Author:MJ Yuan

Editor:Ginger

The history of human existence and development has also been a history of struggle against viruses. With recent outbreaks of SARS in 2003, MERS in 2012, or the current novel coronavirus in 2020, again and again there is an emphasis on the importance of antiviral drug development.

The global anti-virus market has reached more than US$270 billion in the past five years. Drugs to target hepatitis B and C comprise very important markets.

In 2013 Gilead developed Sovaldi (the third generation) to treat and cure chronic hepatitis C in adults.

On October 5, 2020, the Nobel Prize in Physiology or Medicine was awarded to three “virus hunters” who have made outstanding contributions to the discovery of the hepatitis C virus: Harvey J. Alter, Michael Houghton and Charles M. Rice.

Compared with hepatitis C, there is no cure for hepatitis B thus far. In order to access the potential tens of billions of dollars in the market, domestic Chinese and international pharmaceutical companies have entered the battle against hepatitis B. There has been recent good news:

- On July 20, 2020, BeiGene, which has always focused on drugs to treat tumors, in-licensed three anti-hepatitis B drugs from Assembly Biosciences at a price of US$40 million and US$500 million.

- On August 28, 2020, Ionis Pharmaceuticals, which focuses on the development of RNA-targeted antisense oligonucleotide drugs, announced positive results for IONIS-HBVRx and IONIS-HBV-LRx, which are in phase II clinical trials for the treatment of chronic hepatitis B. GlaxoSmithKline will develop and promote these two research therapies. Ionis will receive up to US$262 million and a corresponding share of sales.

- On August 28, 2020, Arrowhead and its partner Johnson & Johnson announced that their RNAi therapy JNJ-3989 achieved positive results in phase II clinical trials for treatment of chronic hepatitis B. It is a subcutaneously injected RNAi therapy specifically targeted for the liver that is combined with a nucleoside (acid) analog antiviral agents.

This article outlines the current hepatitis B market as well as domestic Chinese and international R&D layouts to look to the future R&D trends in this field.

Global hepatitis B market

According to estimates from the World Health Organization, there are 257 million patients with chronic hepatitis B in the world, of which only 4.5 million patients receive corresponding treatment 【1】.

There are 90 million hepatitis B patients in China, accounting for about 1/3 of the global total, the world’s largest hepatitis B market. The market is expected to reach US$1.4 billion in 2024, accounting for 47.2% of the global share. China’s hepatitis B market growth and the huge demand for drugs is predicted to maintain a high growth trend for the foreseeable future.

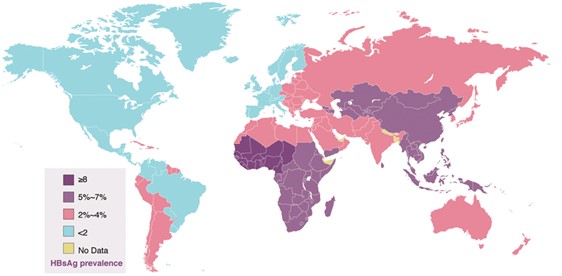

Figure 1: Global distribution of HBV in adults

Source: CDC

Worldwide, about 80% of cases of hepatocellular carcinoma are developed among hepatitis B patients. Among the top ten causes of death in China in 2017, liver cancer ranked fifth.

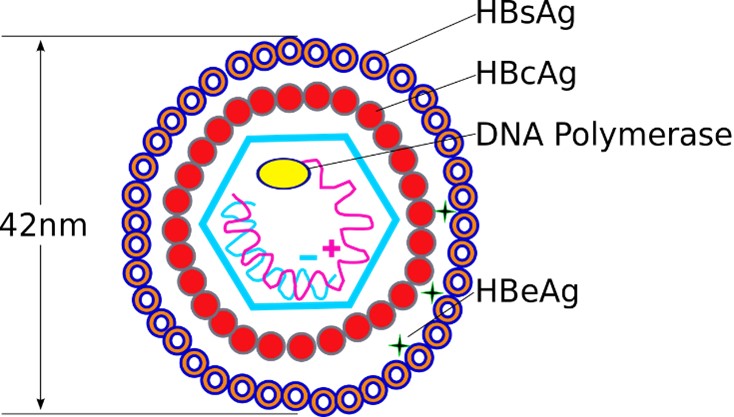

Introduction of the hepatitis B virus

Hepatitis B virus particles are composed of two parts: an envelope and a nucleocapsid. The envelope contains hepatitis B virus surface antigen (HBsAg), glycoproteins and cell fat. The nucleocapsid includes core antigens (HBcAg) and e antigens (HBeAg), circular double-stranded HBV-DNA and DNA polymerase. Therefore, the hepatitis B virus has three antigen components: surface antigen (HBSAg), core antigen (HBcAg), e antigen (HBSAg), which are recognized by the human immune system to produce corresponding antibodies: anti-HBs (HBsAb), anti-HBc ( HBcAb), anti-HBe (HBeAb).

