CHEN Lixing

Age-Related Macular Degeneration (AMD) is a chronic and irreversible eye disease that occurs mostly in people over 50 years of age and is a leading cause of vision loss in people of that age. It affects the central vision and the ability to see fine details. It does not affect peripheral vision.

AMD occurs when a part of the retina, the macula, is damaged. It is divided into two types: dry and wet. Dry AMD is the most common. The loss of vision is usually slow and gradual as parts of the macula get thinner with age and clumps of protein called drusen form. About 80% of people with AMD have dry AMD. Wet AMD is less common but more serious. It is the most common cause of serious loss of vision and occurs when new, abnormal blood vessels grow under the retina and start to leak blood and fluid. At present, there is no treatment for dry AMD. For wet AMD, the main treatment is the injection of medications called anti-VEGF agents. Anti-VEGF agents are used to combat the disease process and reduce the damaging effects of the leaky abnormal blood vessels.

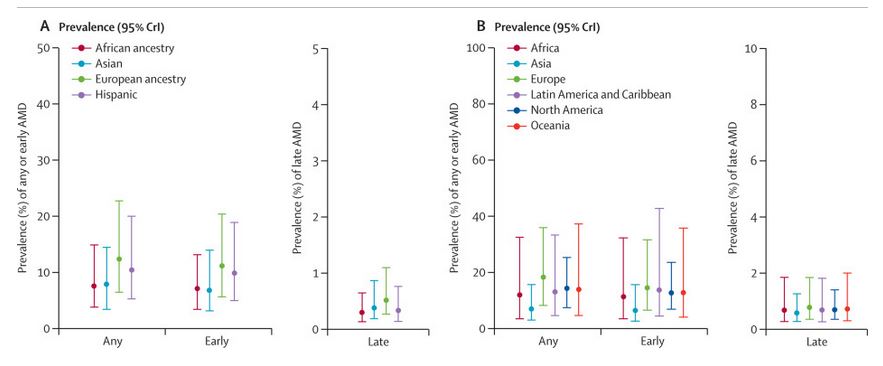

According to estimates, people affected by AMD account for about 2.5% of the world’s population, or about 200 million people. The incidence within white and Hispanic populations is significantly higher than that of Asian and Black populations 【1】. However, due to higher population density within Asian and African countries, the overall number of cases is much higher than that of Western countries.

According to public data, the population of people over 60 years old in China will reach about 300 million in 2025, with the incidence of AMD of about 8-11%. With 11 million existing patients, the estimated number of patients is expected to reach 40 million annually by 2025. Currently in China there are about 6 million patients with wet AMD and 34 million patients with dry AMD.

Source: Science Direct

AMD market size is expected to reach US$16.3 billion by 2028

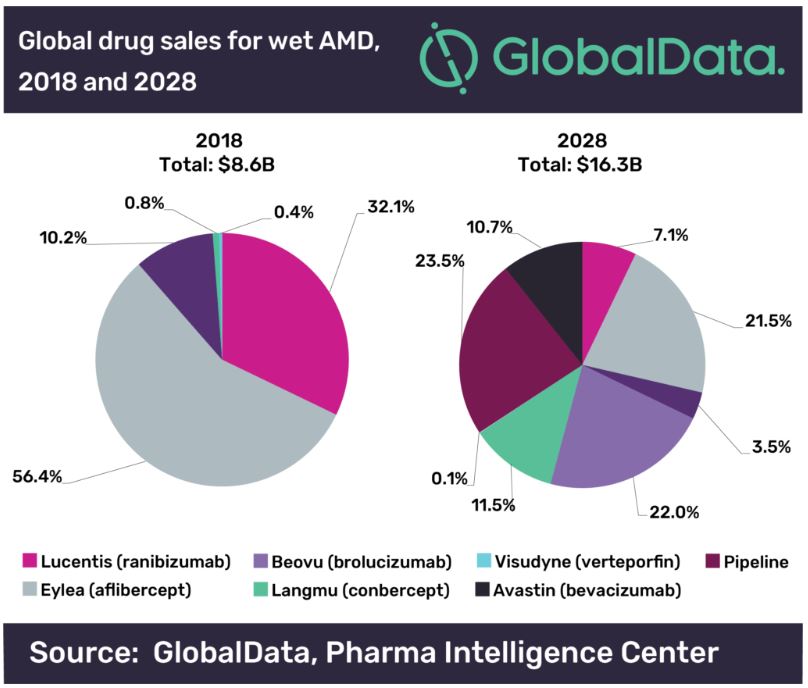

As there is no effective treatment for dry AMD, we will focus on the market size for wet AMD. According to data from Global Data, the market size of AMD drugs in 2018 was US$8.6 billion and will reach US$16.3 billion in 2028, with a compound annual growth rate of approximately 8.1%. At present, China’s eye disease medication market is about US$280 million, far lower than the US$1.5 billion market in the United States. However, the market potential for China is huge due to its large and ageing population.【2】

The wet AMD market is mature, making it difficult to enter the market. Meanwhile, dry AMD drugs are still under clinical research. The market has a lot of potential with promising development prospects. For those who manage to have successful clinical trials, the dry AMD market could be 4 to 5 times that of wet AMD.

