Author: MJ Yuan

Part 2 of a series on the Analgesic Drug Market. Part 1 focused on China while Part 2 takes a global perspective.

Opioid Abuse is a Serious Problem, A New Trend in Non-Opioid Medication Begins

In 1996, Purdue Pharmaceuticals, run by the Sackler family, developed an opioid pain reliever: OxyContin. However, as revealed in reporting from STAT News, only one year after the drug was released, Merck Merdo was cautioning doctors that using OxyContin to treat patients with chronic pain could lead to abuse. Dr. Richard Sackler, pushed for marketing to change this narrative, marking that would ultimately be misleading and false. In the article, it is stated that “[s]pecifically, he said executives should consider giving a “convincing presentation” that controlled-release products like OxyContin are “less prone to addiction potential, abuse or diversion” than other opioid pain pills.”

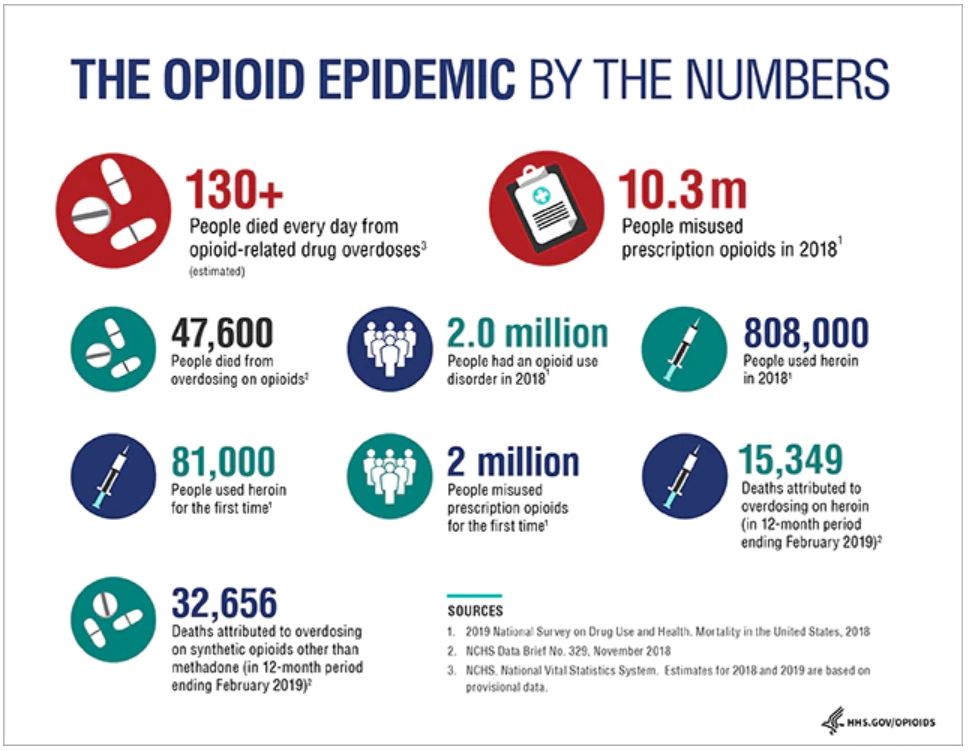

As an affect of the Purdue Pharmaceutical sales representatives’ aggressive marketing, OxyContin quickly swept the US market. The Wall Street Journal reported that in the 12-year span between 2008 and 2016 alone, US$4 billion in sales came from OxyContin. Meanwhile, the reassurances from Purdue and other pharmaceutical companies that patients would not become addicted to opioid pain killers had their affect. Healthcare providers began to prescribe opioids at greater rates, leading to widespread misuse of both prescription and non-prescription opioids. According to the US Department of Health and Human Services (HHS), in 2018 and 2019 an estimated more than 130+ people died every day from opioid related drug overdoses.

Figure 1: The US Opioid Epidemic by the Numbers

Source: HHS

On September 15, 2019, Purdue Pharma filed for Chapter 11 bankruptcy under the pressure of the more than 2,600 federal and state lawsuits in an attempt to shield the company and its owners. Also in 2019, Johnson & Johnson was ordered to pay US$572 million by an Oklahoma court for their role in promoting opioids, although later that year that amount was reduced to US$465 million.