Figure 2: Hepatitis B virus structure

Source: Graham Beards

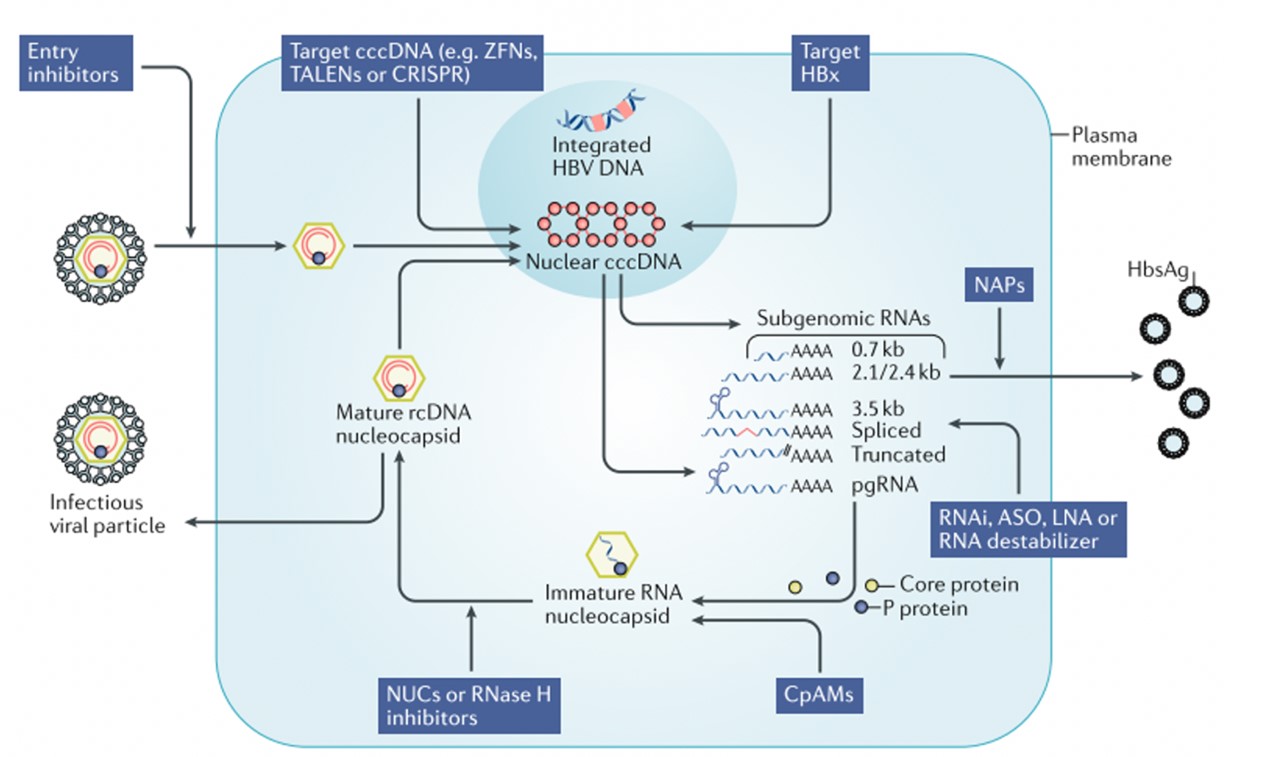

The life cycle of the hepatitis B virus and treatment targets

The hepatitis B virus binds to the host liver cell surface receptor NTCP through HBsAg, transports the uncoated viral particle nucleocapsid to the nucleus, releases double-stranded relaxed circular DNA (rcDNA), and under the action of DNA polymerase converts them to covalently closed circular supercoiled DNA (cccDNA). cccDNA has a high degree of stability and can be maintained in the nucleus for months to years. It is the core of virus replication and cell infection. The virus uses cccDNA to transcribe pregenomic RNA (pgRNA). pgRNA can reverse transcribe rcDNA to form new virus particles. The mature nucleocapsid either circulates back into the nucleus to maintain the cccDNA pool or is packaged with the envelope protein and exported as infectious virus particles. 【2】

Correspondingly, the targets of hepatitis B include virus invasion, cccDNA, virus mRNA, nucleocapsid assembly, virus packaging and discharge, and immune regulation.

Figure 3: Hepatitis B virus life cycle and treatment targets

Source: Fanning et al.

Existing hepatitis B therapies suppress but can not eradicate the virus. A cure is in high demand.

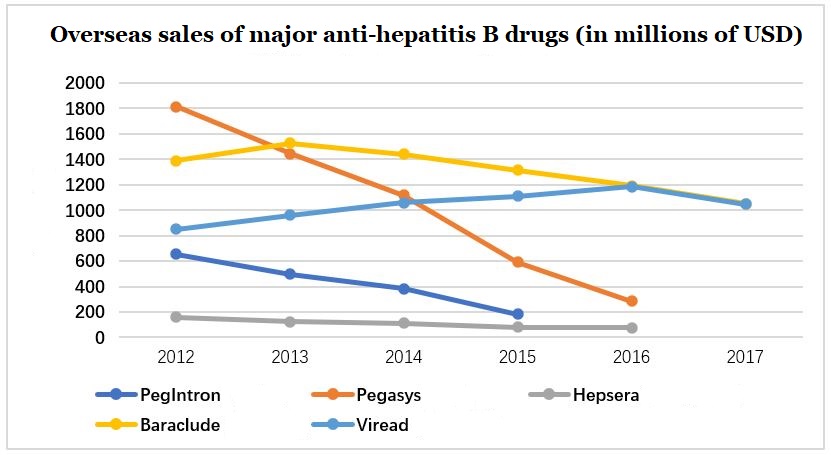

Currently, hepatitis B drugs on the market mainly include two types: nucleoside (acid) analogs (NA) and interferon. Currently, NA drugs are commonly used in clinical. NA inhibits viral polymerase by competing with natural nucleosides to block viral nucleic acid synthesis. Interferon is relatively more expensive, requires intramuscular injection and has many adverse reactions, and therefore its market is gradually shrinking.

Common NA hepatitis B drugs mainly include entecavir, adefovir dipivoxil, lamivudine, telbivudine, tenofovir and so on. Due to the excellent safety and tolerability of entecavir and tenofovir, they are listed as the first-line drugs for hepatitis B treatment by the “2017 EASL (European Society for Liver Research) latest hepatitis B guidelines recommendations”, occupying a huge market share in international anti-hepatitis B virus drugs.

Figure 4: Overseas sales of major anti-hepatitis B drugs

NA drugs are also mainstream drugs in China, accounting for about 80% of the hepatitis B drug market. From 2012 to 2017, the CFDA approved 47 NA hepatitis B drugs, including 6 lamivudine, 20 adefovir, 13 entecavir, 1 telbivudine, and 6 tenofovir.

