Authors: XU Ziyi, CHEN Chun

Editor: Ginger Ding

Source: Photo by Sasha Freemind on Unsplash

According to conservative estimates of the World Health Organization, 350 million people worldwide suffer from depression. Unlike short-term mood swings, the symptoms for depression must be present for at least two weeks. Symptoms include, but are not limited to, persistent sadness or anxiety, feelings of hopelessness or pessimism, irritability, loss of interest or pleasure in hobbies or activities, decreased energy or fatigue, and difficulty sleeping. For patients diagnosed with depression, drug intervention is one of the most important treatment approaches.

From the 1980s to the beginning of the 21st century, a series of antidepressants developed based on the “monoamine hypothesis” are still regarded as most prescribed first-line drugs. After the wave of antidepressant research and development in the last century, what changes have taken place in the global antidepressant landscape? What breakthrough varieties have recently entered the market? For patients suffering from side effects and recurrence, what new drugs are worthy of attention and understanding? For investors, where are the future opportunities? This article will answer each of these queries one by one.

The global market continues to grow, and China is expected to exceed the tens of billions

According to a research report by Medgadget, the market value of antidepressants in 2018 was approximately US$13.7 billion, with a compound annual growth rate (CAGR) of approximately 2.15%. It is expected to reach US$15.88 billion in 2025.

The North American market is the main force in the market. Research has shown that the incidence of depression in the North American market continues to increase and expect to remain dominant over the next 10 years. At the same time, the Asia-Pacific region’s share of the global antidepressant market has increased rapidly in recent years and has continued to steadily rise. The current market share is the second largest【1】.

The total number of patients suffering from depression in China is about 90 million, accounting for about 7% of the total population. China has the largest number of patients with depression in the world. Due to the accelerated pace of life leading to increasing mental stress, changes in treatment concepts, and an increase in disposable income, the drug market for depression in China has developed rapidly in recent years. According to data from CFDA Southern Institute, China’s antidepressant market exceeded RMB 9 billion in 2019, a year-on-year increase of 10.93%. If China can further enhance citizens’ awareness of depression treatment, it is conservatively estimated that the market size in 2020 is expected to reach about RMB 18 billion with the number of patients unchanged【2】.

When it comes to treatment options, SSRI takes the lead

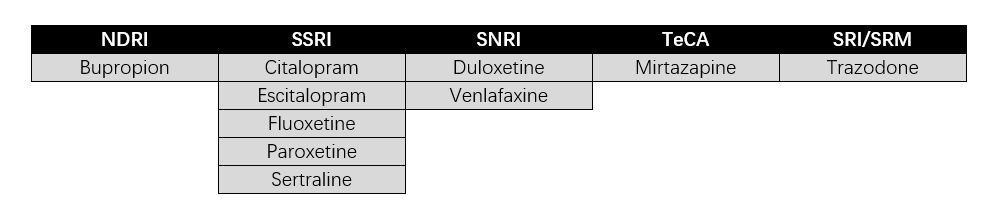

The most common antidepressants are norepinephrine dopamine reuptake inhibitors (NDRI), selective serotonin reuptake inhibitors (SSRI), serotonin and norepinephrine reuptake inhibitors (SNRI), tetracyclic antidepressants (TeCA), and serotonin reuptake inhibitors/5-HT receptor modulators (SRI/SRM). The mechanism of action of these drugs is to regulate the concentration of monoamine neurotransmitters (such as serotonin, norepinephrine, dopamine, and others) in the synaptic cleft to exert antidepressant effects.

▲Figure 1: List of commonly used antidepressants

Source: Compiled by MyBioGate

SSRI antidepressants are used for a variety of reasons. They have a clear mechanism, are efficient, have few adverse reactions, and a safe application. Thus, SSRIs have rapidly become the first line in clinical settings in recent years and are currently represent the highest market share in antidepressants.

