Author: Ginger Ding

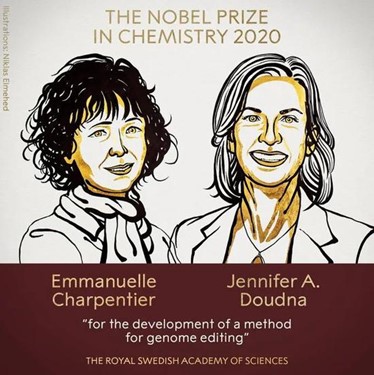

On October 7, 2020, the high-profile 2020 Nobel Prize in Chemistry was announced. Emmanuelle Charpentier and Jennifer A. Doudna won the award for their discovery of CRISPR/Cas9, so called genetic scissors.

CRISPR is a gene editing tool that can be precisely targeted. Since its inception in 2012, the tool has contributed to many important discoveries in basic research, plant research, and medical research. It has been selected as one of the “Top Ten Scientific Breakthroughs in the World” by Science Magazine three times in 2012, 2013 and 2015.

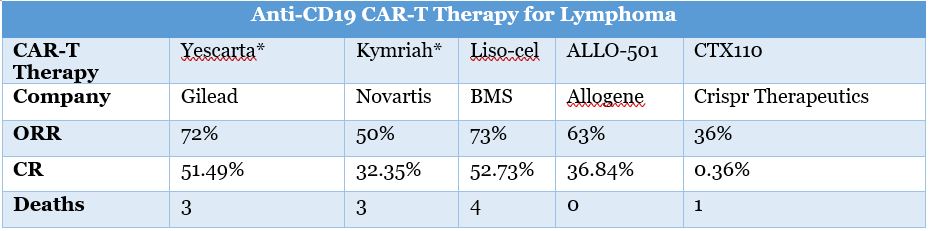

Two weeks after the Nobel Prize announcement, on October 21st, CRISPR Therapeutics announced the clinical data of its blockbuster CRISPR therapy CTX110. Although 4 of 11 subjects showed complete remission, one patient treated with CTX110 for 52 days died. Thus, CRISPR Therapeutics’ stock price fell 14% in pre-market trading.

Undoubtedly, the Nobel Prize for CRISPR is well-deserved, and CRISPR is rapidly promoting the revolutionary progress of life sciences. How can scientists break through CRISPR’s safety risk? How far is CRISPR from clinical application, and what are the bottlenecks and challenges? This article aims to address these questions.

CRISPR’s safety risks

CRISPR, a revolutionary gene editing technology, has become the hottest research tool in the field of biological sciences in just a few years since its introduction in 2012.

In 2016, three CRISPR companies were successfully listed on NASDAQ, including Editas Medicine [NASDAQ:EDIT], Intellia Therapeutics [NASDAQ:NTLA] and CRISPR Therapeutics [NASDAQ:CRSP]. That same year, the West China Hospital of Sichuan University announced that it would proceed with the world’s first human CRISPR gene editing clinical trial (knockout of T cell PD-1 gene) to treat patients with metastatic non-small cell lung cancer.

When CRISPR was upgraded from a research tool to use in clinical setting, it was naturally put under the spotlight for scrutiny.

Cas9 triggers a severe immune response

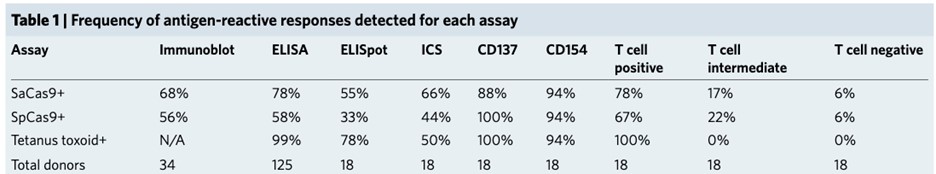

In January 2018, an article titled “Identification of Pre-Existing Adaptive Immunity to Cas9 Proteins in Humans” was published. A team from Stanford University found that 78% of the study subjects had SaCas9 enzyme antibodies, 58% of participants expressed antibodies against the SpCas9 enzyme, 78% of the participants had anti-SaCas9 T cells, and 67% of the participants had anti-SpCas9 T cells. Also in 2018, the research team at the Charité Medical School in Berlin published a similar report.

This means that the human body’s specific antibodies will bind to the Cas9 enzyme in the blood, preventing it from exerting its editing effect and thus reducing its efficacy. It may also trigger a serious immune response.

In response to this discovery, Nature magazine also published its own review: “Researchers hoping to use a gene-editing technique to treat diseases may have to seek alternative enzymes.”