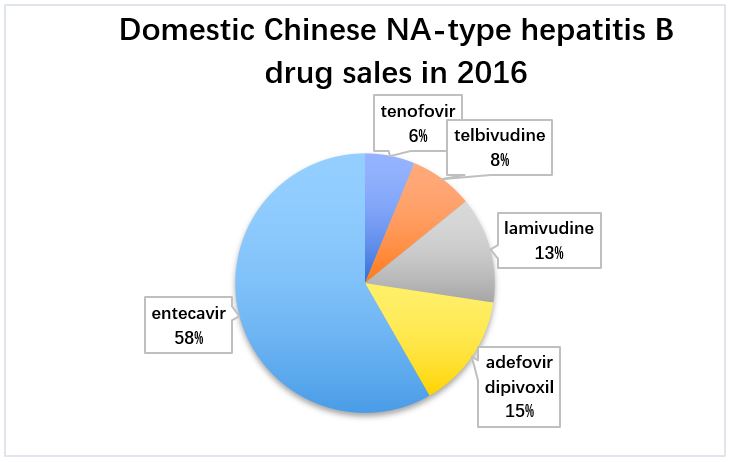

Entecavir’s market share stands out. In 2016, the overall domestic Chinese anti-hepatitis B virus drug market reached RMB 16.2 billion. It occupies half of the market share and has become the main product of domestic NA antiviral drugs.

Many domestic Chinese pharmaceutical companies have passed the “consistency evaluation of generics” for entecavir. The top 3 brands for entecavir are Runzhong from Chiatai Tianquing, Boluding from Bristol Myers Squibb, and Weiliqing from Jiangxi Qingfeng Pharmaceutical. 【3】

Tenofovir is a product developed by Gilead, which was launched lately in China. Although its current share is small, its rapid growth prospects are promising. At present, many domestic pharmaceutical companies such as Brilliant Pharmaceutical in Chengdu have passed consistency evaluation, which is bound to bring about a reshaping of the domestic market.【4】The market shares of telbivudine, lamivudine, and adefovir dipivoxil are gradually shrinking due to their safety and tolerability restrictions.

Figure 5: Domestic Chinese NA-type hepatitis B drug sales in 2016

However, both interferon and NA still stay in the category of inhibition of HBV replication, but do not cure it. In addition, the possibility of relapse in a short period of time after stopping the drug is very high.

As H. Kelley Riley, chief medical officer of EnvisionRxOptions, said, current hepatitis B treatment with antiviral drugs is mainly aimed at reducing liver damage and prolonging the survival of patients, and may require life-long drug treatment. Therefore, the development of more effective drugs for the treatment of chronic hepatitis B is imminent.

Research and development of new hepatitis B drugs

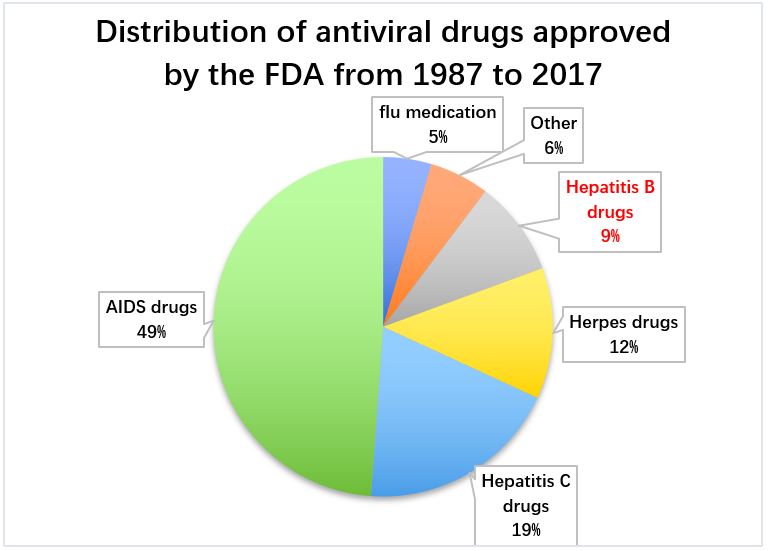

Compared with the vigorous development of antiviral drugs for AIDS and hepatitis C, hepatitis B drugs have not received the same amount of attention. In the past three decades, only about 10% of all antiviral drugs have received FDA approval to treat hepatitis B. 【5】

Figure 6: Distribution of antiviral drugs approved by the FDA from 1987 to 2017

In recent years, with the development of antiviral drug technology, the era of achieving a cure for hepatitis B seems to be getting realistic. Driven by the huge market potential, major pharmaceutical companies have joined the battle.

Hot research drugs are currently concentrated in the following categories: capsid inhibitors, RNAi and antisense RNA drugs, entry inhibitors and therapeutic vaccines. Among them, capsid inhibitors, RNAi and antisense RNA drugs and therapeutic vaccines are the most popular development directions for new hepatitis B drugs.

RNAi and antisense RNA drugs

RNA interference (RNAi) refers to the event when RNA molecules inhibit gene expression or translation by neutralizing targeted mRNA molecules. Antisense RNA refers to RNA that can inhibit the expression of related genes after being complementary to mRNA. Currently, many pharmaceutical companies are using RNAi and antisense RNA technology to develop drugs for the treatment of chronic hepatitis B.

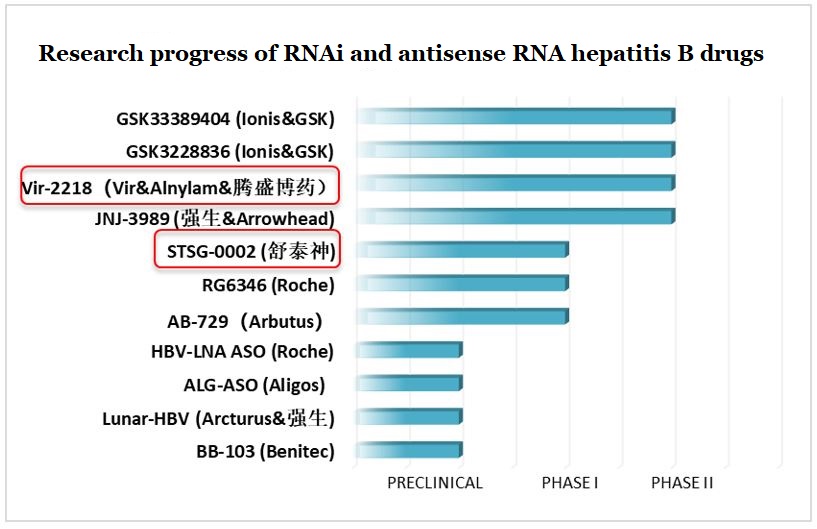

Several international giants, such as Johnson & Johnson, GlaxoSmithKline, and Roche, are already cooperating with other pharmaceutical companies to develop RNAi and antisense RNA drugs. At present, the clinical trials of these companies have entered the late developmental stage. Comparatively, domestic Chinese pharmaceutical companies have been slow to start, and currently there are fewer players in this category. Brii Biosciences and Staidson are worthy of attention.