Generic drugs reign supreme, innovative drug candidates are not widely available

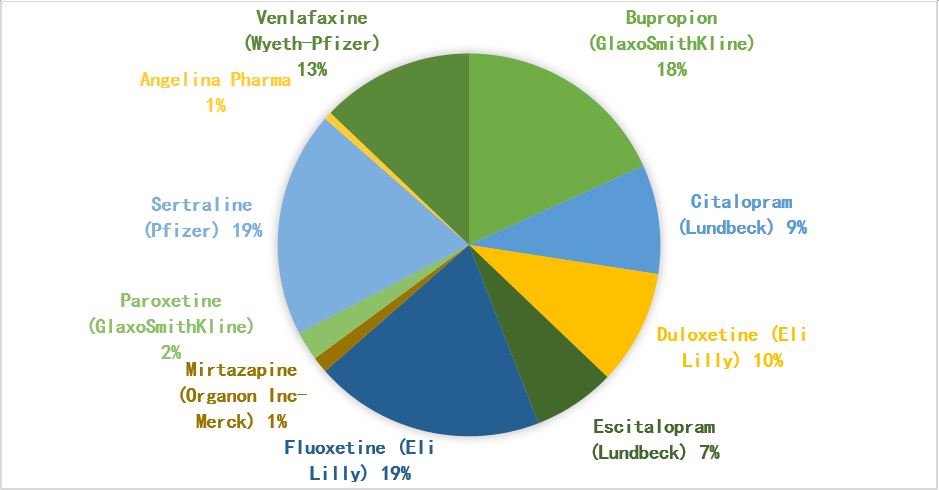

According to statistics and estimates of the market share of antidepressants in 2017, drugs developed by Eli Lilly, Pfizer, GlaxoSmithKline, and Lundbeck dominated the market. Among them, the three antidepressants with the highest sales are Eli Lilly’s fluoxetine, Pfizer’s troseline and Gleso Smith Kline’s bupropion. These three antidepressant drugs are equally divided, with a market share of 18%-19%, and the total sales in 2017 reached US$7.5 billion.

Lundbeck, which focuses on the antidepressant market, followed closely behind, relying on its two blockbuster products, citalopram and escitalopram, to occupy 16% of the antidepressant market. In terms of drug categories, the selective serotonin reuptake inhibitor SSRI is undoubtedly the dominant antidepressant, accounting for 56% of all categories.

▲Figure 2: 2017 U.S. antidepressant market share

Source: ClinCal.com, Drug.com and SingleCare.com public data compilation

Accompanied by the expiration of patents, generic drugs giant Teva and Mylan entered the antidepressant market. After these blockbuster products, the entire antidepressant market, including the top players, failed to continue to develop a new generation of differentiated antidepressant drugs. Losing the protection of patents, the sales of the brand-name pharmaceutical companies have had a huge impact on their sales. For example, GlaxoSmithKline’s paroxetine, compared with the global sales of more than US$3 billion in 2003, the global sales in 2016 was only US$316 million.

In general, the current antidepressant drug market is lacking innovation. Antidepressants with overlapping mechanisms of action flood the market. The top players represented by Eli Lilly, Pfizer, GlaxoSmithKline, and Lundbeck have not extended their advantages from first-generation SSRIs to the development of the second-generation SSRI.

Due to the inadequate understanding of the nervous system emotional regulation, the development of antidepressant drugs has also reached a deadlock. Many pharmaceutical companies, including Lundbeck and GlaxoSmithKline, failed in successive clinical trials from 2001 to 2018, with nearly 50% of the drugs not reaching a clinical endpoint.

This disappointing result meant that the top players gradually abandoned antidepressant and even neuroscience-related pipelines. Currently, none of the above-mentioned four multinational pharmaceutical companies have antidepressant drugs under research and development in their pipelines.

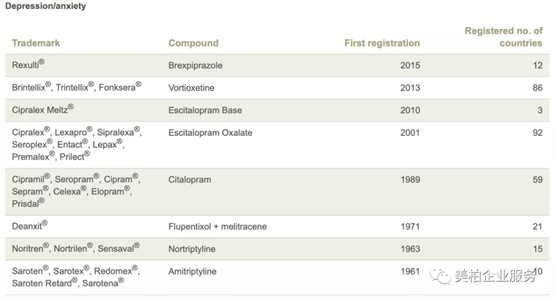

For example, Lundbeck, began research on antidepressant drugs as early as the 1960s. Within 60 years after its first antidepressant, Saroten®, was launched in 1961, Lundbeck focused on the field of antidepressants and successively developed major products such as Cipramil® (citalopram), Cipralex, Brintellix®/Trintellix®. These products have achieved great success in terms of global sales. However, Lundbeck, which is well-known in the field of antidepressants, has also turned its strategic focus to discover and develop innovative treatments for brain diseases, and stopped all current research on antidepressant drugs.