However, the article also pointed out that in vitro CRISPR editing is not likely to be threatened by the anti-Cas9 immune response. In fact, CRISPR Therapeutics, Editas and Intellia are all South Korea’s Samsung Biologics has entered into a strategic partnership with GeneQuantum Healthcare, a China biotech company, to jointly develop an antibody-drug conjugate (ADC) for the treatment of non-small-cell lung carcinoma (NSCLC), triple-negative breast cancer (TNBC), and other solid tumors. The agreement signals Samsung Biologics’ accelerated entry into the China market.

GeneQuantum Healthcare recently received the US FDA’s Investigational New Drug (IND) Good to Proceed Letter in May this year for its first anti-HER2 ADC asset, which was manufactured via GeneQuantum’s patented intelligent ligase-dependent conjugation (iLDC) technology platform.

On June 12, 2018, two papers published in “Nature Genetics” caused a wave in the industry. Both papers showed that CRISPR-Cas9 triggers the p53 gene-mediated DNA damage repair mechanism, which leads to gene editing becoming more difficult. If the p53 gene is artificially removed and this repair mechanism is lifted, the cells will become easier to edit.

After the article was published, the stock prices of related companies plunged. Investors couldn’t help but worry about whether CRISPR gene editing would make it easier to “screen out” cells with p53 defects, which may cause cancer risk. CRISPR Therapeutics fell close to 13%, Editas Medicine fell close to 8%, and Intellia Therapeutics fell close to 10%.

It is worth pointing out that p53-deficient cells are easier to edit, which does not mean that cells are more likely to cause p53 defects after editing. In addition, the article uses pluripotent stem cells, not adult cells.

In order to further study the relationship between CRISPR and p53, an article published by the Broad Institute on May 18, 2020 found that in the absence of exogenous sgRNA, the overexpression of Cas9 can indeed activate the p53 pathway of multiple cell lines (about 10%) , And promote the selective enrichment of p53 inactivating mutations.

In addition, what is even more concerning is that CRISPR gene editing can cause a large number of base deletions:

On August 8, 2018, an article published by the University of Adelaide in Australia in Nature pointed out that frequent and large number of base deletions (in kilobases range) appeared in CRISPR/Cas9 gene-edited mouse fertilized eggs.

Meanwhile, on March 8, 2019, researchers from the University of Bordeaux in France found that CRISPR/Cas9 genome editing can induce large-scale deletions of chromosomal fragments on a megabase scale, including 7 tumor suppressor genes (BCCIP, PTPRE, MGMT) , BNIP3, EBF3, etc.), whose mechanism of action is also related to the p53 pathway.

Does the above research completely deny clinical application of CRISPR? Not really. Academia and industry are exploring potential solutions:

1. Strict in vitro screening

In vitro gene editing can implement rigorous screening methods to ensure that there are no cancer-causing cells injected into the patient’s body, even if it means that it will greatly increase the cost of CRISPR therapy.

2. Improve HDR efficiency

Compared with the NHEJ (non-homologous end joining) pathways, the DNA repair pathway HDR (homologous mediated repair) is more precise and can effectively prevent off-target effects. However, HDR is much less efficient than NHEJ, which greatly affects the effect of CRISPR editing and hinders the wide application of this technology.

Therefore, enhancing the efficiency of HDR and inhibiting NHEJ to achieve precise CRISPR gene modification is one of the solutions: for example, inhibiting KU70 and DNA ligase IV can increase the efficiency of HDR by four to five times. When adenovirus proteins are co-expressed with the Cas9 system, the efficiency is increased by eight, and NHEJ activity is basically eliminated. Furthermore, Scr7 can bind to DNA ligase I to block the NHEJ repair pathway, and the combination of Scr7 can increase the HDR efficiency of CRISPR by 19 times.

3. CRISPR controllable “switch”

Similar to CAR-T therapy, ideally the CRISPR editing system also needs a “switch”. Two independent research teams proved that with tighter control of the light, CRISPR editing can be turned on within a specific time. The anti-CRISPR protein and other molecules can not only control the switch well, but also effectively reduce off-target effects and enhance safety.

Acrigen Biosciences, located in California, USA, is a pioneer in applying anti-CRISPR proteins to safety “switches”.

4. Discovery or modification of CRISPR editing system

In order to improve the inherent specificity of Cas9 and enable it to achieve lower off-target editing activity, a variety of high-fidelity variants are being developed, including eSpCas9 (1.1) from Zhang Feng’s team, HypaCas9 and ProCas9 from Doudna’s team, etc. A recent example is protease-aware Cas9 (ProCas9). A specific polypeptide chain is implanted in ProCas9. This polypeptide chain is only active after being cleaved by the protease present in cancer cells or infectious viruses/bacteria, imposing precise gene editing in specific cells.

