug sales list data shows that bronchodilators, the main drugs to treat asthma and chronic obstructive pulmonary (COPD) respiratory diseases, had sales of US$28 billion in 2018, ranking sixth in the world. In 2024, the annual prescription drug market for these drugs is expected to reach US$30.7 billion, ranking 8th.

▲Figure 2: Worldwide Prescription Drug & OTC Sales by Evaluate Therapy Area (2018 & 2024): Top 15 Categories & Total Market

Source: World Preview 2019, Outlook to 2024

The average R&D investments for new respiratory drugs approval is high

The report counts products that are in the clinical development stage (stages 1-3) or have already been submitted to the FDA in the United States. The data shows that the average R&D investment for respiratory drugs is US$9.2 billion. Due to the small number of respiratory products approved, the average R&D expenditure rose to US$32.1 billion US dollars, second only to 78.2 billion US dollars for oncology.

▲Figure 3: Clinical Development Spend vs Risk Adjusted FDA Approvals by Therapy Area of Current US Pipeline

Source: World Preview 2019, Outlook to 2024

The chronic respiratory disease market in China has great potential

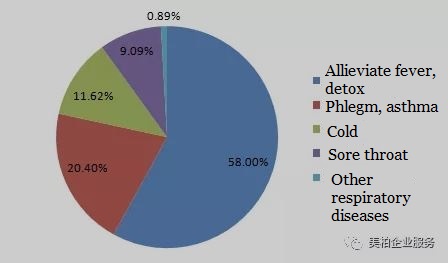

According to the data from Zhongkang CMH, domestic Chinese respiratory system drugs in 2017 reached RMB 143.154 billion, an increase of 4.23% from the previous year【2】. Drugs for alleviating fever and detoxing accounted for 58.00%, drugs to treat the common cold accounted for 11.62%, cough, expectorant and asthmatic medicines accounted for 20.40%, throat medicines accounted for 9.09%, and drugs for other respiratory diseases accounted for 0.89%【3】. The market size of anti-asthma drugs reached RMB 24.131 billion.

▲Figure 4: China’s respiratory drug market share

Source: ldhxcn.com

From the perspective of market segments, the following characteristics are presented:

- Cough and cold medicines represent the largest share of respiratory medicines in the Chinese market. The number and frequency of upper respiratory diseases are relatively high, but due to their short course, the amount of medicine used per capita is relatively small. Market competition has entered a fierce stage and the market concentration is low;

- Anti-asthma drugs are in second place. Chronic obstructive pulmonary disease (COPD) and related illnesses often have a long course and can recur. The per capita consumption of related drugs is relatively large. Four of the top five brands in China are foreign ones;

- Throat medications account for the smallest share of the market in China. Proprietary Chinese medicines account for 97.5% of throat treatments sold.

Driving factors behind China’s respiratory medicine market

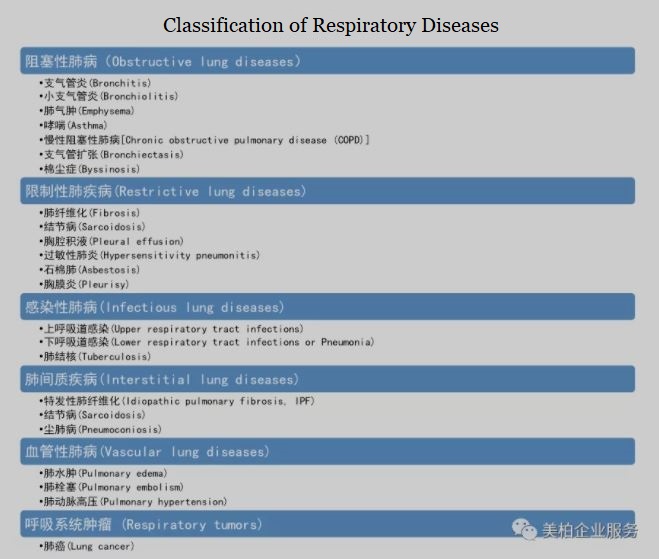

Classification of respiratory diseases

Respiratory diseases include upper respiratory tract diseases, lower respiratory tract diseases, interstitial lung diseases and vascular lung diseases 【4】. Among them, upper respiratory tract diseases are common, including colds, coughs, and pharyngitis. The disease runs its course in a relatively short time, but number and frequency of medical visits are relatively high.