Source: Johns Hopkins Medicine

Opioids clearly have major safety issues, involving a high risk of addiction and abuse. However, a global demand for pain is on the rise. As the average age of the world’s population increases, so does the population affected by chronic analgesia. In addition, an increase in surgical operations in recent years has also resulted in a rise in demand for painkillers.

The survey shows that the global painkillers market was worth US$71 billion in 2019 and is expected to grow to US$92 billion by 2027. From the analysis of indications, the fastest growing demand is to treat pain from cancer. From the analysis of drug types, opioids and non-steroidal anti-inflammatory drugs (NSAIDs) remain the most commonly used and prescribed analgesics. Among them, opioids are still primarily prescribed in European and American markets, while NSAIDs lead the Asia-Pacific, Eastern Europe and Latin American regions. However, due to the horrific effects of the opioid epidemic in the US, there is mounting pressure to move away from prescribing opioids to treat pain.

China’s analgesics market is relatively small, about US$530 million in 2017. There, most analgesics are prescribed to treat pain from surgery. There is a big gap between the treatment of patients for cancer pain in China and developed countries in Europe and America. However, due to an aging population and the rapid increase in cancer incidence, chronic pain relievers are gradually taking up more space in the Chinese pharmaceutical market.

Pain Classification and Analgesics

Pain can be divided into acute pain and chronic pain according to whether the duration exceeds 6 months. Acute pain includes trauma and postoperative pain. Chronic pain involves a variety of diseases, including neuropathic pain from damage or disease affecting the nervous system (postherpetic neuralgia, migraine, diabetic neuralgia, etc.) and nociceptive pain from potentially harmful stimuli detected by nociceptors (such as osteoporosis and rheumatoid arthritis).

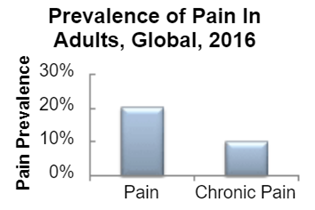

According to statistics, the global incidence of pain in 2016 was about 20%, half of which came from chronic pain.

Figure 2: Global incidence of pain

Source: Sullivan

Analgesics

The current mainstream analgesics are divided into two categories: non-opioid analgesics (such as NSAID) and opioid analgesics.

NSAIDs generally inhibit cyclooxygenase-1 (COX-1) and cyclooxygenase-2 (COX-2), thereby reducing the synthesis of inflammation-related pain-causing substances such as prostaglandins and thromboxanes to achieve analgesic effects. They are suitable for pain caused by inflammation as well as postoperative pain. While there is little to no risk for addition, the analgesic effect is weak and there is a ceiling to the drugs efficacy. In other words, after the drug dose reaches a certain level, increasing the dose further will not enhance the analgesic effect, but only increase the side effects. Aspirin, ibuprofen, and naproxen are common NSAIDs.

Opioids achieve pain relief by inhibiting the pain center. When compared with NSAIDs, they have a stronger effect on pain and are often used for acute and postoperative pain, pain caused by cancer, and moderate to severe chronic pain. Opioids have no ceiling and can increase the analgesic effect by increasing the dose, but long-term use can lead to addiction. Common drugs are morphine, oxycodone, fentanyl, tramadol, and others.

In addition to the above two, antidepressants, anticonvulsants and steroids also have certain analgesic effects.

Current problems and R&D trends in the analgesia market

Due to rising public awareness of the addictive nature of opioids and the toll that the opioid epidemic has taken, various companies that made opioids have withdrawn their products and stopped promotion, resulting in a general decline. However, another major pain reliever, NSAIDs, can cause various side effects including gastrointestinal bleeding, myocardial infarction, and stroke. Therefore, they are not suitable for people suffering from cardiovascular diseases and diabetes. Thus, there is still a big unmet demand in the current pain relief market.