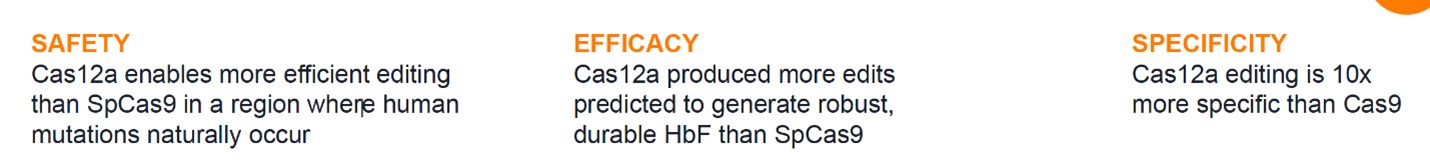

Compared to Cas9, Cas12 has lower off-target effects. Editas Medicine, established by Zhang Feng, is currently studying CRISPR/Cas12a gene editing technology. Of course, the off-target effect of Cas12 cutting DNA has yet to be confirmed.

In addition, CRISPR/Cas9-based single-base editor, prime editors, etc. can also achieve effective and precise editing.

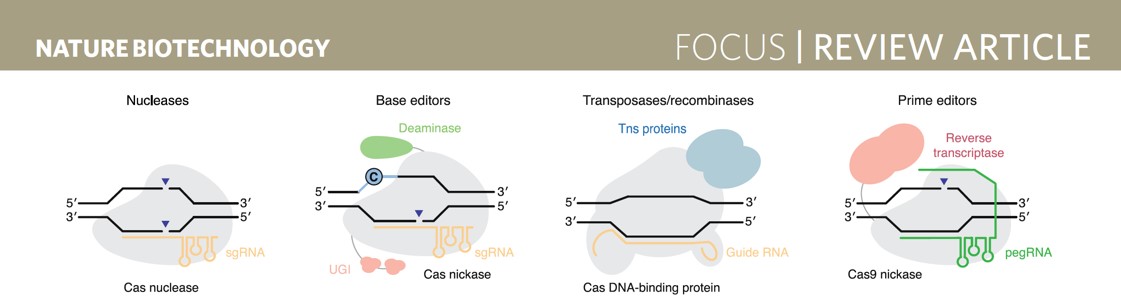

CRISPR gene editing strategy

Source: Nat Biotechnol. 2020 Jul; 38(7):824-844.

From the above article, we can tell that if there is no double-strand DNA break in gene editing, there will be no problems such as base deletion, and single-base editors do not rely on double-strand DNA breaks. Beam Therapeutics, jointly established by Zhang Feng and David Liu, uses the CRISPR single-base editor. Beam Therapeutics was established in 2017 and has been listed on NASDAQ in 2020. Investors include F-Prime Capital, ARCH Venture Partners, Google, and others.

CRISPR Therapeutics vs. Editas

This article focuses on the therapeutic prospects of CRISPR, so we will not discuss diagnostic companies such as Sherlock and Mammoth Biosciences that have attracted much attention during the coronavirus epidemic.

Regardless of the maturity of clinical development, the degree of capital favorability, and the authority of the founders in the industry, CRISPR Therapeutics and Editas are undoubtedly the leaders. The second part of this article will compare CRISPR Therapeutics and Editas from multiple dimensions such as team, financing, finance, pipelines, core technology, and patent protection, and discuss developments and trends within the entire field.