Another category is chronic diseases such as asthma and chronic obstructive pulmonary disease (COPD), which have a longer treatment course. It is estimated that there are approximately 334 million asthma patients and 328 million COPD patients worldwide. Asthma is the second leading cause of death and disability in the world after cancer. In recent years, the prevalence of respiratory diseases has increased.

▲Figure 5: Classification of respiratory diseases

The difference between drugs to treat asthma and COPD

- Asthma is a heterogeneous disease, usually characterized by chronic airway inflammation. The patient has respiratory symptoms that change with time and intensity, such as wheezing, shortness of breath, chest tightness, and coughing, as well as reversible expiratory airflow limitation.

——GINA2019, Global Initiative for Asthma

- COPD is a common and preventable disease that causes persistent respiratory symptoms and airflow restriction caused by abnormal airways and alveoli caused by large exposure to toxic particles or gases.

——GOLD2019, The Global Initiative for Chronic Obstructive Lung Disease

▲Figure 6: GINA/GOLD

Pathogenesis and population differences between asthma and COPD

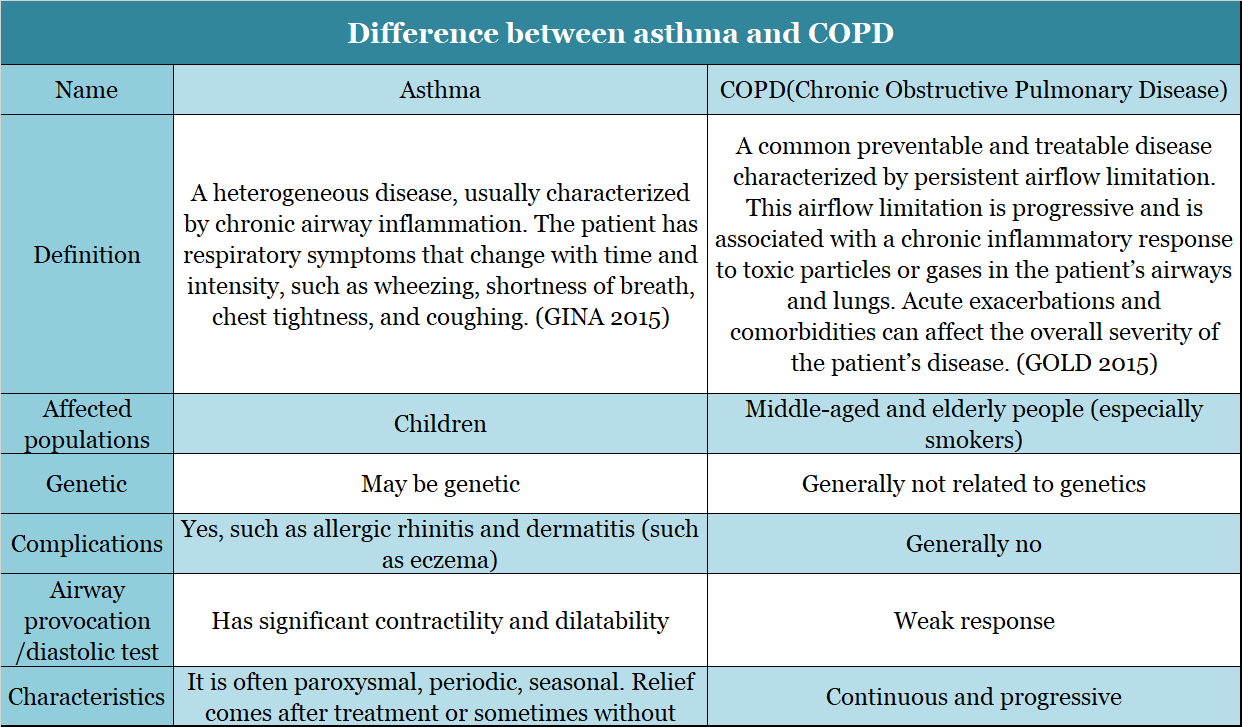

▲Figure 7: Comparison of asthma and chronic obstructive pulmonary disease (COPD)

Source: Public information

Bronchial asthma is not COPD, but COPD and asthma can occur in the same patient. In addition, some airflow limitation diseases with known causes or characteristic pathological manifestations, such as bronchiectasis, tuberculosis, and cystic fibrosis are not COPD. All diagnosis and treatment of COPD must refer to how the lung functions. After inhaling bronchodilators, FEV1/FVC<70% can be determined as persistent airway obstruction and airflow limitation (ie, COPD).

