The global pediatric drug market has steady growth with China ranking second

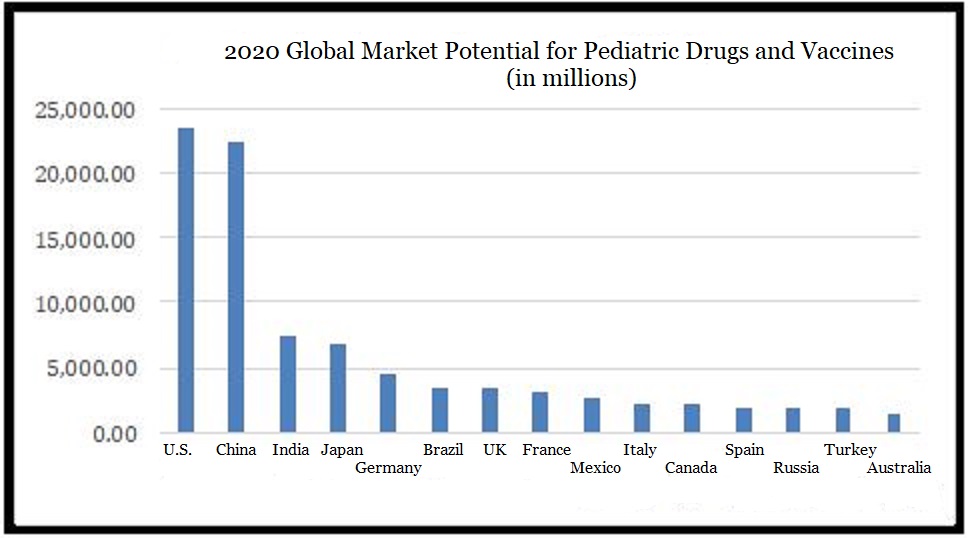

The global pediatric drug and vaccine market was valued at approximately US$122 billion in 2019. By 2025 it is expected to reach US$141 billion, with a compound annual growth rate of 2.4%. At present, the pediatric drug market is growing steadily. The United States is still the largest pediatric drug market, followed by China, and India. The countries within the EU also have huge market potential.

▲ Source: “The 2020-2025 World Outlook for Pediatric Drugs and Vaccines”

The number of children’s doctor visits in China is growing rapidly; the pediatric drug market continues to expand

The number of children’s doctor visits has increased rapidly. China is the world’s second largest pediatric drug market. According to the “2019 Statistical Bulletin of National Economic and Social Development”, at the end of 2019, the number of people aged 0-15 in the country was 249.77 million, accounting for 17.8% of the total population.

With the implementation of China’s “comprehensive two-child policy” and problems such as environmental pollution, the rate of pediatric outpatient and emergency care has remained high, with particularly rapid increase in general hospitals. The Health and Family Planning Commission predicts that 3 to 4 million new births will occur each year with the total population aged 0-18 expected to reach 269 million by 2024. In the past five years, the number of outpatient and emergency pediatric outpatient visits to China’s medical institutions (excluding clinics, health clinics, infirmaries and village clinics) has exceeded 300 million visits per year, accounting for more than 9% of all outpatient and emergency visits.

The pediatric drug market continues to expand. At present, China’s pediatric drug market accounts for about 5% of the entire pharmaceutical industry. However, the pediatric drug market is far from saturated with plenty of potential for growth. The diseases with a higher prevalence of children are mainly respiratory diseases and digestive diseases. Statistics show that in 2016, among children aged 0-14 years old in China, the top five conditions children received medical treatment for were a cold (74.7%), fever (59.8%), cough (56.0%), indigestion (26.1%), and gastroenteritis (19.9%).

The pediatric drug market for children is dominated by respiratory disease drugs and digestive disease drugs. According to data from the 2016 Children’s Drug Safety Survey Report, the market shares of respiratory disease drugs, digestive disease drugs, anti-infection drugs and nutritional supplements in the children’s drug market were 39.2%, 20.5%, 17.6% and 15.8%, respectively. The proportion of the respiratory system medication market was much higher than that of other fields.