Team and financing history

1. Editas Medicine

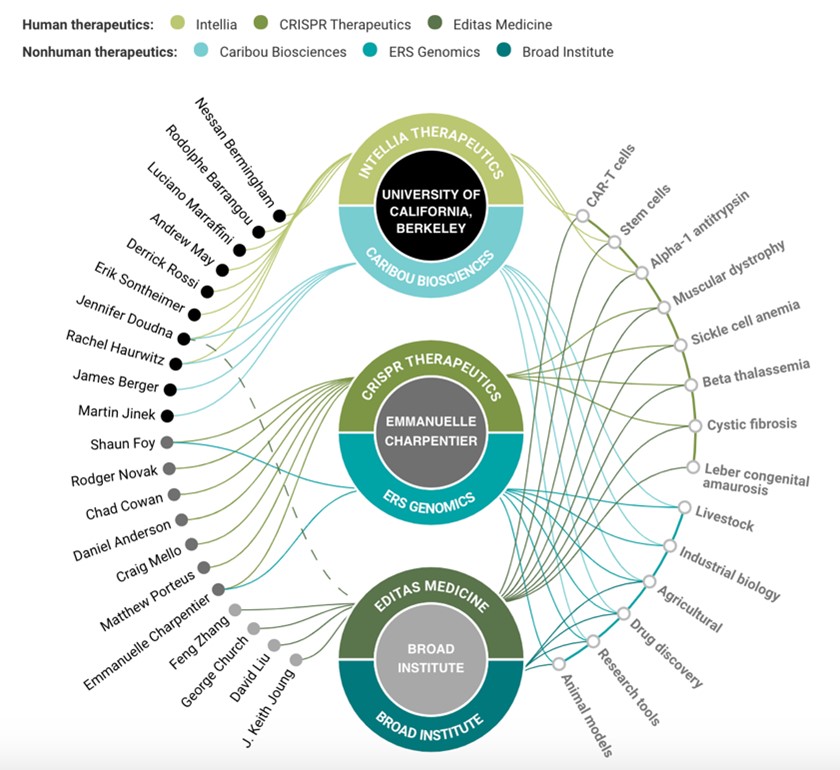

Editas Medicine was established in 2013 and went public in 2016. Its founders gathered almost all the great figures in the field of CRISPR gene editing, including Zhang Feng, Doudna, David Liu, George Church, and J. Keith Joung (zinc-finger nuclease editing technology pioneers). Not long after the company was established, Doudna and Zhang Feng’s patent war broke out and Doudna left Editas.

Before Editas went public on the Nasdaq, it received a total of three rounds of financing. Investors include Third Rock Ventures, Polaris Partners, Flagship Pioneering, Juno Therapeutics, Bill Gates, and Google.

- CRISPR Therapeutics

CRISPR Therapeutics was also established in 2013 and went public in 2016. The core founders are Nobel Prize winners Emmanuelle, Daniel Anderson, Craig Mello, Matthew Porteus, and others.

Investors include Versant Ventures, Abingworth, New Leaf Venture, New Foundation, and New Enterprise.

Financial position

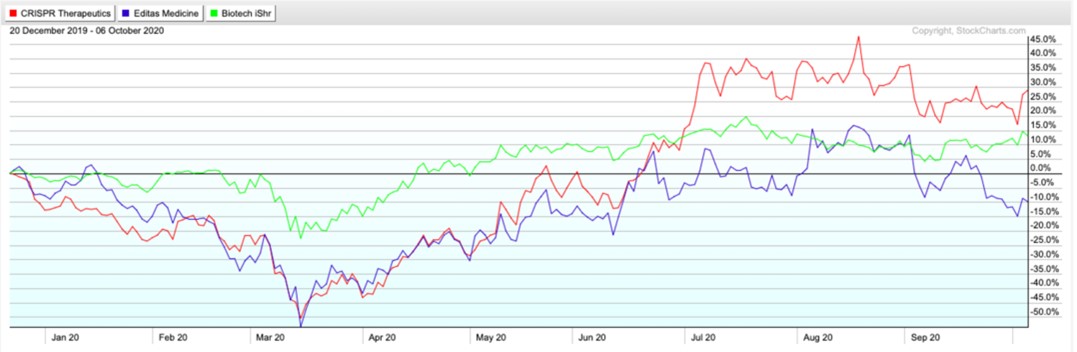

The market value of CRISPR Therapeutics (US$6.5 billion) is 3.25 times that of Editas (US$2 billion). The trading price of CRISPR Therapeutics is approximately $90 per share, while the price of Editas is $32 per share. Looking at the two companies from the perspective of traditional valuation, Editas’ current P/S ratio is about $53.24, while CRISPR Therapeutics’ P/S is more reasonable, at $19.08. For biotech companies, these indicators will fluctuate greatly based on the results of quarterly performance, so they are not a core evaluation factor.

The latest financial statements for the second quarter of 2020 show that Editas has $599 million in cash and cash equivalents. Considering that Editas had a net loss of $23.5 million last quarter, these cash reserves are expected to last for nearly six years. In contrast, CRISPR Therapeutics has a cash reserve of US$949 million, which can last for nearly three years based on the company’s cash consumption rate.

It is worth pointing out that Editas’s collaboration revenue in the second quarter was US$10.7 million, which was much higher than the US$2.3 million in the same period last year. In the second quarter, CRISPR Therapeutics only listed $44,000 in collaboration revenue, which was only 13.8% of the US$318,000 in the same period last year.

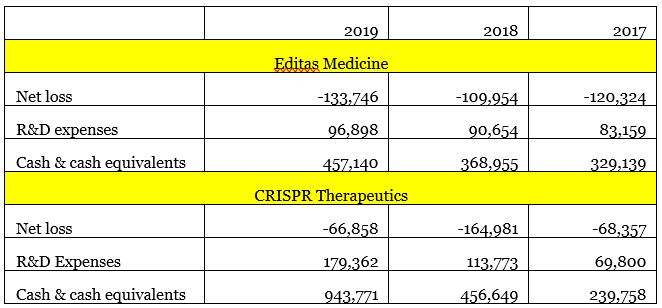

With the support of more collaboration income, I hope to see Editas’ R&D investment can close the distance with CRISPR Therapeutics. In 2019, CRISPR Therapeutics’ R&D investment was 1.85 times that of Editas. In the second quarter of 2020, CRISPR Therapeuticss’ R&D investment (US$59,380,000) continued to rise, reaching 2.12 times that of Editas (US$28,007,000).