Figure 7: Research progress of RNAi and antisense RNA hepatitis B drugs

Note: Brii Biosciences (腾盛博药), Staidson (舒泰神), Johnson & Johnson (强生)

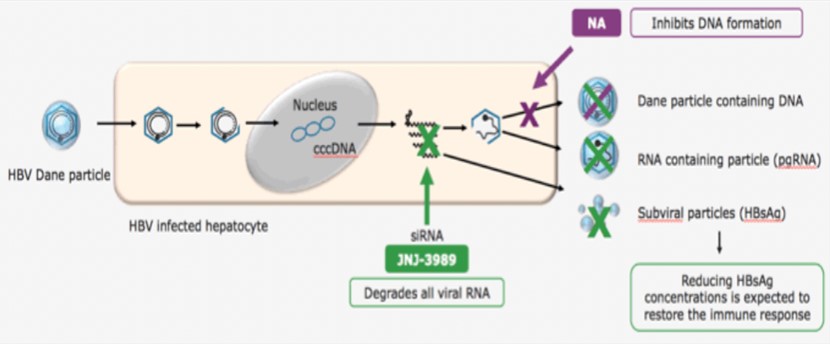

- Johnson & Johnson and Arrowhead: JNJ-3989

JNJ-3989 is a subcutaneously injected antiviral drug, which aims to treat chronic hepatitis B through RNAi. At the just-concluded European Society for the Study of Liver Diseases (EASL2020), Arrowhead and its partner Johnson & Johnson announced the phase II clinical data of JNJ-3989 and NA dual therapy for the treatment of chronic hepatitis B.

The results showed that within 48 weeks after the last administration of JNJ-3989, 39% of patients showed a lasting improvement (HBsAg drop ≥1 log10IU/mL). A decrease in HBV RNA, HBeAg and HBcrAg was observed in all participants. Once every 4 weeks, a total of 3 doses of JNJ-3989 a dose of 400 mg are shown to have long-term safety. These results support the evaluation of a longer treatment duration for JNJ-3989 + NA combination therapy. 【6】

At the same time, a Phase 2 clinical trial of JNJ-3989, JNJ-6379 (another Johnson & Johnson hepatitis B drug under development), and NA triple therapy is also in progress. JNJ-6379 is a capsid inhibitor that disrupts the life cycle of HBV by inducing the assembly of defective capsids. JNJ-3989, JNJ-6379, and NA have different targets. The combined use of the three is expected to contain HBV at various stages.

Picture 8: JNJ-3989 treatment

Source: Edward Gane

2. Ionis and GlaxoSmithKline: GlaxoSmithKline 3228836

In August 2020, the antisense RNA hepatitis B drug GlaxoSmithKline 3228836 jointly developed by Ionis and GlaxoSmithKline also announced their clinical Phase 2 results. Compared with a placebo, GlaxoSmithKline 3228836 was shown to decrease two biomarkers of chronic hepatitis B after 4 weeks of treatment: HBsAg and HBV.

The trial involved four hepatitis B patients who had previously received antiviral drugs and twelve hepatitis B patients who had not received HBV drugs. Six patients in the two groups had their HBsAg levels reduced by 3.0 log10 IU/ml or more after 29 days.

Although the results are still in the preliminary stages, Christopher Corsico, senior vice president of GlaxoSmithKline, said, “The results of the trial are a potential step towards a functional therapy for patients with chronic hepatitis B.” The phase IIb clinical trial will start before the end of the year. 【7】

3. Dicerna and Roche: RG6346

RG6346 is a hepatitis B RNAi drug jointly developed by Dicerna and Roche. In the mouse HBV model, RG6346 reduced the circulating HBsAg by more than 99.9%. This seemed to indicate that the compound could lead to long-term HBsAg clearance.

In the ongoing clinical Phase 1 proof-of-concept trial, HBsAg in the RG6346 the 1.5, 3.0, and 6.0 mg/kg administration groups were reduced to 1.39, 1.80 and 1.84 log10IU/mL, respectively, without adverse reactions occurring.

4. Vir, Alnylam, and Brii Biosciences: VIR-2218

VIR-2218 is an RNAi subcutaneous injection for the functional cure of chronic hepatitis B. VIR-2218 is designed to silence all cccDNA of all 10 HBV genotypes and all HBV transcripts in integrated DNA. At present, Brii Biosciences has submitted a clinical application for VIR-2218.

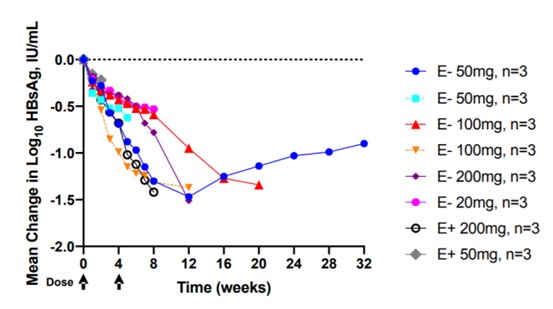

On EASL2020, Vir and Alnylam provided data from a phase II trial of VIR-2218 in patients with chronic hepatitis B. The study included patients with hepatitis B who were treated with NA, and the results showed that in the ongoing trial of 24 patients with chronic hepatitis B, there were no adverse events. Furthermore, HBsAg levels were significantly reduced in all dose groups. Among patients at the 50 mg dose level, the HBsAg level decreased the most at week 12, with an average decrease of 1.5 log10IU/mL from the baseline level. It is worth noting that in this group, the decline in HBsAg was still 1.0 log10IU/mL until week 28. 【8】

Figure 9: VIR-2218 injection significantly reduces HBsAg levels

Source: Edward Gane

5. Staidson: STSG-0002

STSG-0002 injection is an anti-hepatitis B drug independently developed by Staidson in Beijing to block HBV virus replication through the RNAi mechanism. In the pre-clinical effectiveness study using an HBV transgenic mouse model, the STSG-0002 injection showed a significant inhibitory effect on HBV DNA seven days after administration. In the comparison experiment with entecavir, there was a significant decrease in serum HBsAg and HBeAg on the day after the STSG-0002 injection, while the HBsAg and HBeAg in the entecavir group were not significantly different from the control group.

