Author: Youwen Dai

In recent years, the general public’s acceptance of aesthetic medicine and plastic surgery has gradually increased, leading to rapid development in the industry, especially with regards to micro plastic surgery. In general, aesthetic medicine is divided into surgical plastic surgery and non-surgical plastic surgery (micro plastic surgery). Micro plastic surgery is popular because of its comparatively low risk. Aesthetic medicine is divided into two treatment methods: drugs and devices. In the drug category, only a few products are available, such as botulinum toxin. Thus, devices have become the main treatment method in aesthetic medicine.

The size of the global aesthetic medicine market is US$34.3 billion

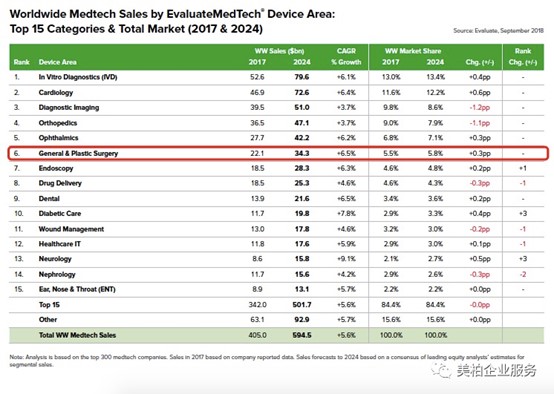

According to “EvaluateMedTech World Preview 2018, Outlook to 2024” released by EvaluateMedTech, it is estimated that the global aesthetic medical equipment (General & Plastic Surgery) market will reach US$34.3 billion in 2024, ranking sixth among all medtech [1] .

▲ Figure 1: Top 15 global medtech market estimates (2017 and 2024)

Source: EvaluateMedTech

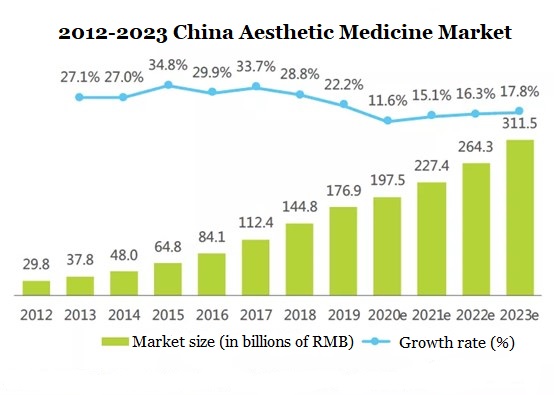

According to iResearch, the China aesthetic medicine market will increase from USD$25.9 billion in 2019 to US$45.7 billion in 2023 [2].

▲ Figure 2: 2012-2023 China aesthetic medicine market

Source: iResearch

In general, sources of revenue come from injections, photoelectric aesthetic medicine, and surgery. China’s aesthetic medical device market is projected to increase from RMB 53.07 billion in 2019 to RMB 99.45 billion in 2023.