Financial status of Editas Medicine and CRISPR Therapeutics in the past three years (unit: thousands of dollars)

Source: company reports

Core pipeline analysis

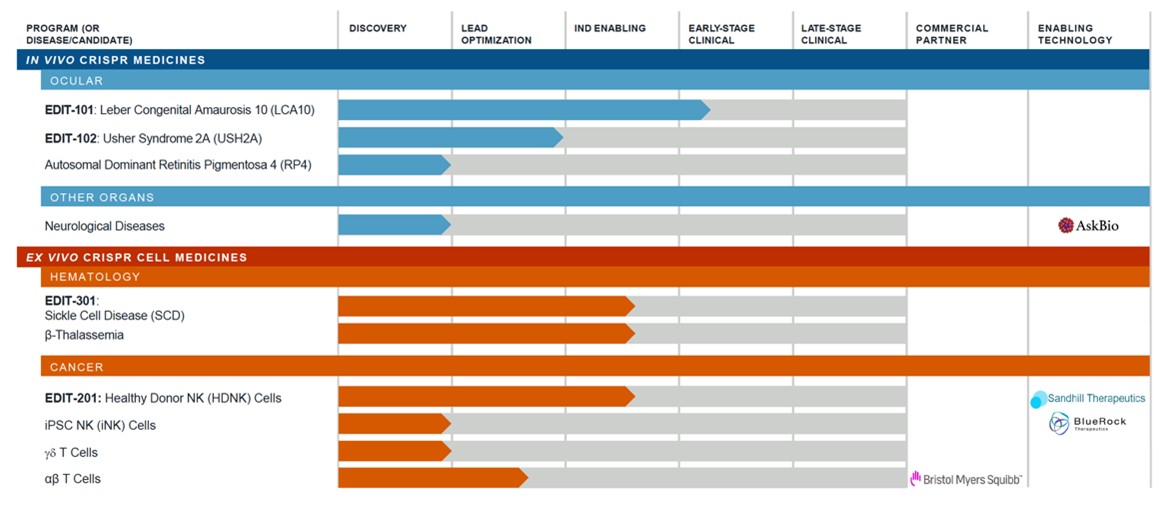

Editas

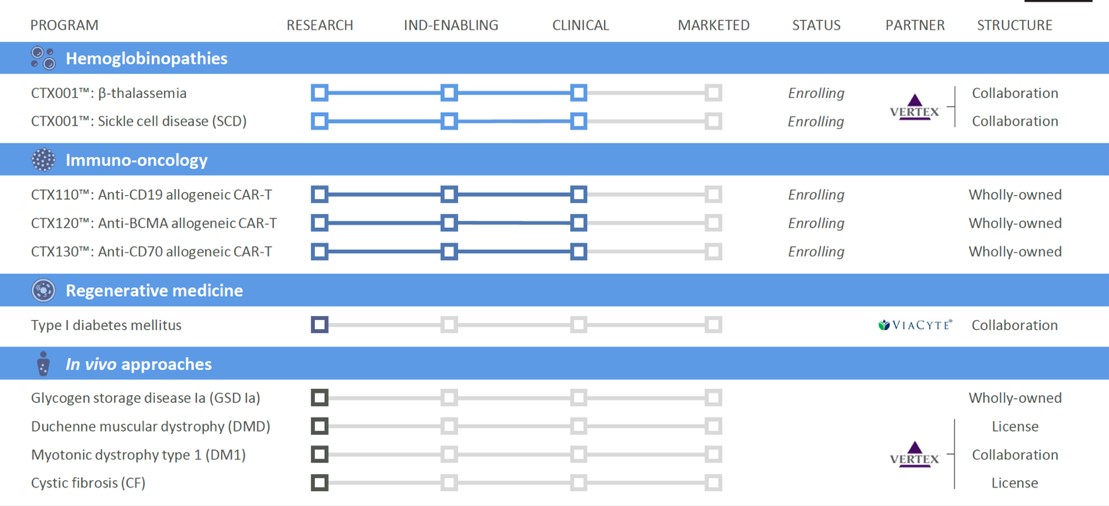

CRISPR Therapeutics

CRISPR Therapeutics seizes the opportunity to focus on inherited blood diseases

Both Editas and CRISPR Therapeutics have focuses in sickle cell disease (SCD) and beta thalassemia. Inherited blood diseases are a very common field in the development and application of gene editing therapy, and other non-CRISPR companies such as Sangamo Therapeutics also aim for such disease areas.