▲Figure 3: Summary of Lundbeck’s antidepressant drugs

Source: Lundbeck official website

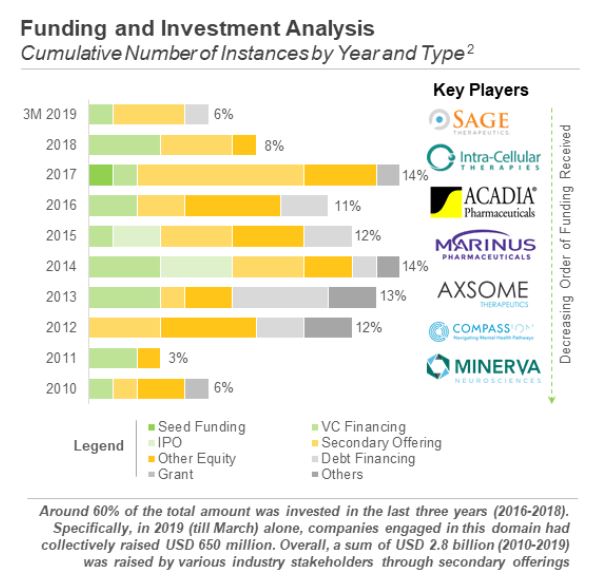

The downturn of large pharmaceutical companies ushered in a reshuffling of the antidepressant market. Now a series of small and medium-sized biopharmaceutical companies are active in the antidepressant market. The top three include Sage Therapeutics, Intra-Cellular Therapies and Acadia Pharmaceuticals. From 2010 to 2019, a total of US$2.8 billion has been raised through secondary issuance. From January to March 2019 alone, companies in the antidepressant field have raised US$650 million.

▲ Figure 4: 2010-2019 global anti-depression market financing analysis

Source: Roots Analysis Funding and Investment Analysis for antidepressants

In general, mainstream antidepressants are not satisfactory in terms of effectiveness and safety

Among patients using existing first-line antidepressant drugs, only about 50% have a positive response to the drugs and are able to have some relief. However, even patients who initially respond to the drug often experience diminished efficacy after taking the medication for a period of time. For patients with clinical depression, the existing treatment options usually only include increased doses, combination medications, and combined cognitive behavioral therapy. Although these options can achieve temporary results, there are major limitations【3】.

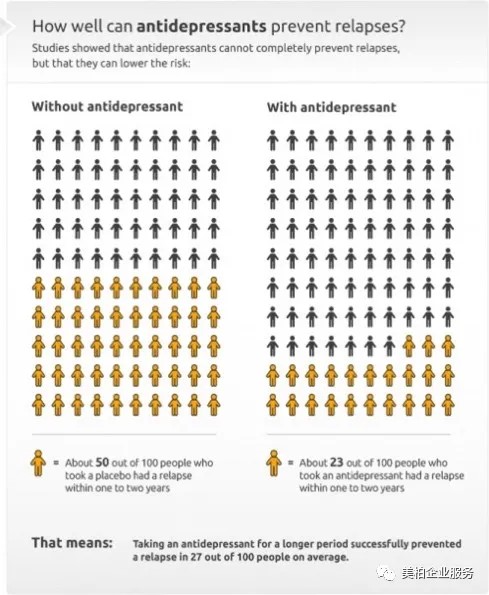

For example, relapse rates are high. If patients cannot persist in taking antidepressants for a long time, about 50% of them will experience repeated symptoms. Long-term use has a certain effect on preventing symptoms from recurring, but 23% of poll respondents still said they felt that taking medication would not reduce relapses.

▲Figure 5: Current effectiveness and relapse likelihood of antidepressants

Source: www.informedhealth.org

Delayed onset is one of the biggest shortcomings of current antidepressants. The vast majority of patients with depression hope to have relief from symptoms soon after treatment, but traditional antidepressants take an average of 2-4 weeks to take effect, causing some patients to stop or even give up treatment. This results in a medical economic burden to patients【4】.

Mainstream antidepressants can also cause a series of side effects, which brings a lot of inconvenience to patients’ lives and affects treatment compliance. A survey based on the adverse reactions and percentages experienced by 225 patients taking different types of antidepressants showed that more than 80% of patients had at least one adverse reaction during the treatment of depression. On average, each patient suffers from four kinds of adverse reactions at the same time, many of which cause significant distress to the patient and even affect daily functions. Among patients taking SSRI, about 40% of patients will actively seek alternative treatment options【5】.

Future Opportunity 1: Develop a new mechanism of action

At present, the top players in the major depression fields have shifted their strategic development goals. The generic drugs are fiercely competitive in China, and the research and development of SSRI and SNRI varieties has become exhausted.

If a company wants to stand out, companies in China need to seize this time window, cooperate with advanced platforms and in-license drugs with new mechanisms of action that can challenge classic SSRIs and SNRIs, which is expected to bring huge economic benefits.