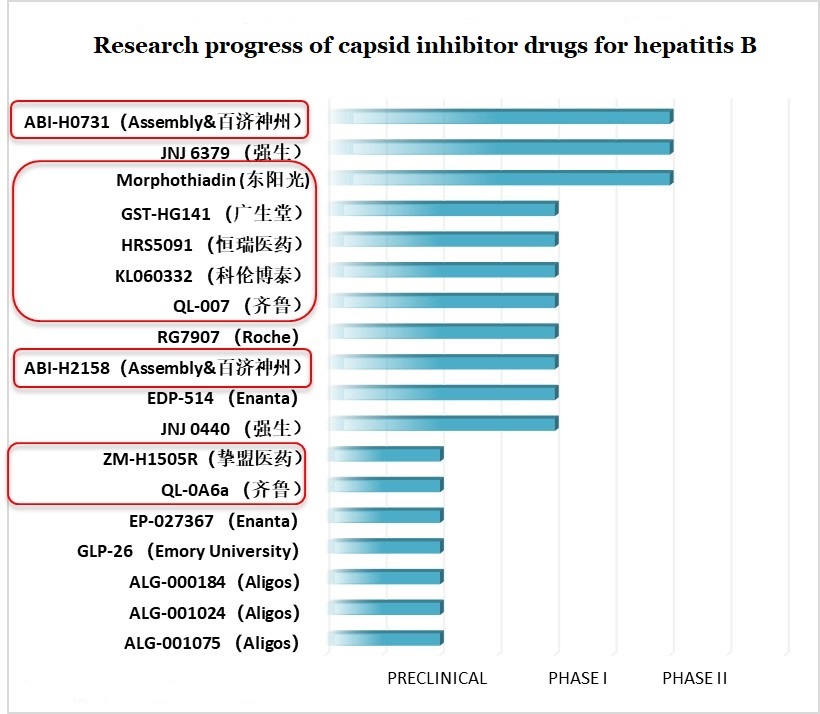

Capsid inhibitors

The HBV capsid protein has multiple functions in virus replication and stability. Capsid inhibitors disrupt the life cycle of HBV by inducing the assembly of defective capsids. In this category, there are a large number of domestic Chinese pharmaceutical companies. Some are conducting in-house research and development while others have collaboration projects with international pharmaceutical companies. For example, in July this year, BeiGene and Assembly reached a cooperation agreement on Assembly’s three capsid inhibitors in China.

Figure 10: Research progress of capsid inhibitor drugs for hepatitis B

Note: BeiGene (百济神州), HEC Group (东阳光), Fujian Cosunter Pharma (广生堂), Jiangsu Hengrui Medicine (恒瑞医药), Kelun Industry Group (科伦博泰), Qilu Pharmaceutical (齐鲁), Zhimeng Biopharma (挚盟医药)

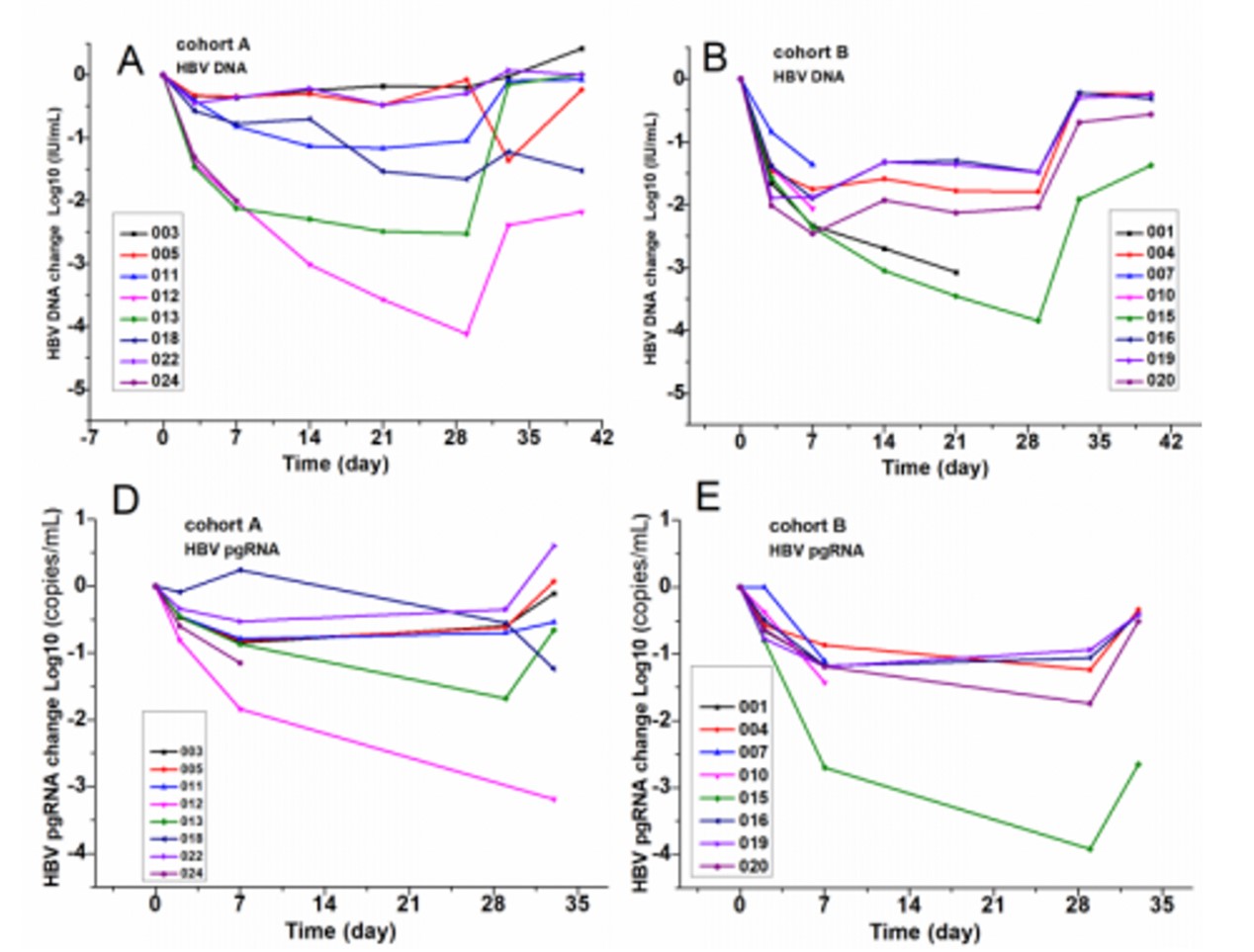

- HEC Group: Morphothiadin (GLS4)