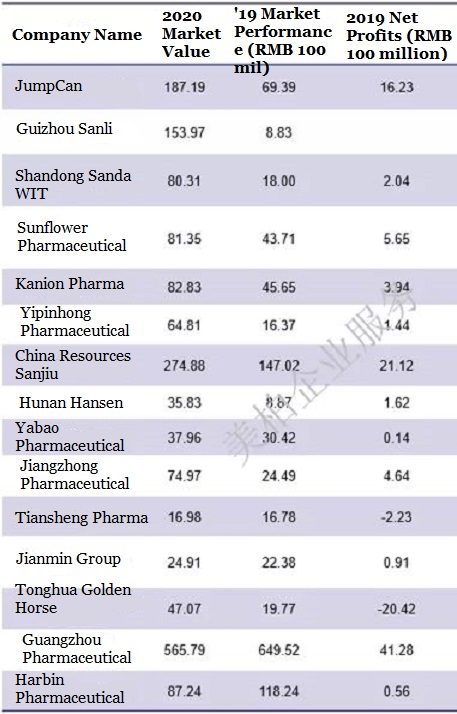

Domestic Chinese companies are catching up with foreign brands, with JumpCan taking the lead

For many years, about 90% of China’s pediatric drug market was dominated by foreign brands. However, recently, domestic Chinese pharmaceutical companies have built their own brands, in order to catch up with foreign companies. At present, Chinese children’s medicine brands mainly include 999 Children’s Cold Medication, Merrill Lynch, Hutong, Xiaokuike, Yokadan, Haohua, and so forth. The main companies include China Resources Sanjiu, Johnson & Johnson, Sunflower Pharmaceutical, HPGC Renmintongtai, and so forth. The main diseases that their drugs address are children’s cold, indigestion, cough relief and reducing phlegm.

▲Sales data of 15 listed pediatric companies in China

Source: Major companies’ 2019 annual financial reports

Domestic Chinese policies favor pediatric drug research and development

From 2018 to 2019, there have been favorable policies for pediatric medicine. In addition to encouraging research and development, adding priority review, strengthening hospital equipment, and encouraging direct bidding and purchasing, the pediatric medicine market has become a hot industry.

Analysis of core advantages of pediatric pharmaceutical companies

Companies want to occupy the market for a long time. They rely on a strong marketing system composed of corporate brands, medical insurance reimbursements, and sales networks. Over-the-counter (OTC) relies more on the brand itself, while prescription drugs focus more on the proportion of medical reimbursements.

1. Sunflower Pharmaceutical

Sunflower Pharmaceutical mentioned in their 2019 annual financial report: “Children’s medicine strategy is the company’s first strategy. Comprehensive leadership advantages, communication, and brand recognition have gained trust among consumers.” Their products are primarily OTC.

2. JumpCan

For prescription drugs, the inclusion of a product among medical reimbursements is an important part of marketing . For example, in the “Influenza Diagnosis and Treatment Plan (2018 Edition)” issued by the Health and Family Planning Commission of JumpCan’s Children’s Liaoqiao Qingre Granules, it is clearly listed as the recommended medicine for the prevention and treatment of influenza in children. JumpCan’s 2019 financial report shows that their pediatric revenue of is RMB 1.5249 billion, of which Children’s Liaoqiao Qingre Granules are the main source of revenue.

3. Yipinhong Pharmaceutical

In the context of China’s encouragement of encouraging new pediatric drug innovation and strengthening of prescription drug promotion and supervision, sales of products with core competitiveness are the cornerstone of a company’s long-term development. Among the R&D pipelines of many listed pediatric companies, the most prominent is Yipinhong Pharmaceutical. According to the “Yipinhong Pharmaceutical 2019 Annual Financial Report”, the company is guided by children’s clinical needs and adopts license-in, cooperative development and independent research and development models. They are committed to the overall technological innovation of pediatric medicine and continuously try to improve key technologies such as drug development, taste masking, delayed release, pellet coating, and so forth. This is to improve the level of research and development and make pediatric medicine that is safe and has precise dosages. At present, the company’s R&D pipeline has 19 special medicine projects for children, covering various high-incidence diseases such as epilepsy, influenza, and asthma.