In 2015, a study on esketamine in the treatment of patients with refractory depression was born, breaking the deadlock of more than 30 years of depression research. Earlier, esketamine was considered to be an N-methyl-D aspartate (NMDA) receptor and was widely used clinically as an anesthetic. Although the antidepressant mechanism of esketamine is not clear, preliminary studies have found that when esketamine is injected into patients with refractory depression, the symptoms of depression are significantly alleviated. Once the results of this research were published, many pharmaceutical companies paid attention to NMDA receptors [6].

Johnson & Johnson used its strong capital and R&D capacity to immediately seize the opportunity. In March 2019, its Spravato (esketamine) nasal spray was approved by the FDA as the first to treat refractory depression. FDA clinical studies have found that compared with traditional antidepressants, Spravato has a faster onset of action. It only takes a spray and it can be effective within a few hours [7]. And the long-term phase 3 clinical results show that Spravato also has a good performance in solving the problem of high recurrence rate. Escetamine plus an oral antidepressant significantly delays the recurrence time of refractory depression [8].

Johnson & Johnson will naturally not miss the huge cake in the Chinese depression market. In May 2018, it launched a randomized, safe and tolerable study of the efficacy, safety and tolerability of esketamine combined with antidepressants in the treatment of refractory depression. Double blind study. The clinical trial has now entered Phase III.

As a giant of Chinese pharmaceutical companies, Hengrui Pharmaceuticals has also identified a valuable time window for entering the field of depression. Hengrui invested more than RMB 10 million in the research and development of ketamine products, and its esketamine hydrochloride injection was also approved as the first domestic imitation, and launched its blockbuster product hydrochloric acid (R)-ketamine nasal spray in May 2019 And carry out phase I clinical trials.

Esketamine has become a rising star in the antidepressant market in 2019, breaking the unchanging competitive landscape and guiding a new direction for the antidepressant market. Nevertheless, the expensive price of Spravato (a total of $30,000 for the entire course of Esketamine) is still a barrier to expanding market share. At the same time, ketamine belongs to a class of psychotropic drugs in China and is subject to a high degree of regulation. The drug is also controversial due to its possible abuse and possible side effects. In the future, Spravato may be used for acute treatment in China instead of long-term maintenance treatment.

However, the potential of NMDA receptor drugs in the field of antidepressants cannot be ignored. If the next generation of new drugs can break through the barriers and enter the market in a short period of time, they will have a place in the antidepressant market just around the corner.

This article will take stock of several startup companies that focus on targeting NMDA receptors like esketamine, and provide references for companies that are interested in cooperation. In order to meet different needs, we have classified the drugs according to their indications, clinical trial stages and ways of taking them. Help pharmaceutical companies or investors to find cooperation opportunities suitable for their respective development strategies.

Axsome Therapeutics and Neuro Rx: AXS-05 and NRX-101

Axsome Therapeutics is far ahead of other competitors in terms of clinical trial stage and coverage of major and sub-categories of clinical depression. In particular, AXS-05 for the treatment of clinical depression has a fast onset and remarkable efficacy. It completed the pre-market registration application (Pre-NDA) with the FDA in August this year. Once approved, it has the potential to expand.

NRX-101 is the only drug candidate for bidirectional depression with strong suicidal tendencies. Currently in phase II clinical trials, NRX-10 has been shown to significantly relieve depression and reduce patients’ suicidal ideation. Designated by the FDA as a breakthrough therapy and granted fast track, phase III clinical trials are underway.

Relmada Therapeutics and Clexio Biosciences: REL-107 and CLE-100

In phase II clinical trials, REL-107 has a faster onset, is a long-lasting antidepressant, and shows statistical significance compared to the placebo group. It has been designated by the FDA as a “fast track” for adjuvant treatment of clinical depression. It is estimated that it will take two years to complete clinical trials and reach the market.

Compared to REL-107, CLE-100, developed by Clexio, has successfully completed phase II clinical trials to measure drug safety. The study is now recruiting for a randomized, double-blind, placebo-controlled test of drug efficacy. It is a potential adjuvant therapy for patients with clinical depression who do not respond well to available antidepressant treatments.

ixbiopharma and Shenox Pharmaceuticals: WaferiX and SHX-001

Compared to traditional oral medications, ixbiopharma has used its patented wafer-based delivery platform technology WaferiX to develop the world’s first patented sublingual racemic ketamine wafer, which could relieve pain and clinical depression. At present, clinical trials for pain show that sublingual administration can make the drug start to work in 10 minutes. If similar pharmacokinetic properties can be extended to clinical depression and other central nervous system drugs, investing in such drug delivery platforms will allow the company’s future layout to expand to more central nervous system indications.