GLS4 is a domestic Chinese capsid inhibitor developed by HEC Group. Clinical data shows that the combined use of GLS4 (120 or 240 mg) and ritonavir (100 mg) in group A and group B, respectively, has had a significant effect on inhibiting HBV. In groups A and B, the average drop in HBV DNA after 28 days of treatment was -1.42 and -2.13 log10 IU/mL; pgRNA was -0.75 and -0.78 log10 IU/mL, respectively; HBsAg was -0.06 and -0.14 log10 IU/mL, respectively mL; HBeAg is -0.23 and -0.5 log10 IU/mL9, respectively. 【9】

Figure 11: The combination of GLS4 and ritonavir can significantly reduce HBV DNA and pgRNA

2. Johnson & Johnson:JNJ-6379

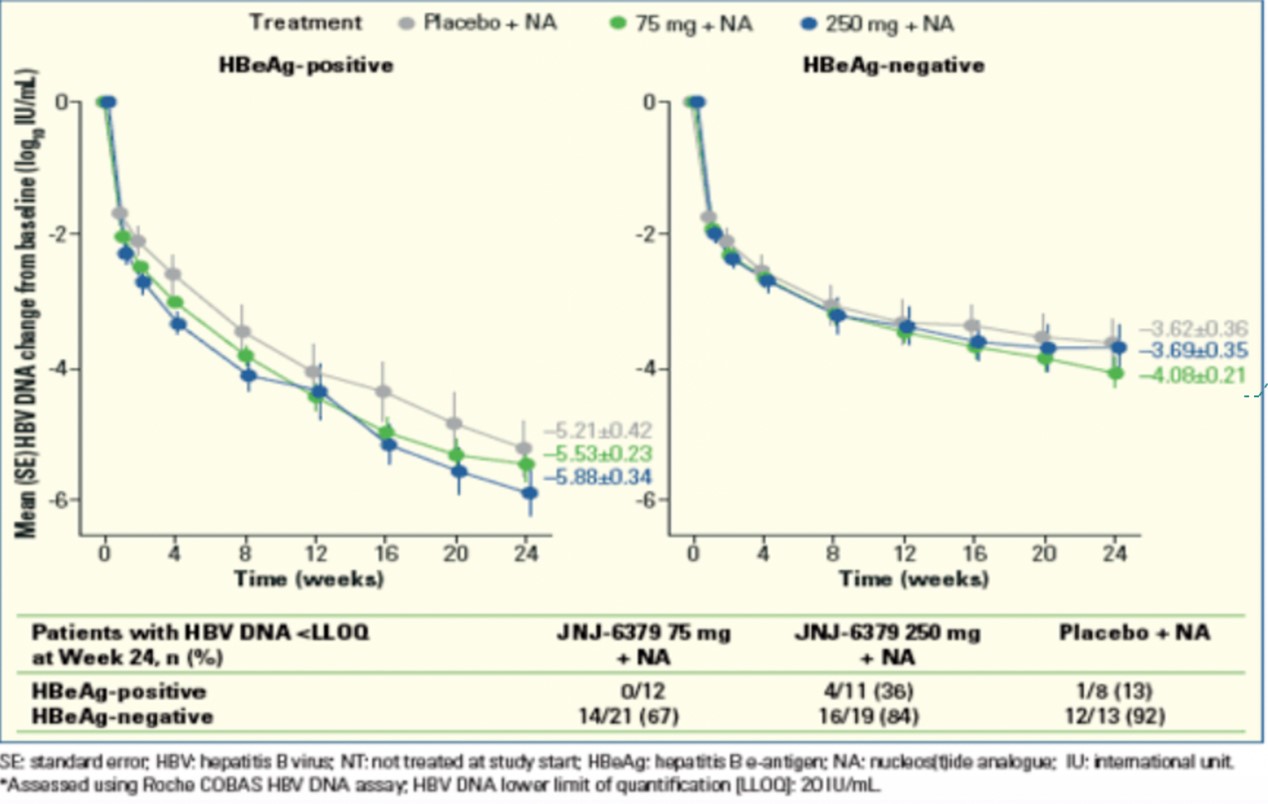

JNJ-6379 is a capsid inhibitor developed by Johnson & Johnson. At EASL2020, Johnson & Johnson announced its clinical trial data. The results show that JNJ-6379 combined with NA could effectively inhibit HBV DNA and RNA. Among untreated HBeAg-positive patients, HBV DNA in the 75mg JNJ-6379+NA and 250mg JNJ-6379+NA treatment groups decreased by 5.53 and 5.88 log10 IU/mL from baseline, which was significantly higher than the NA+placebo group at 5.21 log10 IU/mL mL. 35% of JNJ-6379+NA-treated patients had a HBsAg drop of more than 0.3 log10 IU/mL, while only 13% of patients in the NA+placebo group had a HBsAg drop of more than 0.3 log10 IU/mL.

Due to the epidemic, Johnson & Johnson decided to terminate JNJ-6379 monotherapy and devote more energy to the development of combination therapies. 【10】

Figure 12: JNJ-6379 combined with NA could effectively inhibit HBV DNA

Source: EASL2020

3. Assembly and BeiGene: ABI-H0731, ABI-H2158 and ABI-H3733

Assembly currently has three clinical-stage HBV drugs (ABI-H0731, ABI-H2158 and ABI-H3733), all of which are capsid inhibitors. In phase II clinical trials, the first-generation inhibitor ABI-H0731 combined with NA was well-tolerated. Compared with NA treatment alone, it showed higher antiviral activity in reducing HBV DNA and pgRNA. In the second week of combined use, there was a significant drop in pgRNA levels. Since cccDNA is the only known source of pgRNA, a further drop in pgRNA levels may indicate a decrease in the cccDNA pool. 【8】

The second-generation inhibitor ABI-H2158 has shown good safety profile and antiviral activity in phase I clinical trials.