Comparison of drugs to treat asthma and COPD

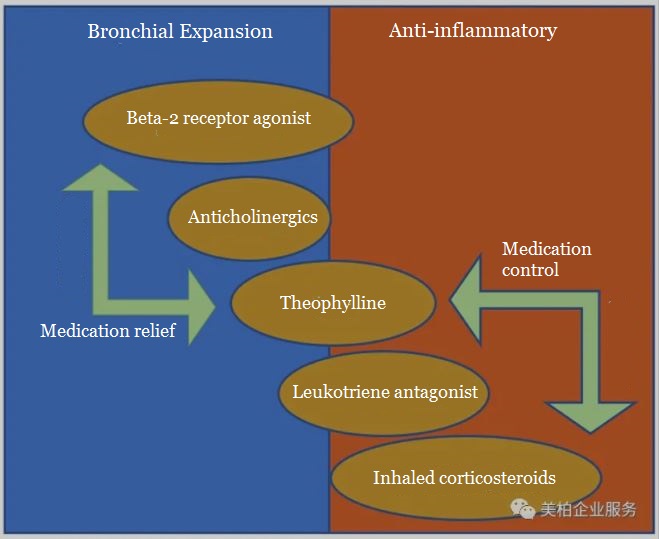

According to the latest Global Asthma Prevention and Control Guidelines from GINA in 2019, asthma drugs are mainly divided into two categories: bronchial expansion and anti-inflammatory drugs.

▲Figure 8: GINA 2019 Asthma Drug Classification

Source: Drug Evaluation Center Gcplive

The latest edition of the COPD Guide from GOLD in 2019 also shows that bronchodilators and glucocorticoids (ICS) are commonly used drugs.