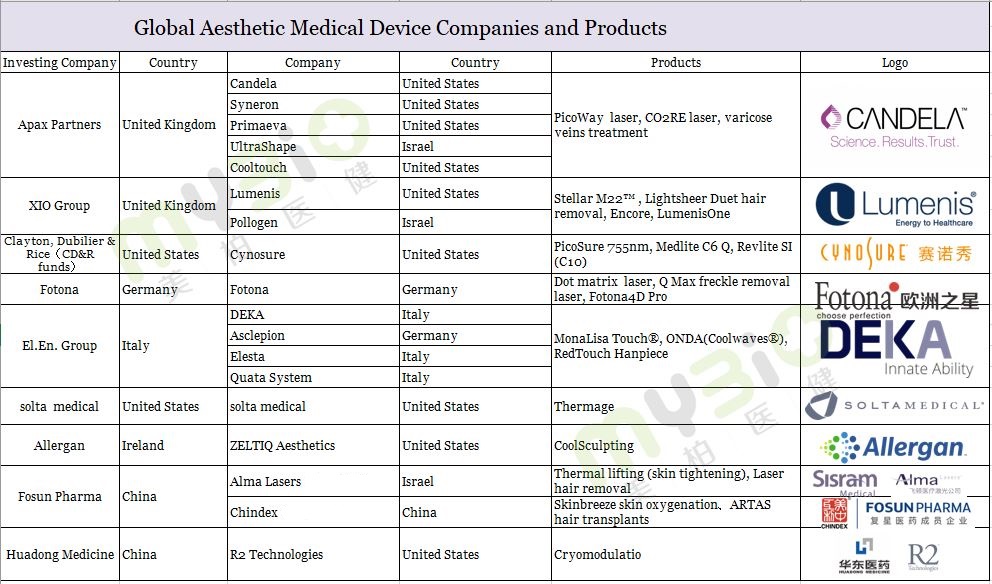

Overview of global aesthetic medical device companies

Aesthetic medicine originated in the 1960s in Germany and Italy. The aesthetic medical equipment industry in developed countries represented by aesthetic lasers has gradually matured. Many products are exported around the world. In the market of China’s aesthetic medical device industry, international enterprises still dominate. Companies include Fotona Eurostar (founded in Germany in 1964), Candela (founded in the United States in 1970), Cynosure (Sinoshow, established in the United States in 1991), Lumenis (founded in the United States in 1992), Alma Lasers (Feiton, founded in Israel in 1999). Due to technological synergy and the matching of market coverage populations, the market has undergone intricate M&A in the past 20 years. For example, there was the capital intervention of APAX, XIO Group, CD&R funds, and others, which jump-started further rapid development within the global aesthetic medical device industry.

▲ Figure 3: Global aesthetic medical equipment companies and products

Source: Public information

Analysis of China’s Leading Companies

Due to Chinese companies getting a late start in the context of the global market, research and technologies remains relatively behind. At present, the Chinese aesthetic medical device market is still dominated by international enterprises. According to communication between the author and industry insiders, the market share of China’s in-house aesthetic medical devices (excluding international investment projects) is only about 20%. However, Chinese companies are undergoing external investment mergers and acquisitions (Fosun Pharmaceutical, Huadong Medicine) and independent research and development (Miracle Laser, Peninsula Med, GSD Medical, Beijing Desheng Granville Technology Development Co., Ltd.) in order to compete with those international companies.

Fosun Pharma [600196, 02196HK]

Fosun’s aesthetic medical device division contains two companies, Sisram Medical and Chindex International Inc.

Sisram Medical [01696.HK]

Mergers and acquisitions (M&A): In the first half of 2013, Sisram Med, a subsidiary of Fosun Pharma, spent US$240 million to acquire a 95.6% stake in Alma Laser. Alma Laser is mainly engaged in high-end aesthetic medical devices, with an annual revenue of nearly US$100 million with a 15% global market share. It was founded in China in 2003 and has now become a market leader for aesthetic lasers. On March 26, 2020, Sisram Medical announced that a Fosun Pharma subsidiary acquired 21.93% Sisram Medical’s shares, originally held by Magnificent View. Fosun Pharma’s stakes in Sisram Medical increased to 74.76%.

Company performance: Sisram Medical’s 2019 annual report shows that total revenue in 2019 reached US$173.5 million, an increase of 12.7%, gross profit increased 16.5% with the adjusted net profit attributable to the parent company at US$26.95 million. In 2019, Sisram Medical’s surgical (minimally invasive) product line revenue increased by 16%, and the core product line revenue increased 10.2%.

Competitive products: Laser hair removal products drive the entire product line with their good market performance (increased revenue by 31.5% in 2019). Sisram Medical ranks among the top four in the world when it comes to augmentation implants.