Analysis of challenges facing pediatric drug development in China

The shortage pediatric medicine in China presents challenges to the market. First, there are fewer varieties of children’s special drugs, fewer children-specific dosage amounts, more general drugs, and more adverse reactions. Second, the taste for pediatric medicines is not good, medication compliance is poor, and the potential for children’s drug abuse all seriously damage children’s health.

At the same time, the use of adult drugs by children in China is common, and doctors often adopt methods such as halving the dose of adult drugs when prescribing medicine. Data show that the adverse reaction rate of children is twice that of adults, and the adverse reaction rate of newborns is four times that of adults. Improper use of drugs causes hearing loss in about 30,000 children in China each year.

For the research and development of pediatric medicine, the number of subjects in clinical trials is small. Furthermore, their design is often complicated, the cost is high, and the research and development time is long, resulting in low enthusiasm for proceeding through the R&D process. At present, drugs addressing respiratory diseases, digestive diseases, and infections account for most approvals for children. The first two categories account for 80% of the total number of drug approvals. Many approvals within the same categories have similar ingredients and functions. Meanwhile, drugs to address less common illnesses such as mental illness, immune diseases, and tumors are very scarce.

China’s pediatric drug licensing out introduction, opportunities, and analysis

In May 2017, the State Food and Drug Administration of China joined the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH). On July 10, in order to better meet the needs of patients for medication, the China National Medical Products Technical Guiding Principles for Trial Data (hereinafter referred to as the Guiding Principles) recognized overseas clinical data to accelerate the listing of new overseas drugs in China. As a result, the introduction of overseas marketed phase II/phase III products under development would have a greatly shortened time to market, and at the same time solve the problem of delays in listing drugs. In the “Yipinhong Pharmaceutical 2019 Annual Financial Report”, it is also mentioned that “the company is guided by children’s clinical needs, adopts a combination of license-In, cooperative development and independent research and development, and is committed to the comprehensive technological innovation of children’s drugs.” The transfer of rights and interests (licensing-in) has become an important model in the development of enterprises. Therefore, we believe that in the future, the transfer of overseas pediatric drugs’ cross-border rights and interests will usher in collaborative opportunities in the following directions:

- Products in the respiratory field, digestive tract field, and anti-infective field have been listed, entering the market through new products and new dosage forms;

- A technology platform or medicine with sustained and controlled release preparations, special routes of administration, such as transdermal administration, and transpulmonary inhalation;

- Drugs in emerging fields such as epilepsy, asthma, hyperactivity disorder (ADHD), childhood tumors, hemostasis, dermatitis, bipolar disorder, hemophilia, and so forth that have been listed overseas but have not yet been developed in the Chinese market.

MyBioGate focuses on linking overseas medical and health innovations. At present, they maintain close contact with many pharmaceutical companies such as Jiangsu Hengrui Medicine, Fosun Pharmaceuticals, Shijiazhuang Pharma Group, Huadong Medicine, Salubris Pharmaceuticals, Tasly and many other pharmaceutical companies. Currently MyBioGate is holding the MyBioGate Global Challenge. At present, Sunflower Pharmaceutical, Yabao Pharmaceutical Group Co., Ltd., Dyne Pharma, Jiangsu Kanion Pharmaceutical Co., Ltd. and other leading pediatric drug companies have confirmed participation. Pediatric drug innovation projects and teams are welcome to sign up for free!

Sources:

- “The 2020-2025 World Outlook for Pediatric Drugs and Vaccines” Professor Philip M. Parker, Ph.D. INSEAD

- 2019 National Bureau of Statistics of the National Economic and Social Development Statistical Bulletin

- “Report on the market competition pattern and future development trend of China’s children’s medicine industry from 2019 to 2025” Zhiyan Consulting

- “2016 Children’s Drug Safety Investigation Report” Southern Institute of Pharmaceutical Economics, State Food and Drug Administration

- “Development and Current Status of Children’s Drug Clinical Trials” Wu Juan

- “Sunflower Pharmaceutical 2019 Annual Financial Report”

- “Jichuan Pharmaceutical’s 2019 Annual Financial Report”

- “Yipinhong Pharmaceuticals 2019 Annual Financial Report”

- ” Yabao Pharmaceutical Group Co., Ltd. 2019 Annual Financial Report”

- FDA official website

- MyBioGate health database

0 Comments