In July 2020, Assembly and BeiGene announced that the two parties will collaborate in China on these three HBV drugs from Assembly. According to the terms of the agreement, Assembly will grant BeiGene the exclusive right to develop and commercialize ABI-H0731, ABI-H2158 and ABI-H3733 in China (including Hong Kong, Macau and Taiwan).

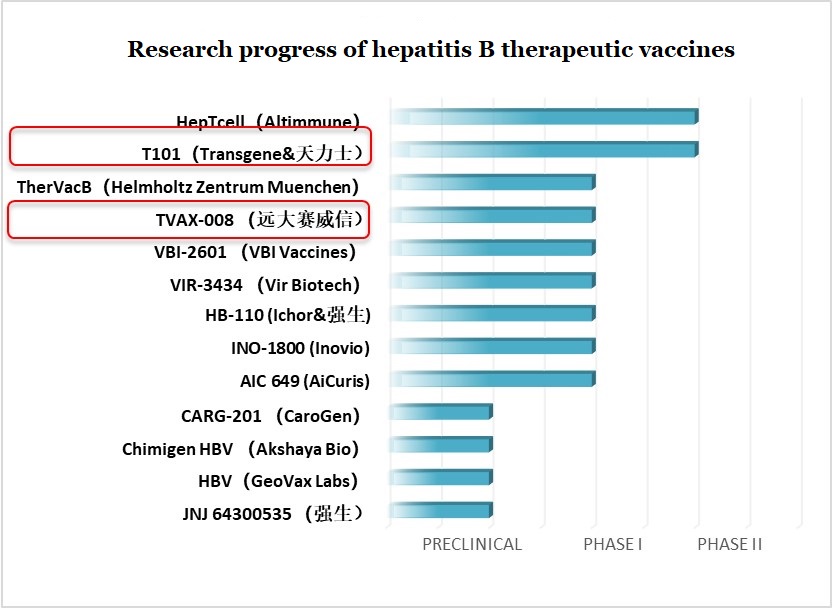

Therapeutic vaccines

Therapeutic hepatitis B vaccines may be suitable for patients diagnostic with the hepatitis B virus by stimulating specific immune responses. At present, CGE Healthcare and Tasly are the only domestic Chinese pharmaceutical companies in this field.

Figure 13: Research progress of hepatitis B therapeutic vaccines

Note: Tasly (天力士), CGE Healthcare (远大赛威信), Johnson & Johnson (强生)

- Transgene and Tasly: T101

T101 is a viral vector that expresses three specific antigens of hepatitis B. It is the Chinese counterpart of TG1050 that currently undergoing clinical trials in North America. It is developed in China by French-owned Transgene in cooperation with Chinese-owned Tasly. Phase I clinical results indicate that T101 can rapidly induce virus-specific T-cell immune responses two weeks after vaccination and last for at least twelve weeks. In the fourth week after vaccination, the HBsAg level of the T101 group decreased by about 22% on average. It is currently entering phase II clinical trials.

- CGE Healthcare: TVAX-008

TVAX-008 is a therapeutic hepatitis B vaccine developed by CGE Healthcare in Nanjing. TVAX-008 utilizes multi-targeted HBsAg and HBcAg combined with CpG adjuvants. HBsAg/HBcAg promotes humoral immunity and restores Th1/Th2 balance and CpG activates TLR9 of B cells and pDC and induces cellular immunity against hepatitis B virus. Preclinical studies have shown that TVAX-008 can also produce strong humoral and cellular immune responses in C57BL/6 in different serotypes of HBV transgenic mice and immune tolerance mice. It has shown to break through immune tolerance, with HBsAg clearance up to 98%.

In July 2020, TVAX-008 was officially approved to carry out human clinical trials.

Current projects worthy of attention and potential collaboration

RNAi and antisense RNA drugs

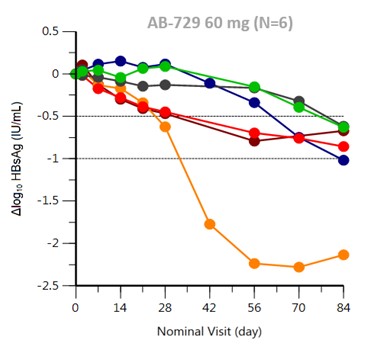

- Arbutus: AB-729

AB-729 is a subcutaneously injected RNAi drug for hepatocytes. It uses a new covalently combined GalNAc delivery technology to inhibit virus replication and reduce all HBV antigens. Currently in phase I clinical study, AB-729 could cause an average drop in HBsAg of approximately 1 log10 IU/mL in the twelfth week at a single dose of 60 mg. At week twelve, the smallest drop in HBsAg among the subjects was -0.62 log10 IU/mL, and the largest was -2.14 log10 IU/mL.

Figure 14: AB-729 could reduce HBsAg

Source: Arbutus

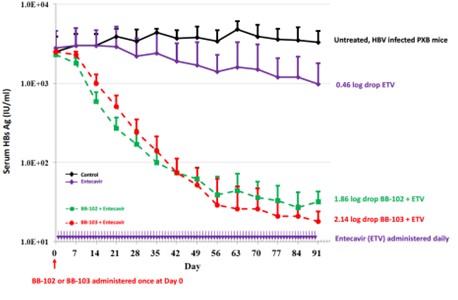

2. Benitec: BB-103

Benitec is an Australian biotechnology company established in 1997. It is committed to using DNA-guided RNA interference technology to develop gene silencing therapies to treat chronic and life-threatening diseases. BB-103 is an anti-hepatitis B drug. In the chimeric mouse model, single-agent entecavir treatment resulted in a drop of 2.63 log and 0.46 log of HBV DNA and HBsAg, respectively, while a single dose of BB-103 combined with entecavir could reduce serum HBV DNA by 3.72 log and HBsAg by 2.14 log9.