There are several reasons why inherited hematological diseases are so popular. First, the treatment options so far can only relieve symptoms, and cannot cure SCD. Secondly, SCD and thalassaemia belong to the category of rare diseases, and the development of such drugs can enjoy policy dividends. Third, although it is a rare disease, it is not a trivial area from a market point of view. According to Grand View Research, the market size of SCD by 2023 is US$5.5 billion and the market size of thalassemia in 2022 is estimated to be US$3.53 billion. Moreover, the marketed gene therapy drug Zynteglo for the treatment of thalassaemia is forecast to have sales of US$1.87 billion in 2024.

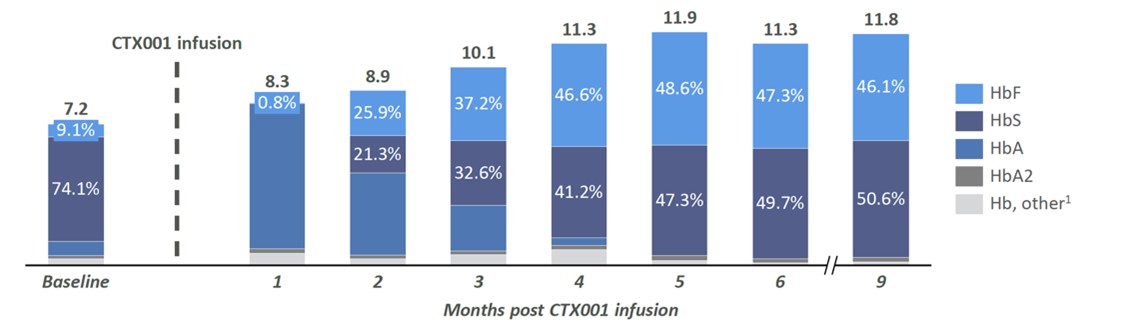

From the perspective of the development stage, CRISPR has an advantage over Editas. CTX001 has entered clinical phase I/II for the treatment of thalassaemia and SCD and has obtained the Fast Track Designation (FTD) and Orphan Drug Designation (ODD) from the US FDA and the European Commission granted ODD. The early clinical data of CTX001 also showed that the main symptoms of the two patients with infusion-dependent thalassaemia and SCD had been reversed.

Source: CRISPR Therapeutics website

In addition, CRISPR is developing CTX001 jointly with Vertex Pharmaceuticals. In addition to rich experience in R&D and commercialization, Vertex Pharmaceuticals has also successfully marketed the cystic fibrosis drug Orkambi and has made considerable achievements in the development of rare disease drugs.

It is worth pointing out that Editas’ EDIT-301 is also aimed at SCD and thalassaemia. Although the start is slow, CTX001 targets the BCL11Ae gene, while EDIT-301 edits the HBG1/2 gene. This difference may make the safety of EDIT-301 is higher than that of CTX001, and it maintains the function of hematopoietic stem cells more effectively.

Source: Editas website

Distinct focus in cancer immunotherapy

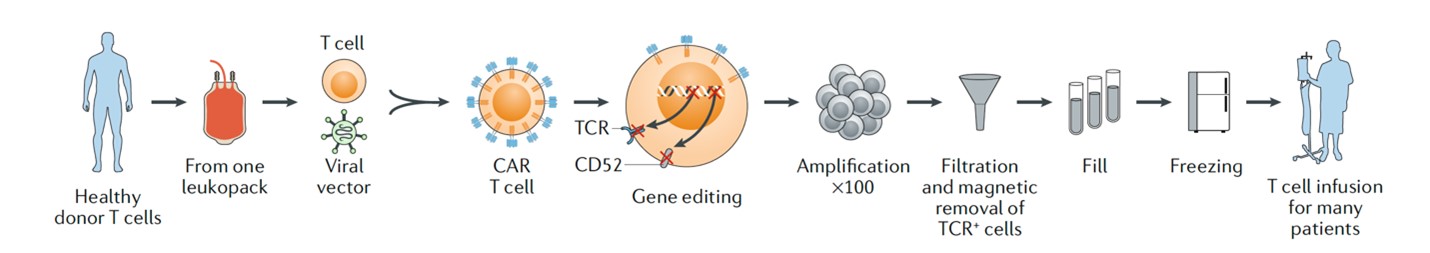

Cancer immunotherapy is a hot field nowadays and many international giants including Novartis and Gilead have entered the battlefield. From the point of view of commercialization, the approved CAR-T therapies sold for hundreds of thousands of dollars are undoubtedly an important factor hindering full marketization.

Therefore, the universal allogeneic cell therapy “off-the-shelf” came into being. The vast majority of CAR-Ts now use autologous CAR-T, but patients’ own T cells usually have defects in quality and quantity. In addition, autologous CAR-T needs to be customized and is expensive to produce, while “off-the-shelf” CAR-T can be supplied from stocks, saving time and money as the cost is only about one-fifth of autologous CAR-T.