The decline of opioids and the contraindication of NSAIDs have led pharmaceutical companies to focus on the development of other painkillers. The current three major research and development focuses include:

- Abuse-Deterrent Opioid Analgesics (ADF)

- Non-opioid analgesics

- Development of new drug delivery methods based on existing drugs

Abuse-Deterrent Opioid Analgesics (ADF)

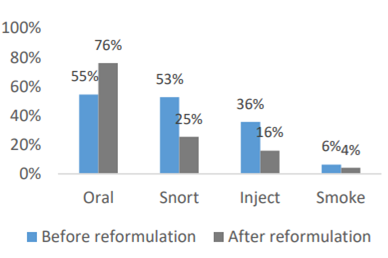

The main methods of opioid abuse include taking them by mouth, crushing the pills to facilitate inhalation of the powder, and intravenous injection. The main goal of ADF opioids is to make the opioids difficult to abuse by individuals through a series of modifications. Specific methods include adding physical and/or chemical barriers to prevent the tablets from being ground up or adding agonists/antagonists to eliminate the euphoria that comes from using the drugs. The FDA encourages the development of innovative anti-abuse technologies and will give priority to applications for opioids that suppress abuse and provide a series of policy preferences.

There are currently 5 ADF drugs on the US market: OxyContin (Purdue Pharmaceuticals), Hysingla ER (Purdue Pharmaceuticals), MorphaBond ER (Daiichi Sankyo Pharmaceuticals), Xtampza ER (Collegium Pharmaceuticals) and RoxyBond (Japan’s No. 1 Pharmaceuticals). No generic drugs have been approved by the FDA.

However, it is worth noting that studies have shown that although ADF opioids significantly reduce non-oral abuse routes such as snorting and injections, patients can still abuse the drug by taking them orally. Thus, there are still many problems with the effectiveness of ADF opioids.

Figure 3: The influence of ADF opioids on different ways of abuse

Non-opioid analgesics

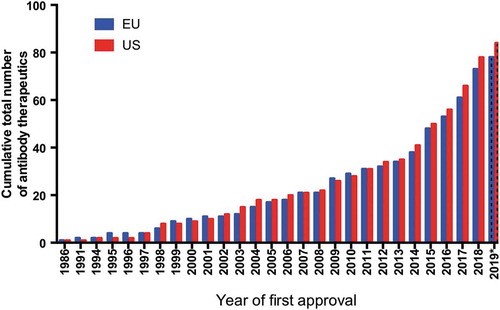

Among non-opioid analgesics, non-monoclonal antibodies have the most potential. Monoclonal antibody therapies have been advancing in the EU and US markets since 2010, and the number of monoclonal antibody therapies that have passed FDA review in 2010-2019 has almost tripled. The monoclonal antibody research pipelines of major pharmaceutical companies are in full swing. There are currently 79 innovative monoclonal antibody drugs in the late developmental stages.

Figure 4: The number of monoclonal antibody therapies approved in Europe and the United States

Nerve growth factor (NGF) inhibitor monoclonal antibodies

During injury, inflammation, or chronic pain, the level of NGF in the body rises. By inhibiting NGF, pain signals can be blocked from the site where pain occurs from reaching the brain.

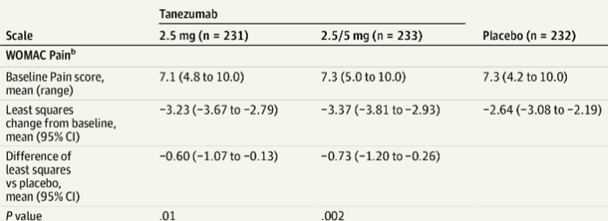

In the first quarter of this year, Tanezumab, jointly developed by Pfizer and Eli Lilly, obtained the FDA’s biological product license application for the treatment of patients with chronic pain caused by moderate to severe osteoarthritis (OA). Because Tanezumab has a different mechanism from other current analgesics, if approved, the drug will become the first NGF inhibitor analgesic for the treatment of OA analgesia.