Figure 15: Combining BB-103 and entecavir could reduce HBsAg

Image source: Benitec

Capsid inhibitor:

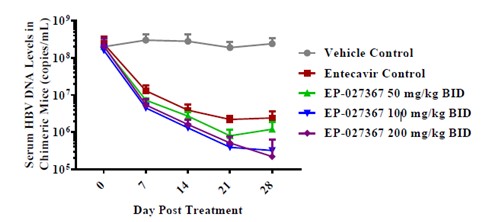

- Enanta: EP-027367

Enanta is a company focused on the development of small molecule drugs for the treatment of viral infections. EP-027367 is the company’s anti-hepatitis B drug currently under development. EP-027367 can regulate HBV capsid assembly in vitro and block viral pgRNA encapsidation. In the human liver chimeric mouse model, EP-027367 was used at 50, 100, and 200 mg/kg BID for 28 days, and HBV DNA levels were reduced from baseline by 2.2, 2.7 and 3.0 logs, respectively.

Figure 16: EP-027367 reduced HBV DNA in a chimeric mouse model

Source: ESAL2018

Therapeutic vaccines:

- Altimmune: HepTcell

HepTcell is an immunotherapeutic product composed of nine synthetic HBV-derived peptides formulated with IC31, a TLR9-based adjuvant. HBV peptides are designed to drive the T cell response of patients with multiple genetic backgrounds to all HBV genotypes. In phase I clinical studies conducted in the United Kingdom and South Korea, the combination of HepTcell and NA was shown to cause a strong T-cell response to the HBV antigen. Currently there is no evidence that there are immune-mediated adverse events. Altimmune recently announced that the FDA has approved its Phase II clinical trial.

Figure 17: HepTcell Therapy

Source: Altimmune

2. AiCuris: AIC649

AIC649 is a proprietary inactivated parapox virus (iPPVO). It can induce a natural, self-limiting immune response. It is known to induce immune response and loss of woodchuck hepatitis surface antigen (WHsAg) and induce anti-WHsAg antibodies, which indicates that AIC649 could achieve a functional cure in CHB patients. Phase I clinical trials have proved that the single intravenous dose of AIC649 is safe and well tolerated in all dose groups. Moreover, AIC649 caused the increase of IL-1b, IL-6, IL-8 and IFN-γ and the decrease of IL-10, successfully activating an immune response. 【10】

In addition to its antiviral activity, AIC649 could also prevent and improve liver fibrosis, and has powerful anti-tumor properties. AIC649 is currently open for collaboration.

Figure 18:AiCuris

Source: AiCuris

3. Inovio: INO-1800

INO-1800 is a DNA immunotherapy developed by Inovio for the treatment of hepatitis B virus (HBV) infections. The clinical phase I results show that INO-1800 has been well-tolerated. Moreover, it could induce the production of specific T-cells that recognize key components of the hepatitis B virus, including CD8 killer T-cells, and antiviral cytokines (such as interferon gamma).

Dr. J. Joseph Kim, President and CEO of Inovio, said: “Our hepatitis B immunotherapy trial results clearly demonstrate the potential of INO-1800 as an immunotherapy. INO-1800 promotes HBV-specific killer T-cells in all areas. We regard INO-1800 as the key immunotherapy component of anti-HBV combination therapy. We have discussed with several potential partners and hope to further improve the product through collaboration or partnership.”

Conclusion

Hepatitis B has a huge market. It has garnered interest from many pharmaceutical companies around the world, and various target drug technologies have advanced by leaps and bounds.

About the author:

MJ Yuan is an investment analyst at MyBioGate, a PhD student at Boston University School of Medicine, majoring in nutritional epidemiology. One of the founders of the Boston University Biotechnology Business Club, a former consultant of the MIT Consulting Club, active in the pharmaceutical science industry in the Greater Boston area.

Reference materials:

【1】Hepatitis B. https://www.who.int/en/news-room/fact-sheets/detail/hepatitis-b. Accessed September 18, 2020.

【2】Fanning GC, Zoulim F, Hou J, Bertoletti A. Therapeutic strategies for hepatitis B virus infection: towards a cure. Nat Rev Drug Discov. doi:10.1038/s41573-019-0037-0

【3】Feng Xuejiao, Huang Yong, Cheng Pingsheng, Yu Qiong. Market analysis of anti-hepatitis B virus drugs.

【4】Gilead Announces New Data from Viral Hepatitis Research Programs at The Liver Meeting® 2019. https://www.gilead.com/news-and-press/press-room/press-releases/2019/11/gilead-announces- new-data-from-viral-hepatitis-research-programs-at-the-liver-meeting-2019. Accessed September 6, 2020.

【5】Chaudhuri S, Symons JA, Deval J. Innovation and trends in the development and approval of antiviral medicines: 1987–2017 and beyond. Antiviral Res 2018;155:76-88. doi:10.1016/j.antiviral.2018.05.005

【6】Arrowhead and Collaborator Janssen Present Phase 2 Clinical Data on Investigational Hepatitis B Therapeutic JNJ-3989 at The Digital Liver Congress | Business Wire. https://www.businesswire.com/news/home/20200828005039/en/Arrowhead-Collaborator- Janssen-Present-Phase-2-Clinical. Accessed September 6, 2020.

【7】GlaxoSmithKline presents promising phase 2a data for chronic hepatitis B treatment | GlaxoSmithKline. https://www.GSK.com/en-gb/media/press-releases/GSK- presents-promising-phase-2a-data-for-chronic-hepatitis-b-treatment/. Accessed September 6, 2020.

【8】Ding X, Connolly L, Huang S, Kim J, Pang P, Yuen M. chronic hepatitis B patients Mean Change in Log 10 HBsAg, IU / mL. :4-5.

【9】Zhang H, Wang F, Zhu X, et al. Antiviral Activity and Pharmacokinetics of the HBV Capsid Assembly Modulator GLS4 in Patients with Chronic HBV Infection. doi:10.1093/cid/ciaa961/5869864

【10】Efficacy and Safety Results of the Phase 2 JNJ-56136379 JADE Study in Patients with Chronic Hepatitis B: Interim Week 24 Data. https://www.natap.org/2020/EASL/EASL_88.htm. Accessed September 20, 2020 .

0 Comments