Universal CAR-T therapy

Source: Nat Rev Drug Discov.2020 Mar; 19(3):185-199

A major challenge for “off-the-shelf” cell therapy is that allogeneic T cells can cause host immune cell rejection. Therefore, using gene editing tools such as CRISPR to knock out related signaling pathway genes on allogeneic T cells to prevent host rejection is to achieve “off-the-shelf” CAR-T The key step.

This naturally triggered a new wave of cooperation between CAR-T and other cell therapies and gene editing: as early as January 2015, Novartis announced a five-year R&D cooperation program with Intellia Therapeutics, mainly dedicated to accelerating the development of CRISPR technology. Application of CAR-T cell therapy; In May of the same year, Juno and Editas signed a three-year cooperation agreement to assist in the development of CAR-T therapy and TCR therapy with the help of CRISPR technology developed by Editas.

At present, UCART (Cellectis) and UCRT19 (Allogene), which have the fastest clinical progress in the global “off-the-shelf” CAR-T, are based on TALEN gene editing technology. CRISPR-based products that have entered the clinic include CD19UCART (Shanghai Bangyao Biological), UCART019 (301 Hospital), and CRISPR’s CTX110.

In addition to CTX110 (CD19), CRISPR is also developing CTX120 (BCMA) and CTX130 (CD70). CTX130 is expected to become the first in its class, and the other two products will usher in strong competition. However, in view of the prospects of the CAR-T market (the global CAR-T market is expected to reach US$8.92 billion in 2026), even if CTX110 and CD120 only occupy a small part, their size cannot be ignored.

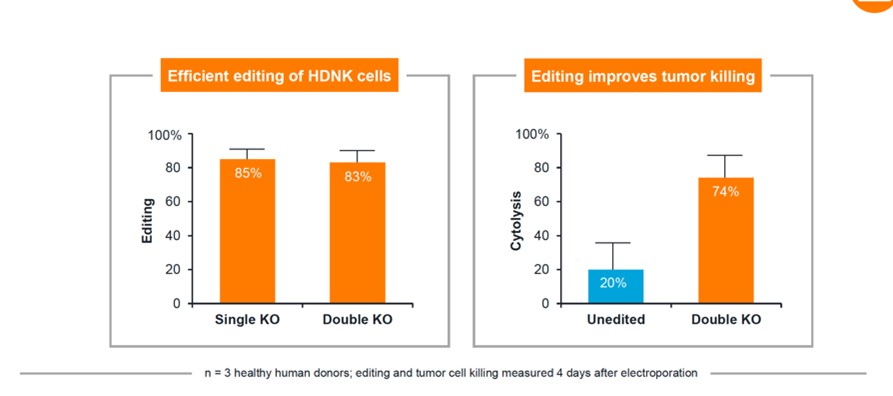

Different from CRISPR’s relatively conservative play, Editas not only cooperates with BMS on the CAR-T track, but also focuses on more cutting-edge and challenging new cell therapies, such as NK cell therapy (EDIT-201). Although it can effectively avoid the fierce competition in the CAR-T market, the clinical efficacy of NK cell therapy has yet to be verified. Improving the in vitro production of NK cells also needs to be overcome. There are certain risks, and it is expected to enjoy the high returns inherited with the risks.

NK cell therapy in vitro experimental data

Source: company official website

Editas takes the lead in challenging non-blood diseases

One of the reasons why blood diseases have become the early targets of gene editing is that the editing for correcting mutant genes can be done in vitro, but achieving in vivo editing is a daunting challenge of gene therapy.

CRISPR Therapeutics focuses its efforts on blood diseases, but Editas’ most promising drug candidate, EDIT-101, is an in vivo gene editing therapy that targets blindness in infants with abnormal retinal development, called Leber congenital amaurosis (LCA).

LCA’s existing gene therapy is Luxturna, developed by Spark Therapeutics, which costs up to US$850,000 to treat both eyes. Luxturna and EDIT-101 both use AAV as a drug delivery vehicle, but Luxturna’s gene therapy delivers the correct copy of the affected gene to the retinal pigment cells, while EDIT-101 uses genome editing to directly correct mutations.

EDIT-101 has entered clinical phase I. Taking Luxturna’s sales data as a reference, the peak sales of EDIT-101 are around US$1 billion. In addition to LCA, Editas is also exploring other in vivo gene therapies.

If EDIT-101 can be approved successfully, this will not only bring huge profits to Editas, but also stabilize Editas’ dominance of CRISPR gene therapy in the field of non-blood diseases, opening up unlimited possibilities for expansion.