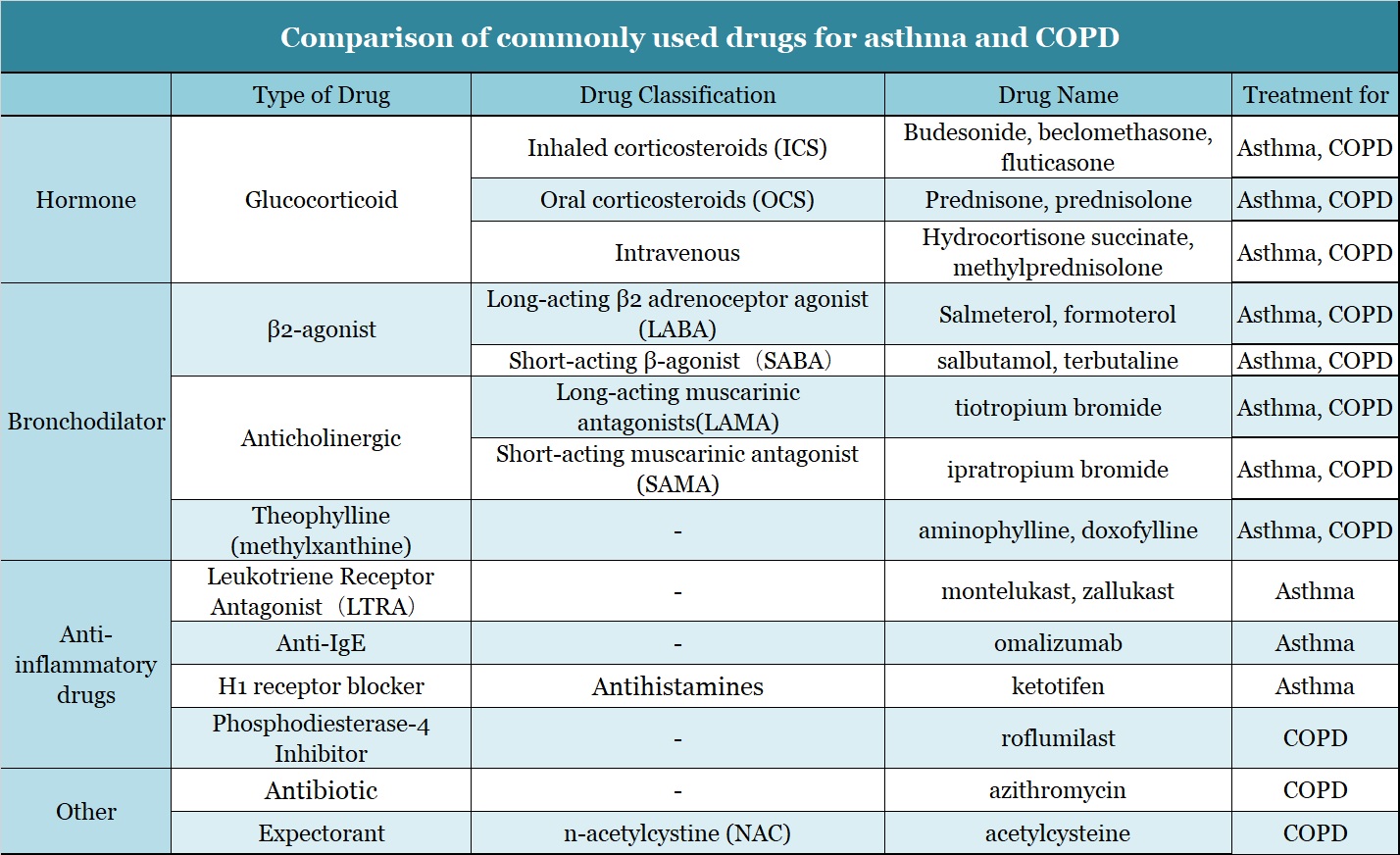

▲Figure 9: Comparison of commonly used drugs for asthma and COPD

Domestic Chinese market for asthma and COPD

There are nearly 40 varieties of asthma and COPD medications in China. Top 10 products used in 2018 are budesonide, montelukast sodium, budesonide/formoterol, doxofylline, tiotropium bromide, salmeterol/fluticasone, terbutaline, salbutamol, ipratropium bromide, and methenamine/aminophylline/chlorpheniramine/narcotine products.

The domestic Chinese asthma and COPD medication market is about RMB 17 billion, with a CAGR of 14% from 2012 to 2018. According an analysis by Ping An Securities, the actual domestic respiratory system drug market in 2018 was about RMB 32.2 billion, an increase of 2.43%. Asthma and COPD medication was about RMB 16.9 billion, an increase of 9.57%. The market is estimated to be RMB 14.7 billion for asthma and RMB 2.2 billion for COPD. From the 2012-2018 CAGR, the use of asthma and chronic obstructive pulmonary (COPD) medications is as high as 14.19%, which is significantly higher than the respiratory system’s 9.14%. 【5】