Compared with the placebo, Tanezumab significantly reduced pain in patients with osteoarthritis. The latest phase III clinical trial results show that Tanezumab at a dose of 5mg is more effective than NSAIDs in reducing pain and increasing function. And as of now, Tanezumab has not shown the risk of addiction.

Figure 5: Tanezumab significantly reduces pain in patients with osteoarthritis

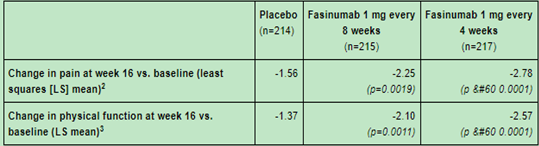

At the same time, another NGF inhibitor, Fasinumab, jointly developed by Teva and Regeneron, is currently in phase III clinical trials. Previous clinical data showed that 1mg of Fasinumab treatment can significantly improve the pain of arthritis patients.

Figure 6: Fasinumab treatment can significantly improve arthritis patients’ pain

Calcitonin gene-related peptide (CGRP) antibody drugs

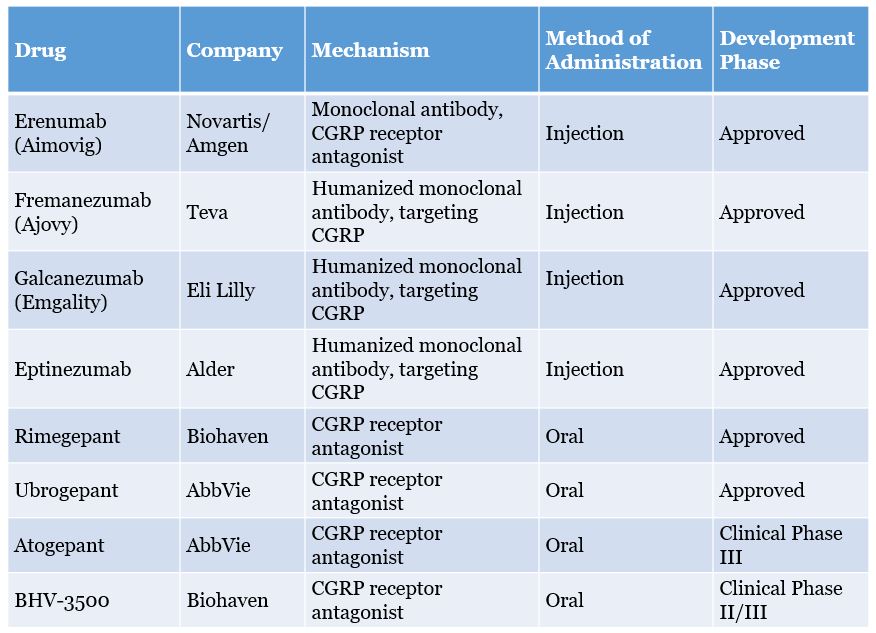

In addition to monoclonal antibodies against NGF, monoclonal antibody drugs against CGRP are becoming important drugs for the treatment of chronic migraines. CGRP is a potent vasodilator, which is mainly released by sensory nerves. The release level of CGRP increases significantly during migraine attacks. Studies believe that CGRP is the cause of migraine attacks.

In recent years, CGRP and its receptors have become popular targets for migraine drug development. In 2018, a total of three CGRP receptor antagonist antibody drugs were approved by the FDA for marketing: Aimovig (Novartis/Amgen), Emgality (Lilly) and Ajovy (Teva). All three are injected subcutaneously. At the same time, AbbVie and Biohaven are focusing on the development of oral CGRP antagonist drugs. In 2019, AbbVie’s Ubrelvy was approved by the FDA for the acute treatment of adult migraine, becoming the first oral CGRP drug for migraine. In 2020, Rimegepant (Biohaven) also received FDA approval.