With exclusive patents, Editas takes the lead

Editas has exclusive rights to Harvard, Massachusetts Institute of Technology and Broad Research Institute, and an unparalleled intellectual property portfolio of 70 patents and 600 patent applications currently pending. This will be a strong backing for Editas in the long-term.

How the battle lines over CRISPR were drawn

Editas’ technology improves steadily

As a biotechnology company, technological upgrading is a key factor in established a moat in long term for a biotech company. From this perspective, Editas is relatively more active than CRISPR Therapeutics.

Taking improvement and discovery of Cas enzyme as an example. CRISPR Therapeutics mainly relies on Cas9. In addition to Cas9, Editas also includes the application of Cas12a (EDIT-301) in its existing product line. Compared with Case9, Cas12a has the advantages of lower mismatches and higher specificity. In addition, Editas founders Zhang Feng and David Liu further discovered Cas13 on the basis of Cas9, and founded Beam Therapeutics, focusing on RNA editing.

Second, an important limitation of the broad use of CRISPR is the reliance on the PAM sequence. The targeting specificity of CRISPR is determined by two parts: one is the base pairing between the guide RNA and the target DNA, and the other is the protospacer adjacent motif (PAM) of the Cas9 protein recognition.

Although the PAM sequence is very common in human DNA, if there is no adjacent PAM sequence near a certain gene, the Cas enzyme will not be able to recognize or successfully attach and cut the required DNA fragment, resulting in limited applications. The founders of Editas, Zhang Feng and David Liu, continue to contribute to the breakthrough of PAM sequence dependence.

In an article published by Zhang Feng in 2017, through structure-guided mutagenesis screening, two Cas enzyme variants carrying mutations were designed to expand PAM recognition. David Liu’s team used phage-assisted continuous evolution to evolve an expanded PAM SpCas9 variant (xCas9) that can recognize a broad range of PAM sequences including NG, GAA and GAT, and support its application in human cells. In addition to having wider PAM compatibility, the DNA specificity of xCas9 is also much higher than that of SpCas9.

Judging from public information, CRISPR Therapeutics has not reported on breaking through the limitations of PAM, which may become challenge for long-term development.

Summary

Since its inception in 2012, CRISPR, a revolutionary gene editing technology, has gained both fame and fortune. Its discoverers not only won the Nobel prize, but it also gave birth to more than a dozen new biotechnology companies and made great contributions in the field of basic scientific research.

CRISPR may not be able to compete with the discovery of DNA double helix, PCR and other technologies, but its far-reaching impact on scientific development is beyond doubt. The first part of this article discusses the bottlenecks and challenges of the clinical application of CRISPR, and uses the case studies of CRISPR Therapeutics and Editas to represent a larger picture, and interpret how different innovative companies build an indestructible moat on the CRISPR battlefield.

The next part of this article will extend from CRISPR to the overall situation of gene editing, answering the following questions: Is CRISPR the king of gene editing? Is there a chance for the previous wave of gene editing such as zinc-finger nuclease to return? What new gene editing technologies are booming? Stay tuned.

About the author

Dr. Ginger Ding is the Director of Investment Analysis at MyBioGate and a Consultant for the Texas Medical Center and Columbia University Consulting Club. She has worked at the Howard Hughes Medical Institute and MD Anderson Cancer Center. During that period, she participated in the preclinical research of tumor brain metastasis and received funding from the National Institutes of Health RO1, Susan G. Komen, and Taiho Pharmaceutical.

References

【1】Nat Med. 2019 Feb;25(2):249-254.

【2】Nat Med. 2019 Feb;25(2):242-248

【3】Nat Med. 2018 Jul;24(7):939-946

【4】Nat Med. 2018 Jul;24(7):927-930

【5】Nat Genet. 2020 Jul;52(7):662-668

【6】Nature. 2018 Aug;560(7717):E8-E9

【7】Nat Commun. 2019 Mar 8;10(1):1136

【8】Nat Biotechnol. 2015 May;33(5):543-8

【9】Nat Biotechnol. 2015 May;33(5):538-42

【10】ACS Cent Sci. 2020 May 27;6(5):695-703

【11】Angew Chem Int Ed Engl. 2020 Jun 2;59(23):8998-9003.

【12】Nature. 2020 Jan;577(7790):308-310

【13】Cell. 2019 Jan 10;176(1-2):254-267.e16

【14】Nat Biotechnol. 2020 Jul;38(7):824-844.

【15】https://www.grandviewresearch.com/press-release/global-sickle-cell-disease-treatment-market

【16】https://www.fiercepharma.com/special-report/4-lentiglobin

【17】Polaris Market Research

【18】https://www.fool.com/investing/2020/07/25/could-editas-medicine-be-a-millionaire-maker-stock.aspx

【19】Nat Biotechnol. 2017 Aug;35(8):789-792

【20】Nature 556, 57–63 (2018).

0 Comments