Difficulty in entering the wet AMD international market

The drugs currently used to treat wet AMD are primarily anti-VEGF agents. Large companies still own the greater market share of those drugs. Roche (32.1%), Novartis (10.2%), and Bayer (56.4%) occupy almost all of the market 【3】. Since the existing products are relatively mature, entering the market can only be achieved through a more rapid effective period. Beovu by Novartis, which was approved in 2019, is a typical representative. After the first three months, patients only need to receive injections once every 8 to 12 weeks, while similar products need to be injected every 4 weeks.

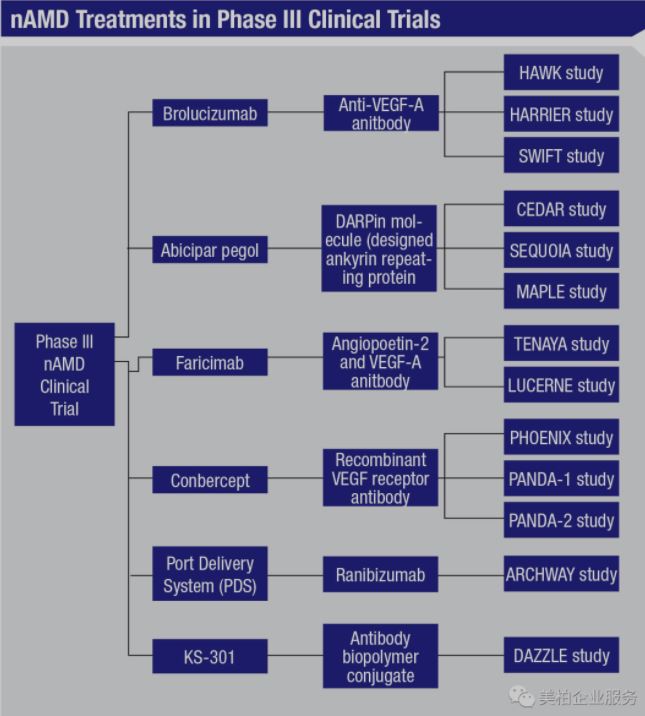

The drugs currently undergoing clinical trials worldwide include (1) the bispecific antibody Faricimab, which is a collaboration between Roche and Genentech, for simultaneous inhibition of Angiopoietin 2 and VEGF-A; (2) Conbercept, a recombinant VEGF receptor antibody led by Chengdu Kanghong Pharmaceutical; and (3) Kodiak Sciences’ VEGF antibody KSI-301【4】. Their injection cycle is about 12 weeks, all of them are expected to complete clinical trials in 2022 except for KSI-301. From preliminary test results, Faricimab can help patients improve about eyesight by 10.1 letters, while Conbercept can help patients improve vision by 9.6 letters. Neither have serious adverse reactions thus far. Therefore, the products from Roche and Kanghong have comparable efficacy. Whichever is approved first will have an advantage in seizing more of the international market.

Roche and Genentech are developing a Port Delivery System (PDS). This require patients to surgically implant an intraocular sustained-release drug delivery system. The effective period is expected to reach about one year. Based on its ease of use and low frequency of supplementary drugs, if the implant can prove to be effective and approved, the market potential could be greater than other injections.

Problems remain for treating dry AMD

There is no effective treatment for dry AMD for the time being, and the causes of the disease are also more complicated. Causes include not only natural aging but also the combined effects of two factors: environment and genetics.

The process by which the cells of the eye are converted into electrical signals after receiving light stimulation is the visual cycle. Various metabolic waste materials are produced during this cycle. The accumulation of metabolic waste materials can easily lead to inflammation of the eye and induce dry AMD. If this can be reduced, anti-inflammation produced at the stage may reduce the possibility of developing dry AMD.

From the perspective of controlling the visual cycle, Otsuka Pharmaceutical in Japan collaborated with Accela® to conduct a clinical trial of ACU-4429 in 2008. After an eight-year clinical trial, it was declared a failure in 2016. Oral ACU-4429 failed to prove effective in phase III clinical trials【5】. Another similar product is ALK-001 from Alkeus®, which is currently recruiting phase III clinical trial subjects. However, adjusting the visual cycle often produces side effects of night blindness. Furthermore, it cannot cure dry AMD, only only delay symptoms.

In terms of the anti-inflammatory approach, doxycycline from Galderma® has now completed phase III clinical trials and is analyzing the results. The FHTR2163 jointly developed by Roche and Genentech is used to inhibit the HTRA1 gene that has been proven to be associated with the onset of dry AMD and is currently in phase II clinical trials.

From the perspective of optic nerve protection, only brimonidine tartrate under Allergan has been proven to be effective. However, the effect is not obvious from the phase IIa clinical trial data. It needs to complete the increased dose phase IIb to verify its effectiveness.