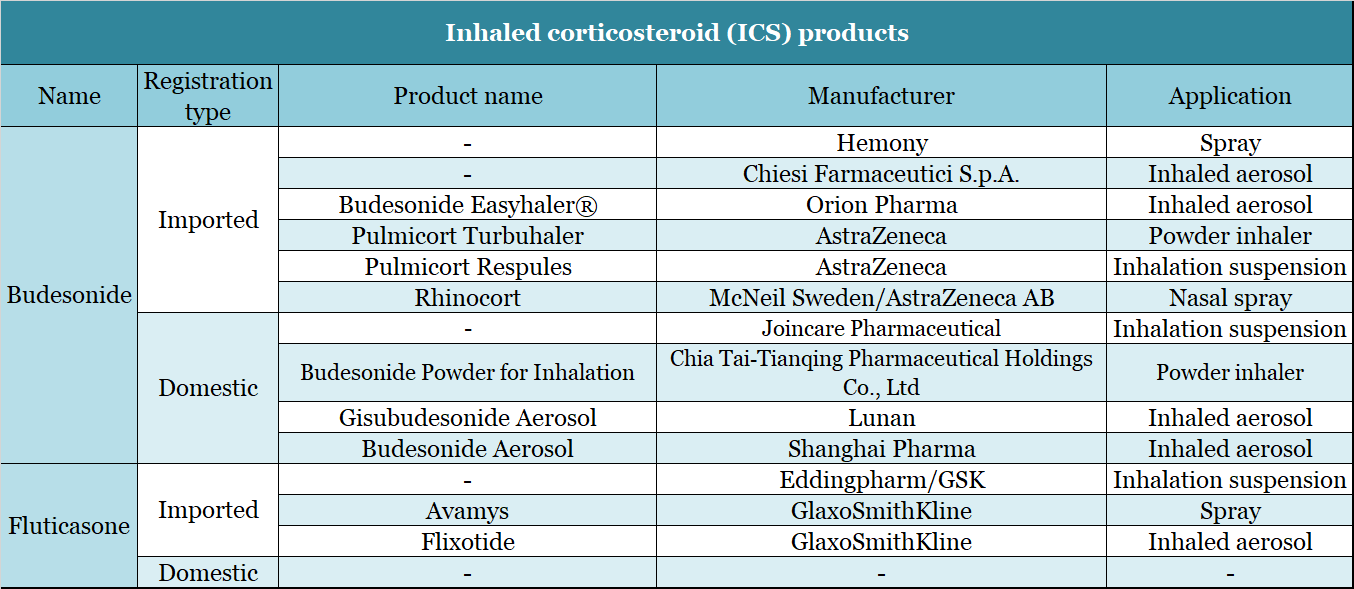

- Corticosteroids (ICS)

The domestic drugs for treating COPD are mainly bronchodilators and inhaled corticosteroids. AstraZeneca’s budesonide (Pulmicort Ressu) ranked first in the sample hospital market with a market share of over 35% in the first half of 2019. At the same time, Chinese companies have followed the example of inhaled suspension formulations. On February 27, 2020, Chia Tai Tianqing’s respiratory drug “Budesonide Suspension for Inhalation” was approved by the State Food and Drug Administration. On July 21, 2020, Joincare Pharmaceutical’s “Budesonide Suspension for Inhalation” was also approved for listing. Furthermore, Eddingpharm B.V., a subsidiary of Eddingpharm, obtained the “fluticasone propionate aerosol inhalation suspension” produced by GlaxoSmithKline and was approved for listing in May 2020.

▲Figure 10: Inhaled corticosteroid (ICS) products

Source: National Medical Products Administration (NMPA)

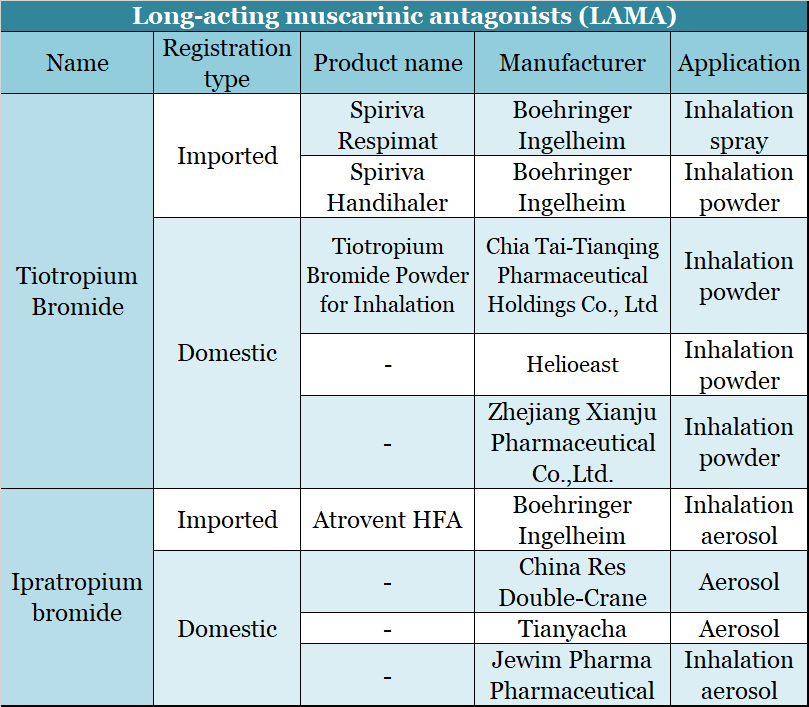

- Long-acting muscarinic antagonists (LAMA)

LAMAs hold the second largest sector of the asthma and COPD market. Boehringer Ingelheim’s Silva Spiriva (tiotropium bromide) was the world’s first inhaled COPD treatment drug. It reached about US$330 million globally in 2019, while its peak sales in 2012 were US$3.901 billion. The decline in profit was mainly due to the increasing market share of combination drugs and generic drugs. Chia Tai Tianqing’s tiotropium bromide generic drug (Tianqing Sule) had sales of about US$92 million in 2019.