Figure 7: Progress of CGRP analgesics

Sodium channel blockers

Nav 1.7 is the channel that controls the entry of sodium ions into sensory neurons. Studies have found that people with loss of Nav 1.7 are inherently insensitive to analgesic stimulation, making Nav 1.7 a potential analgesic target. However, in the past 20 years, many large pharmaceutical companies have repeatedly hit a wall in the development of Nav 1.7 drugs. The reason is that Nav 1.7 is widely present in other important signaling pathways, and the existing Nav 1.7 inhibitors are not effective. It selectively acts only on the analgesic pathway. With a series of companies such as Biogen, Roche, Teva and Xenon failing in the research of Nav 1.7 inhibitors, the prospect of this analgesic has also been questioned.

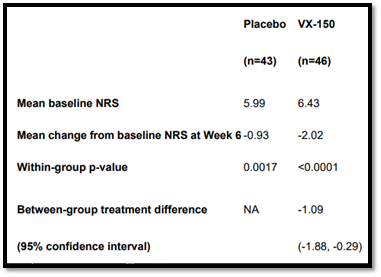

Nav1.8 inhibitors may bring new hope. AVertex’s Nav 1.8 inhibitor VX150 has performed well in phase II clinical trials to treat chronic pain caused by small fiber neuropathy. Studies have shown that when compared with the baseline at week 6, the pain index of patients with VX150 changed -2.02, compared with -0.93 in the control group, proving that VX150 achieved a statistically significant and clinically significant pain reduction7. In this study, VX150 was generally well tolerated. Vertex said it will continue to invest in the development of other molecules and analgesic mechanisms against Nav 1.8.

Figure 8: VX-150 significantly reduces chronic analgesia

Source: Vertex

5-Hydroxytryptamine 1F (5-HT1F) Agonists

Serotonin receptors, also known as 5-HT receptors, are a group of G protein-coupled receptors and ligand-gated ion channels located in the central nervous system and peripheral nerves. They are involved in the regulation of various physiological functions of the body. 5-HT and its analogues can inhibit the analgesic signal by binding to 5-HT receptors of different subtypes and different positions.

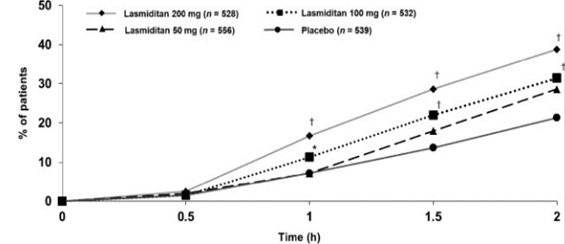

In 2019, Eli Lilly’s new drug Reyvow (lasmiditan) was approved by the FDA for the acute treatment of migraines. It is the first and only 5-HT1F receptor agonist approved by the FDA and represents the first major breakthrough in the field of acute treatment of migraines in more than 20 years.

Clinical data showed that compared with the placebo group, the lasmiditan treatment group had a significantly higher ratio of pain with some symptoms (MBS including nausea, light sensitivity, and sound sensitivity) eliminated 2 hours after the first dose. Lasmiditan has no vasoconstrictor activity and is suitable for patients with cardiovascular diseases.

Figure 9: Lasmiditan significantly decreases pain

Development of new pharmaceutical dosage forms of analgesics

In addition to the development of new drug mechanisms, the use of new dosage or formulation for traditional analgesics has gradually become a research and development trend. For example, low-dose, sustained-release, intravenous injection, nano dosage form and transdermal delivery have been developed for old drugs. Recently, two new drugs based on the traditional NSAID drug meloxicam have passed FDA and EU reviews, respectively.

Anjeso: Meloxicam injection preparation based on nanocrystal technology

Meloxicam was originally an oral medicine used to relieve arthritis pain, but because of its low water solubility and slow gastrointestinal absorption, it cannot provide rapid pain relief. Baudax Bio has developed meloxicam for intravenous injection (trade name: Anjeso) through a brand-new nanocrystal technology, which greatly improves the speed of pain relief. In February 2020, Anjeso was approved by the FDA for the treatment of moderate to severe analgesia, becoming the first once-daily intravenous analgesic. Studies have shown that the use of Anjeso can effectively reduce the patient’s use of opioids.