M&A: In December 2010, Fosun Pharma signed an agreement with US-China Mutual Benefit to jointly establish a joint venture company Chindex Medical Limited (CHDX). Fosun Pharma will hold 51% of shares in the Chindex Medical joint venture, and US-China Mutual will hold 49% of the equity. The goal is to realize integration with US-China Mutual and improve Fosun’s medical device business. The agreement covers areas from R&D and manufacturing to domestic and foreign marketing. On February 18, 2014, Fosun Pharma (600196.SH) formally took a controlling interest in Chindex International Inc. (hereinafter referred to as “US-China Mutual Benefit”). US-China Mutual Benefit will delist from NASDAQ after the contract is completed, ending its status as a listed company.

Products: Its products mainly include Skinbreeze skin oxygenation and ARTAS hair transplants.

Huadong Medicine [000963]

LG Yiwan, an agent of Ningbo Huadong, a subsidiary of Huadong Medicine, occupies China’s largest market for hyaluronic acid products. In 2019, Huadong Medicine established the Aesthetic Medicine Product Management Department, and quickly formed a team to comprehensively manage and coordinate domestic Chinese and international innovative aesthetic medicine business.

On July 29, 2020, Huadong Medicine announced that a machine that eliminates freckles from R2 Technologies, a company in which it owns shares, has undergone approval consideration by the US FDA. It is currently registered with the FDA and is expected to be officially approved in the US in 2020.

Miracle Laser [832861]

Miracle Laser is located in Wuhan, China. After more than ten years of development, it has become a high-tech enterprise in the aesthetic medical device industry. Due to the strength of its R&D, it provides solutions by integrating R&D, production, and sales. Its main products include self-developed and produced optoelectronic aesthetic medical devices for cosmetology and urology.

Founded in 2008, Peninsula is a high-tech enterprise integrating research, production, and sales. It is a leading brand in China’s innovative aesthetic medical devices. It focuses on technological innovation in the two sub-fields of plastic surgery and skin disease treatment.

Global Skin Dermatologist (GSD)

GSD was founded in Shenzhen in 2004. GSD is an international comprehensive service provider of aesthetic medicine, specializing in the research, development, production, and sales of cutting-edge technology and products. Its scope of business covers aesthetic medical devices, professional skin care products, and other fields. Three companies, namely GSD Technology Co., Ltd., GSD Biotech Co., Ltd., and GSD Beauty Consulting Co., Ltd., jointly support the flagship’s operations.

ADS was established in 2007 and is headquartered in Beijing. It is an aesthetic medical device manufacturer integrating R&D, production, and sales. The products are used in the field of aesthetic lasers, such as skin management, skin rejuvenation, slimming, hair removal, tattoo removal, and so forth. ADS is engaged in export business, with partners in nearly 100 countries. It has obtained US FDA certification, European authority TUV certification, ISO: 13485 system certification, China CFDA certification, and Chinese patents. In addition, ADS’s newest plant area is planned for 160,000 square meters of which 33,000 square meters are already construction and put into production (including R&D, production, and laboratories). The annual order volume covers about RMB 100 million.

Opportunity analysis of Chinese aesthetic medical device companies

Chinese aesthetic medicine is still in its infancy and there are huge opportunities for future growth. The author believes that the following factors will be key factors for the rapid development of this industry:

- Technology-driven: China’s aesthetic medical device industry has developed in a short time with technology that still has room to develop. Therefore, improving technology is key to for the company growth. Investment in R&D or in M&A will lay a solid foundation for corporate development.

- User-driven: there has been explosive growth in the potential population base of aesthetic medicine in China, especially in third and fourth tier cities, with unmet need for high-end products. This is a great opportunity for high-quality aesthetic medical devices.

- Capital-driven: Because China’s aesthetic medical device industry in still in its infancy, international medical aesthetic device M&A cases abound. Listed companies such as Fosun Pharma and Huadong Pharmaceutical acquired international brands. The market also has a strong interest in the field of aesthetic medicine and will favor teams that own core technologies.

About the author:

Youwen Dai is the regional business development director at MyBioGate. He focuses on collaborations between China and overseas companies in healthcare, as well as maintaining close relations with listed Chinese pharmaceutical companies to gain insight into cross-border collaboration trends.

0 Comments