SHX-001 is a transdermal patch developed by Shenox Pharmaceuticals to treat depression. In theory, its new drug delivery platform will greatly reduce the side effects of its active ingredients. It obtained FIH (phase IIa clinical) IND approval for clinical depression in November 2018. Clinical trials are now active, but recruitment has not started.

VistaGen Therapeutics: AV-101

AV-101 (4-Cl-KYN) is an NMDA (N-methyl-D-aspartic acid) glutamate receptor modulator. It is the precursor of oral 7-chlorokynurenic acid, which can interact with the NMDA receptor. The glycine site uniquely binds and may become a new therapy for MDD involving NMDA receptors. Currently, phase II clinical trials to measure safety, tolerability and efficacy of AV-101 for the treatment of MDD are underway. The drug is still in early stages of development.

Future opportunity 2: Expand the antidepressant market

In March 2019, Zulresso, the first drug developed by Sage Therapeutics for postpartum depression, was approved by the FDA as a breakthrough therapy.

According to data from the Centers for Disease Control and Prevention, approximately 400,000 women in the United States experience postpartum depression each year. However, only about half of women with postpartum depression are diagnosed and treated. The reason for this may be that the human body additionally produces isopentanolone (allopregnanolone) in the brain, ovaries and placenta during pregnancy, which is used to regulate the neurotransmitters related to emotion in the brain. After delivery, isopentanolone returns to normal levels. If this reset is disrupted in some way, it is thought that it may lead to the development of postpartum depression.

Zulresso (SAGE-547) is an analog of isopentanol ketone, which was used to treat refractory seizures in the early stages of development. However, it was discovered that SAGE-547 is effective for severe postpartum depression. The mechanism of its antidepressant effect is complex. One of the claims is that its neurosteroid-like structure acts on the positive allosteric modulator of GABAA receptors and regulates the inhibitory neurotransmitter GABA, thereby achieving the effect of alleviating depression and anxiety.

Compared with traditional SSRI antidepressant drugs that take 2-4 weeks to take effect, Zulresso’s results of two clinical phase III showed that patients significantly improved their depression symptoms within 2.5 days of injection.

Although it is difficult to enter the mainstream antidepressant market, the listing of Zulresso reflects the market potential. Postpartum depression as a niche indication was estimated to have a market capacity of US$138 million in 2017. The current price of $34,000 for Zulresso’s entire treatment course has brought a lot of obstacles to it becoming widely used. Intravenous injections require medical staff, which can cause inconvenience to patients. Furthermore, it only has significant effects on patients with severe symptoms.

In NMDA’s drug development track, Seelos Therapeutics is different from other companies. The SLS-002 is being developed for patients with acute suicidal tendency and post-traumatic stress disorder. Through the communication between the author and the management at Seelos Therapeutics, I learned that the company chose this niche market precisely to avoid direct competition with Johnson & Johnson Spravato. SLS-002 has obtained FDA fast track qualification and is expected to be approved in 2022.

If you or someone you know is having suicidal thoughts, reach out for help. The National Suicide Prevention Lifeline is open 24 hours a day at 800-273-8255.

About the authors

XU Ziyi is an investment analyst at MyBioGate and PhD student in the Department of Chemistry at Boston University, majoring in chemical biology and drug delivery systems. One of the founders of the Boston University Biotechnology Business Club, Tufts Biotechnology Business Club, was a consultant of the MIT Consulting Club and was active in the pharmaceutical science industry in the Greater Boston area.

CHEN Chun is an investment analyst at MyBioGate and a PhD student in the Department of Chemistry at Boston University, majoring in natural product organic synthesis and drug development. Co-founder of Boston University Biotechnology Business Club, member of Tufts University and Massachusetts Institute of Technology Consulting Club, active in the pharmaceutical science industry in the Greater Boston area.

Resources

【1】Medgadget research report

【2】Daily Economic News: The market size this year may reach 18 billion: When depression becomes “normal”, who is producing the antidote?

【3】www.informedhealth.org

【4】China Medical Tribune: The clinical significance of the onset time of antidepressants

【5】Sohu Homepage·Health: Genetic testing can help patients with depression reduce drug side effects

【6】J South Med Univ, 2017, 37(4): 567-569

【7】N Engl J Med 2019; 381:1-4

【8】Expert Opin Pharmacother. 2020Jan;21(1):9-20.

0 Comments