Zynrelef: Sustained release drug combined with meloxicam and bupivacaine

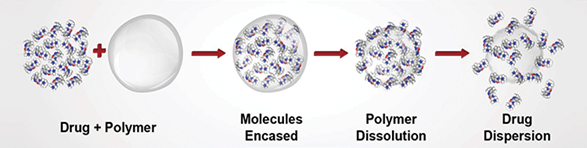

Zynrelef is a non-opioid analgesic developed by Heron. The main ingredients are meloxicam and bupivaca, which are used to treat postoperative pain and inflammation. Zynrelef uses Heron’s proprietary Biochronomer drug delivery technology to provide sustained pain relief after a single use. Biochronomer technology packs polymers and the drug together. When injected into the subcutaneous tissue, the polymers will slowly hydrolyze, which allows the encapsulated drug to diffuse slowly. Zynrelef is currently the first long-acting, sustained-release local anesthetic. Clinical trials have shown that Zynrelef significantly reduces pain and the use of opioids compared with traditional postoperative pain medications. In September 2020, Zynrelef was approved by the European Union for listing.

Figure 10: Biochronomer drug delivery technology

Source: Heron

Global Project Introduction

With an aging population, China’s domestic analgesic market is expected to continue to grow in the future. However, domestic painkillers are still at the stage of traditional medicines, and there are few innovative medicines. Despite the lessons learned from the abuse of opioids in the United States, the use of opioids in China is increasing year by year. In order to provide a safe and effective analgesic treatment plan for pain patients, in addition to the new drugs mentioned above, we are also introducing some global projects here.

Levicept: LEVI-04

Levicept is a British biological research and development company dedicated to the development of LEVI-04. LEVI-04 is a p75 nerve growth factor receptor fusion protein (p75NTR-Fc), injected once a month for the treatment of osteoarthritis and chronic pain. It exerts an analgesic effect by reducing the activity of NGF. In preclinical models of osteoarthritis, LEVI-04 was shown to provide analgesic effects comparable to NGF antibody therapies, and produce fewer side effects. Currently it is in phase I clinical trials.

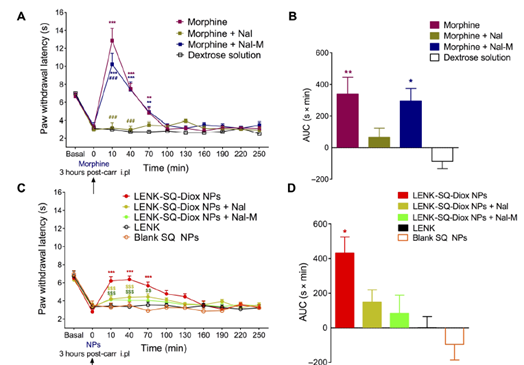

University of Saclay and University of Descartes in Paris: Neuropeptide nanoparticles

Enkephalin is a naturally occurring opioid receptor binder. Due to pharmacokinetic problems, the clinical use of enkephalin has been limited. In this study, researchers from Saclay University and Descartes University in Paris synthesized lipid squalene (SQ) and leucine enkephalin (LENK) into corresponding LENK-SQ bioconjugates and formulated them into nanoparticles. This new nano-formulation improves the kinetic performance of LENK. In mouse models, LENK-SQ was shown to have a better analgesic effect than opioids. The technology is still in preclinical testing stage.

Figure 11: The analgesic effect of LENK-SQ is better than morphine

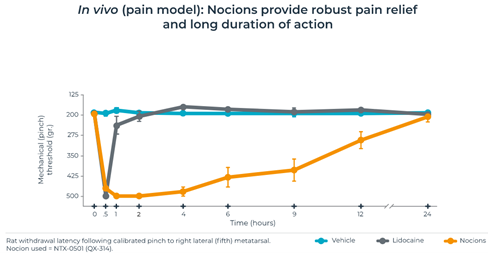

Nocion: Highly specific sodium channel blocker

Nocion is a company dedicated to the development of small-molecule sodium channel blockers for analgesics. Its drug, Nocions, can specifically act on nociceptors activated by inflammation without having any side effects on the central nervous system. In the mouse model, Nocions has better analgesic effects than lidocaine.