▲Figure 11: Long-acting muscarinic antagonist (LAMA) products

Source: NMPA

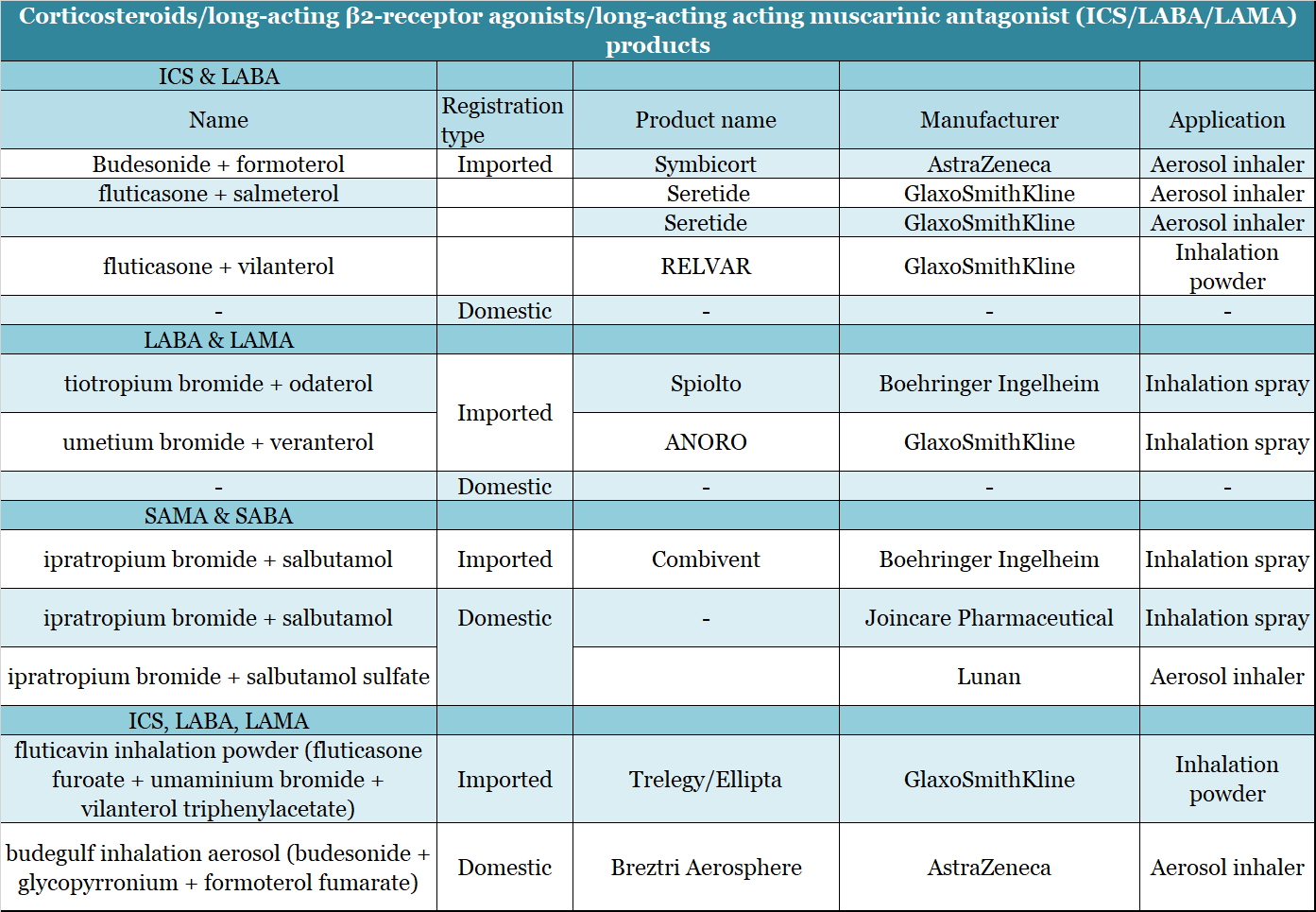

Combination medication

- Dual: corticosteroids/long-acting beta receptor agonists (ICS/LABA)

Currently, the three main ICS/LABA drugs on the global market are AstraZeneca’s Symbicort and GSK’s Seretide and Breo (not listed in China). The sales of these three drugs in 2018 and 2019 totaled US$7.230 and 5.952 billion, a decrease of 17.67%. However, more domestic Chinese companies have made breakthroughs and are starting to join the market. For example, on April 9, 2019, Joincare’s “Compound Ipratropium Bromide Solution for Inhalation” was approved for listing. GSK’s salmeterol ticasone is also under review as well as four generic listing applications from Jiangsu Hengrui Medicine and Tianyancha.