Cell therapy is divided into stem cell therapy and non-stem cell therapy. Johnson & Johnson’s non-stem cell therapy CNTO-2476 treats stem AMD by transplanting human umbilical cord tissue cells. However it was terminated after phase II clinical due to strong adverse reactions. The Chinese company Aokvision tried to use retinal pigment epithelial cells (RPE) to replace the damaged RPE cells in the eyes of patients. At present, the patient’s vision has improved by about 10 letters in clinical trials, but further clinical data certification is needed. Ocata Therapeutics treats patients by transplanting human embryonic stem cells. The therapy has now completed phase II clinical trials and is expected to enter phase III.

Complement system inhibitors mainly target C5b, C3, and complement factor D. Both eculizumab under Alexion and avacincaptad pegol under Iveric Bio are C5b inhibitors. The former has been verified in clinical trials without significant improvement, and the latter has been proven to delay 27% of the disease progression in clinical trials. It is expected to enter phase III clinical trials. Genentech’s Lampalizumab is a complement silver D inhibitor that failed after phase III clinical trials in 2018. The most promising is Pegcetacoplan, a C3 selective inhibitor under Apellis. The phase I clinical trials for dry AMD have been completed, showing that it can slow the disease progression of about 40% of dry AMD. At the same time, it submitted an application for the treatment of paroxysmal nocturnal hemoglobinuria to the FDA in September 2020 【6】.

In general, because dry AMD drugs and therapies are still in the development stage, it gives innovative companies the possibility to enter the market.

Improved vitamin A: ALK-001

Alkeus’ ALK-001 is an improved vitamin A. Compared with the normal intake of vitamin A, it can effectively reduce the metabolic waste that is toxic to the optic nerve after being consumed and metabolized by eye cells. Moreover, the drug itself is an oral preparation, which is more advantageous than other therapies that require drug injections into the eye 【7】. At present, the drug has confirmed safety, and clinical trial subjects are being recruited. Although there are not many clinical data to support the effect of the drug, it has great market potential as the only oral drug for dry AMD.

Embryonic stem cell transplantation: MA09-hRPE

Ocata Therapeutics’ MA09-hRPE is a human embryonic stem cell transplantation therapy. 9 AMD patients and 9 Stargardt disease patients were tested in the I/II clinical safety study evaluation. Three dose groups (50,000, 100,000 and 150,000 stem cells) were used. There was no adverse proliferation, rejection, or serious eye or systemic safety problems related to the transplanted tissue. Of the 16 people who finally completed the trial, 9 people had improved vision, and 7 people remained unchanged without obvious adverse reactions【8】. Phase III clinical trials should begin soon.

Selective C3 complement inhibitor: Pegcetacoplan

The drug with the best clinical results is Pegcetacoplan from Apellis. It is a PEGylated (PEG) synthetic cyclic peptide that specifically binds to C3 and C3b, thereby inhibiting the cleavage of C3 and activating it into C3a and C3b. Pegcetacoplan effectively inhibits all three pathways of complement activation (classical, bypass, and lectin). Clinical trial results prove that it can slow the progression of dry AMD by 40%. Another indication has already been submitted to the FDA for market application to prove its effect.

Synthetic fibroblast growth factor inhibitor: Ethamsylate

Ethamsylate is a drug that has been studied since the 1970s. DobeCure in Spain intends to use the drug to treat both dry and wet AMD. It is currently in phase III clinical trials, and the test results show that about 55% of patients show a certain degree of improvement. However, 40% of patients have more severe symptoms after taking the drug. The drug needs to be studied in more patients. 【9】

Summary

Large companies have strong market control over wet AMD treatments, and it is difficult to access for now. Dry AMD is an undeveloped area. There are far more patients with dry AMD than those with wet AMD, and the market potential is unlimited.

Sources

【1】https://www-sciencedirect-com.ccl.idm.oclc.org/science/article/pii/S2214109X13701451

【2】https://zhuanlan.zhihu.com/p/157169171

【3】https://med.sina.com/article_detail_103_2_73337.html

【4】https://m.semeye.com/newscenter/2020/yb823Lev.html

【5】https://www.globaldata.com/global-age-related-macular-degeneration-market-will-more-than-double-in-size-by-2028/#:~:text=The%20pharmaceutical%20market%20for%20age,leading%20data%20and%20analytics%20company.

【6】https://www.reviewofophthalmology.com/article/phase-iii-trials-in-wet-amd-whats-next

【71】https://www.fiercepharma.com/pharma-asia/japan-s-otsuka-ends-pacts-acucela-after-trials-failure

【8】https://www.globenewswire.com/news-release/2020/09/15/2093578/0/en/Apellis-Announces-Submission-of-Pegcetacoplan-Marketing-Applications-to-FDA-and-EMA-for-Patients-with-PNH.html

【9】Phase 3 Study of ALK-001 in Geographic Atrophy. ClinicalTrials.gov. https://clinicaltrials.gov/ct2/show/NCT03845582. Accessed November 30, 2019.

【10】https://www.reviewofophthalmology.com/article/whats-ahead-for-the-treatment-of-dry-amd

【11】http://dobecure.com/wp-content/uploads/2018/01/DOBECURE-ID-DBC-AMD-001-Teaser-EN-v1.1.pdf

0 Comments