Figure 12: Nocions has longer analgesic time than lidocaine in mouse model

Source: Nocion

Kineta: Nicotinic Acetylcholine Receptor (nAChR) Antagonist

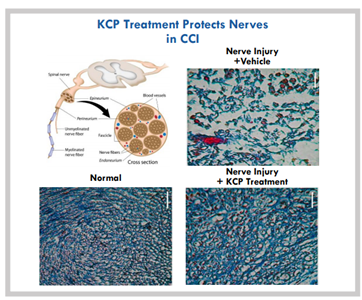

Kineta is an American clinical-stage biotechnology company dedicated to the key development of drugs in the neuroscience field. KCP506 is the first α9α10 nicotinic acetylcholine receptor (nAChR) antagonist for the treatment of chronic neuropathic analgesia. In a variety of preclinical chronic pain models, nAChR antagonists have shown strong analgesic effects and anti-neuro-inflammatory effects. At present, it has obtained FDA approval to carry out phase I clinical trials.

Figure 13: KCP506 can protect nerve damage

Source: Kineta

Conclusion

Strengthening the development of non-opioid drugs and providing reliable and safe treatment plans will be a boon to everyone.

About the author

MJ Yuan is an Investment Analyst at MyBioGate and a PhD student at Boston University School of Medicine, majoring in nutritional epidemiology. One of the founders of the Boston University Biotechnology Business Club, a former consultant of the MIT Consulting Club, active in the pharmaceutical science industry in the Greater Boston area.

References

- Synnott P, Webb M, Chapman R, Ollendorf DA, Pearson SD. Chief Scientific Officer Institute for Clinical and Economic Review.; 2017. http://icer-review.org/programs/new-england-cepac/. Accessed November 4, 2020.

- Kaplon H, Muralidharan M, Schneider Z, Reichert JM. Antibodies to watch in 2020. MAbs 2020;12(1):1703531. doi:10.1080/19420862.2019.1703531

- Schnitzer TJ, Easton R, Pang S, et al. Effect of Tanezumab on Joint Pain, Physical Function, and Patient Global Assessment of Osteoarthritis among Patients with Osteoarthritis of the Hip or Knee: A Randomized Clinical Trial. JAMA – J Am Med Assoc 2019;322(1):37-48. doi:10.1001/jama.2019.8044

- Pfizer-Lilly Endeavor Shows NGF Inhibitor Tanezumab Lowers Osteoarthritic Pain | BioSpace. https://www.biospace.com/article/pfizer-lilly-endeavor-shows-ngf-inhibitor-tanezumab-lowers-osteoarthritic-pain-in-phase-iii-trials/. Accessed November 4, 2020.

- Regeneron and Teva Announce Positive Topline Phase 3 Fasinumab Results in Patients with Chronic Pain from Osteoarthritis of the Knee or Hip | Regeneron Pharmaceuticals Inc. https://investor.regeneron.com/news-releases/news-release-details/regeneron-and-teva-announce-positive-topline-phase-3-fasinumab/. Accessed November 4, 2020.

- Sparrow AM, Searles JW. The market for migraine drugs. Nat Rev Drug Discov. doi:10.1038/d41573-018-00014-3

- Vertex Announces Treatment with the NaV1.8 Inhibitor VX-150 Showed Significant Relief of Acute Pain in Phase 2 Study | Vertex Pharmaceuticals. https://investors.vrtx.com/news-releases/news-release-details/vertex-announces-treatment-nav18-inhibitor-vx-150-showed?ReleaseID=1057489. Accessed November 5, 2020.

- Goadsby PJ, Wietecha LA, Dennehy EB, et al. Phase 3 randomized, placebo-controlled, double-blind study of lasmiditan for acute treatment of migraine. Brain 2019;142(7):1894-1904. doi:10.1093/brain/awz134

- Feng J, Lepetre-Mouelhi S, Gautier A, et al. A new painkiller nanomedicine to bypass the blood-brain barrier and the use of morphine. Sci Adv 2019;5(2):5148-5161. doi:10.1126/sciadv.aau5148

0 Comments