- Triple: corticosteroids/long-acting M receptor blockers/long-acting β receptor agonists (ICS/LAMA/LABA)

On November 16, 2019, GlaxoSmithKline (GSK) announced that the first once-daily three-in-one inhalation preparation for the treatment of chronic obstructive pulmonary disease, “Trelegy® Ellipta®” (generic name: fluti) Meiwei inhalation powder mist, Fluticasone Furoate/Umeclidinium/Vilanterol, 100/62.5/25 μg) was officially launched in China. This inhalation preparation is suitable for the treatment of stable COPD. It contains inhaled corticosteroids (ICS), long-acting muscarinic antagonists (LAMA) and long-acting β2 receptor agonists (LABA).

▲Figure 12: Combination medication products (ICS/*ABA/*AMA)

Source: NMPA

Drugs that are useful for treating asthma but have no obvious effect on COPD mainly include leukotriene receptor antagonists (LTRA), short-acting β receptor agonists (SABA), theophylline drugs, and antibody drugs.

Leukotriene receptor antagonist (LTRA)

According to data from Minai.com, in 2018, the sales of end-user montelukast in China’s urban public hospitals, county-level public hospitals, urban community centers and township health centers were RMB 2.841 billion, an increase of 17.29%. Among them, Singulair, Merck has a market share of 66.26%, Lunambate accounts for 18.99%, and Otsuka Pharmaceutical accounts for 14.75%. 【6】

Beta receptor agonist (LABA/SABA)

For a long time, β2 receptor agonists were the drugs of choice for controlling acute asthma attacks. Commonly used short-acting β2 receptor agonists are salbutamol and terbutaline. They are the first choices for alleviating mild to moderate acute asthma symptoms. Long-acting β2 receptor agonists include formoterol, salmeterol and procaterol. They are divided into quick-acting (acting in a few minutes) and slow-acting (effective within 30 minutes).

However, the updated GINA2019 guidelines mention that for safety reasons, it is no longer recommended to use short-acting β2 receptor agonists (SABA) alone. Instead, it is recommended that all adults and adolescents with asthma should use symptom-driven use (in mild Asthma) or regular daily use of medications containing low-dose inhaled corticosteroids (ICS) to reduce the risk of severe acute exacerbations. As a result, the beta-agonist market may decline and be replaced by inhaled glucocorticoid (ICS) drugs.

Theophylline drugs

In 2018, the sales of doxofylline drug salbutamol was US$51.82 million, ranking fourth in the asthma market in China. GlaxoSmithKline’s salbutamol sulfate aerosol Ventolin’s global sales in 2018 was US$1 billion. However, there are many domestic Chinese manufacturers and the competition is fierce.

Antibody drugs

In recent years, the research and development of asthma drugs has made great progress. Since the first monoclonal antibody drug Xolair (omalizumab) for asthma was approved, five monoclonal antibodies in this field have been approved for marketing worldwide, namely Novartis’ Xolair (omalizumab) and GSK’s Nucala (Mepolizumab), TEVA’s Cinqair (Relizumab), AstraZeneca’s Fasenra (Benralizumab), Sanofi’s Dupixent (dupiluzumab).

Currently listed in China is Novartis’ Xolair (omalizumab), but its cost is still at a relatively high level, about US$587 per tube.

About the author:

Dai Youwen is the regional business development director of MyBioGate China. He focuses on collaborations between China and overseas companies in the medical and health fields, as well as maintaining close contact with listed Chinese pharmaceutical companies to gain insight into cross-border collaboration trends.

References:

【1】World Preview 2019, Outlook to 2024, EvaluatePharma

【2】The domestic anti-asthma inhalant market breaks the RMB tens of billions mark. TOP 5 varieties account for more than 85%, Xinkangjie https://mp.weixin.qq.com/s/xYTTYXH-aygql0QS6hSLIA

【3】2017-2022 China’s respiratory system drug market status and investment prospects research report, Linghe.com

【4】https://zh.wikipedia.org/wiki/Respiratory diseases, Wikipedia

【5】Which is the first domestic company to break through the domestic respiratory inhalation market? Insight database

【6】”2.8 billion anti-asthma drugs, CSPC enters the market”, Mi Nei Net https://mp.weixin.qq.com/s/u4FB6axrqEu382SCmy1H1Q

0 Comments